B) Calculate monthly members needed to earn an annual Target Profit of $80,000.

Monthly memberships needed:

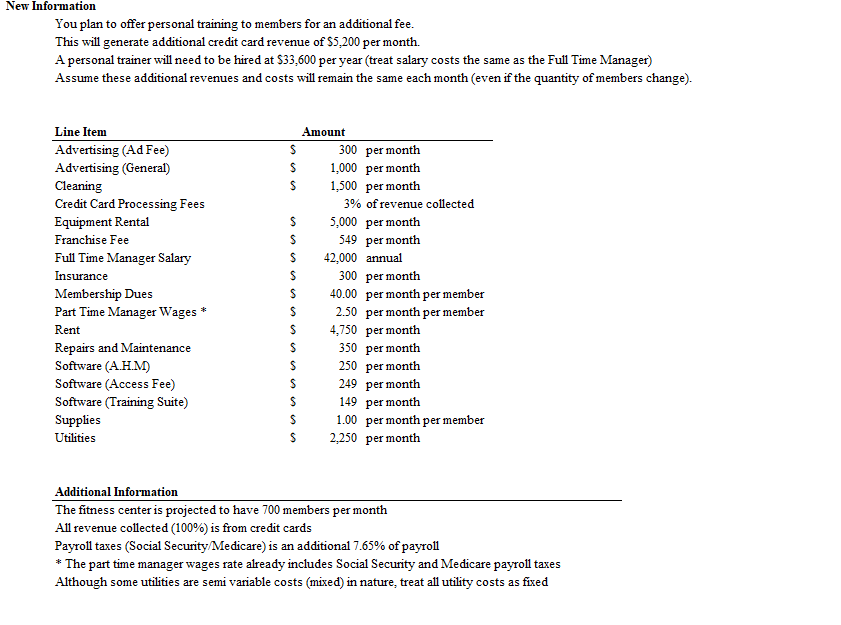

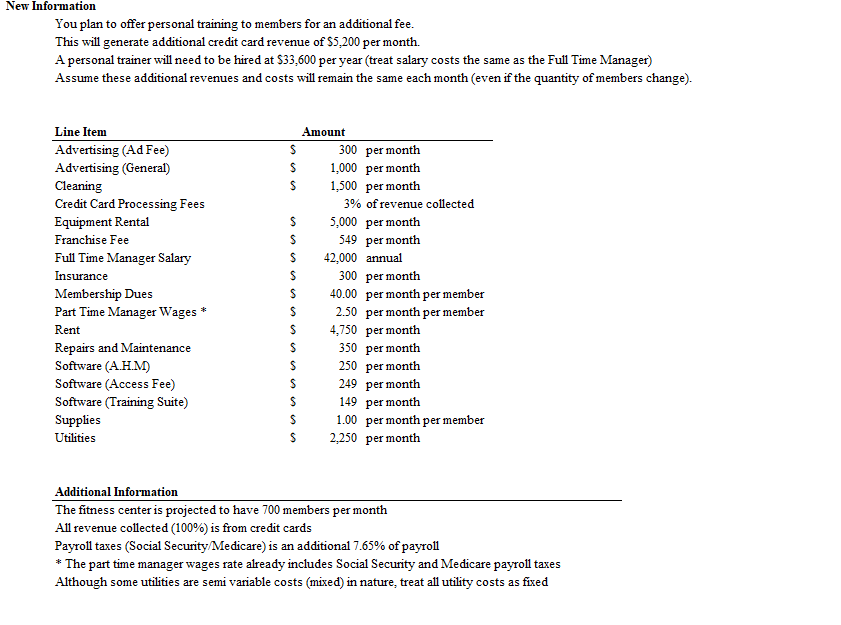

New Information You plan to offer personal training to members for an additional fee. This will generate additional credit card revenue of $5,200 per month. A personal trainer will need to be hired at $33,600 per year (treat salary costs the same as the Full Time Manager) Assume these additional revenues and costs will remain the same each month (even if the quantity of members change). Line Item Advertising (Ad Fee) Advertising (General) Cleaning Credit Card Processing Fees Equipment Rental Franchise Fee Full Time Manager Salary Insurance Membership Dues Part Time Manager Wages * Rent Repairs and Maintenance Software (A.H.M) Software (Access Fee) Software (Training Suite) Supplies Utilities Amount $ 300 per month $ 1,000 per month $ 1.500 per month 3% of revenue collected $ 5,000 per month $ 549 per month $ 42,000 annual $ 300 per month $ 40.00 per month per member $ 2.50 per month per member $ 4,750 per month $ 350 per month $ 250 per month $ 249 per month $ 149 per month $ 1.00 per month per member $ 2,250 per month Additional Information The fitness center is projected to have 700 members per month All revenue collected (100%) is from credit cards Payroll taxes (Social Security/Medicare) is an additional 7.65% of payroll * The part time manager wages rate already includes Social Security and Medicare payroll taxes Although some utilities are semi variable costs (mixed) in nature, treat all utility costs as fixed New Information You plan to offer personal training to members for an additional fee. This will generate additional credit card revenue of $5,200 per month. A personal trainer will need to be hired at $33,600 per year (treat salary costs the same as the Full Time Manager) Assume these additional revenues and costs will remain the same each month (even if the quantity of members change). Line Item Advertising (Ad Fee) Advertising (General) Cleaning Credit Card Processing Fees Equipment Rental Franchise Fee Full Time Manager Salary Insurance Membership Dues Part Time Manager Wages * Rent Repairs and Maintenance Software (A.H.M) Software (Access Fee) Software (Training Suite) Supplies Utilities Amount $ 300 per month $ 1,000 per month $ 1.500 per month 3% of revenue collected $ 5,000 per month $ 549 per month $ 42,000 annual $ 300 per month $ 40.00 per month per member $ 2.50 per month per member $ 4,750 per month $ 350 per month $ 250 per month $ 249 per month $ 149 per month $ 1.00 per month per member $ 2,250 per month Additional Information The fitness center is projected to have 700 members per month All revenue collected (100%) is from credit cards Payroll taxes (Social Security/Medicare) is an additional 7.65% of payroll * The part time manager wages rate already includes Social Security and Medicare payroll taxes Although some utilities are semi variable costs (mixed) in nature, treat all utility costs as fixed