Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) Calculate the price and Macaulay duration of a five-year 5% coupon bond where the market interest rate is 5%. Assume the par value of

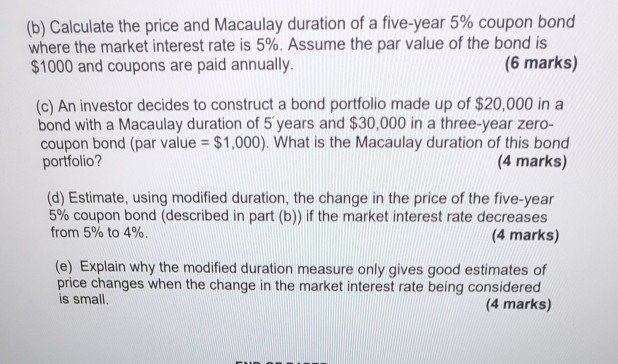

(b) Calculate the price and Macaulay duration of a five-year 5% coupon bond where the market interest rate is 5%. Assume the par value of the bond is $1000 and coupons are paid annually. (6 marks) (c) An investor decides to construct a bond portfolio made up of $20,000 in a bond with a Macaulay duration of 5 years and $30,000 in a three-year zero- coupon bond (par value = $1,000). What is the Macaulay duration of this bond portfolio? (4 marks) (d) Estimate, using modified duration, the change in the price of the five-year 5% coupon bond (described in part (b)) if the market interest rate decreases from 5% to 4%. (4 marks) (e) Explain why the modified duration measure only gives good estimates of price changes when the change in the market interest rate being considered is small (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started