Answered step by step

Verified Expert Solution

Question

1 Approved Answer

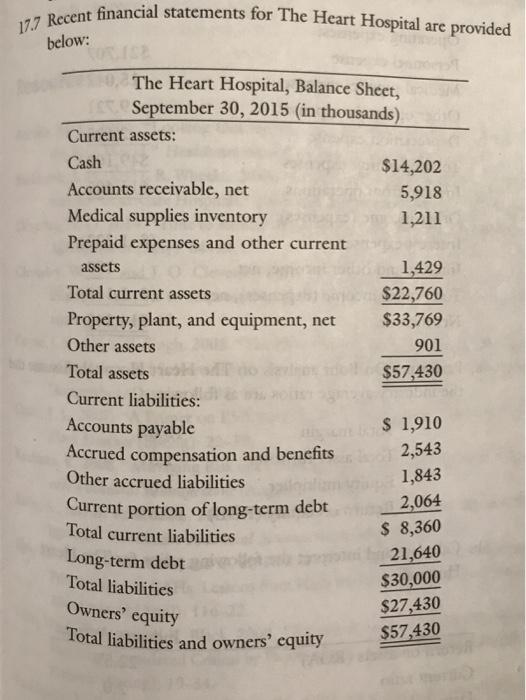

17.7 Recent financial statements for The Heart Hospital are provided below: The Heart Hospital, Balance Sheet, September 30, 2015 (in thousands). Current assets: Cash

17.7 Recent financial statements for The Heart Hospital are provided below: The Heart Hospital, Balance Sheet, September 30, 2015 (in thousands). Current assets: Cash $14,202 Accounts receivable, net 5,918 Medical supplies inventory 1,211 Prepaid expenses and other current 1,429 $22,760 assets Total current assets Property, plant, and equipment, net $33,769 Other assets 901 Total assets $57,430 Current liabilities: Accounts payable Accrued compensation and benefits Other accrued liabilities $ 1,910 2,543 1,843 2,064 $ 8,360 21,640 $30,000 $27,430 $57,430 Current portion of long-term debt Total current liabilities Long-term debt Total liabilities Owners' equity Total liabilities and owners' cquity 676 Healthcare Finance The Heart Hospital, Statement of Operations Year Ended September 30, 2015 (in thousande Patient service revenue net of discounts and allowances $66,962 2,457) $64,505 Provision for bad debt Net patient service revenue Operating expenses: Personnel expense Medical supplies expense Other operating expenses Depreciation expense Total operating expenses Income from operations $21,707 15,047 9,721 2,625 $49,100 $15,405 Other income (expenses): Interest expense (S 1,322) Interest and other income, net 159 Total other income (expenses), net ($1,163) Net income $14,242 a. Perform a Du Pont analysis on The Heart Hospital. Assume the the industry average ratios are as follows: Total margin 15.0% Total asset turnover 1.5 Equity multiplier Return on equity (ROE) 37.6% 1.67 b. Calculate and interpret the following ratios for The Heart Hospital: Industry Average 22.5% Return on assets (ROA) Current ratio 2.0 85 days Days cash on hand Average collection period 20 days Debt ratio 40% 0.67 Debt-to-equity ratio Times interest carned (TIE) ratio 5.0 Fixed asset turnover ratio 1.4

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

In order to give better clarity details of calculations have be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started