Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B cannot open yet Exercise 12.18 The accounting profit before tax of Nebo Lid for the year ended 30 June 2020 was $21,629. It included

B cannot open yet

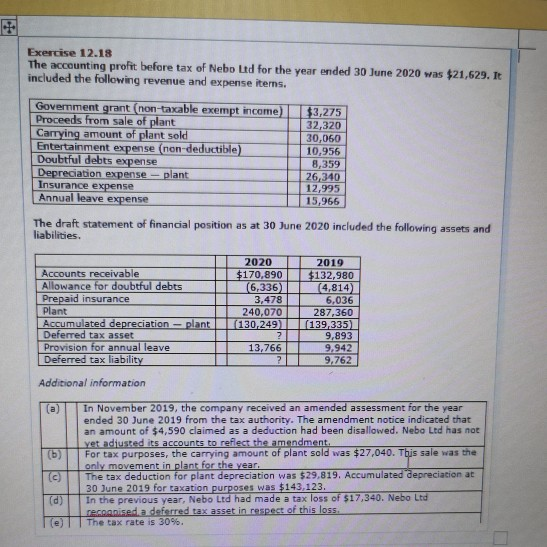

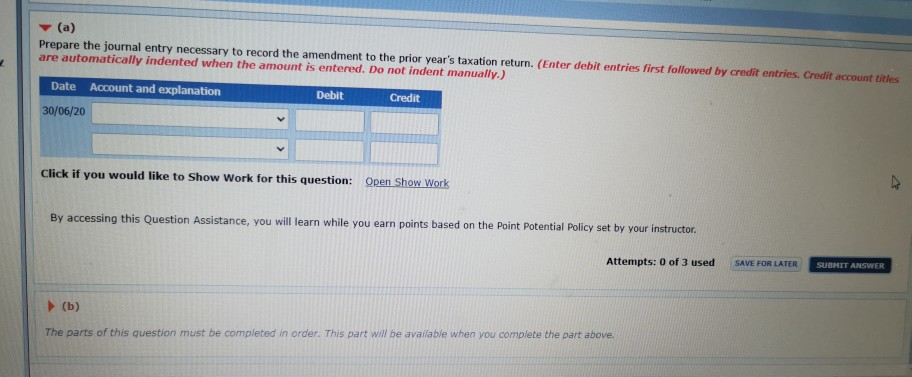

Exercise 12.18 The accounting profit before tax of Nebo Lid for the year ended 30 June 2020 was $21,629. It included the following revenue and expense items. Government grant (non-taxable exempt income) $3,275 Proceeds from sale of plant 32,320 Carrying amount of plant sold 30,060 Entertainment expense (non-deductible) 10,956 Doubtful debts expense 8,359 Depreciation expense - plant 26,340 Insurance expense 12,995 Annual leave expense 15,966 The draft statement of financial position as at 30 June 2020 included the following assets and liabilities. Accounts receivable Allowance for doubtful debts Prepaid insurance Plant Accumulated depreciation - plant Deferred tax asset Provision for annual leave Deferred tax liability 2020 $170,890 (6,336) 3,478 240,070 (130,249) ? 13,766 ? 2019 $132,980 (4,814) 6,036 287,360 (139,335) 9,893 9,942 9,762 Additional information (a) (b) In November 2019, the company received an amended assessment for the year ended 30 June 2019 from the tax authority. The amendment notice indicated that an amount of $4,590 claimed as a deduction had been disallowed. Nebo Ltd has not Yet adiusted its accounts to reflect the amendment. For tax purposes, the carrying amount of plant sold was $27,040. This sale was the only movement in plant for the year The tax deduction for plant depreciation was $29.819. Accumulated depreciation at 30 June 2019 for taxation purposes was $143,123. In the previous year, Nebo Ltd had made a tax loss of $17,340. Nebo Ltd recognised a deferred tax asset in respect of this loss The tax rate is 30%. (c) (d) (a) Prepare the journal entry necessary to record the amendment to the prior year's taxation return. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account and explanation Debit Credit 30/06/20 Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 0 of 3 used SAVE FOR LATER SUUNIT ANSWER (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started