Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) (c) Suppose there are three types of people in an economy. type A's. B's and C's. There are also three assets X. Y

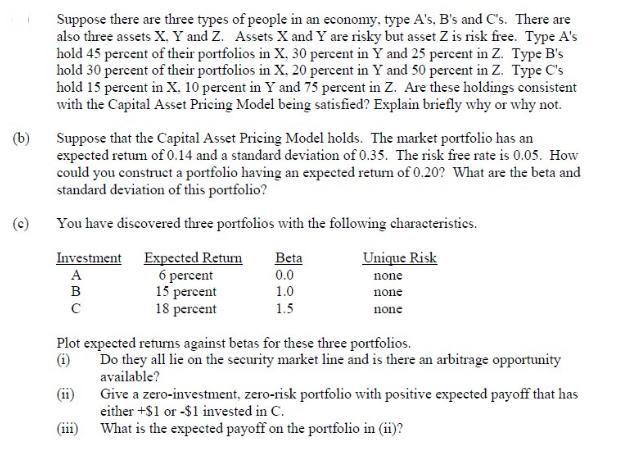

(b) (c) Suppose there are three types of people in an economy. type A's. B's and C's. There are also three assets X. Y and Z. Assets X and Y are risky but asset Z is risk free. Type A's hold 45 percent of their portfolios in X. 30 percent in Y and 25 percent in Z. Type B's hold 30 percent of their portfolios in X. 20 percent in Y and 50 percent in Z. Type C's hold 15 percent in X. 10 percent in Y and 75 percent in Z. Are these holdings consistent with the Capital Asset Pricing Model being satisfied? Explain briefly why or why not. Suppose that the Capital Asset Pricing Model holds. The market portfolio has an expected return of 0.14 and a standard deviation of 0.35. The risk free rate is 0.05. How could you construct a portfolio having an expected return of 0.20? What are the beta and standard deviation of this portfolio? You have discovered three portfolios with the following characteristics. Investment A B (11) Expected Return 6 percent 15 percent 18 percent (111) Beta 0.0 1.0 1.5 Plot expected returns against betas for these three portfolios. Do they all lie on the security market line and is there an arbitrage opportunity available? Unique Risk none none none Give a zero-investment, zero-risk portfolio with positive expected payoff that has either +$1 or -$1 invested in C. What is the expected payoff on the portfolio in (ii)?

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution a In order to determine if the holdings are consistent with the Capital Asset Pricing Model CAPM we need to examine the relationship between ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started