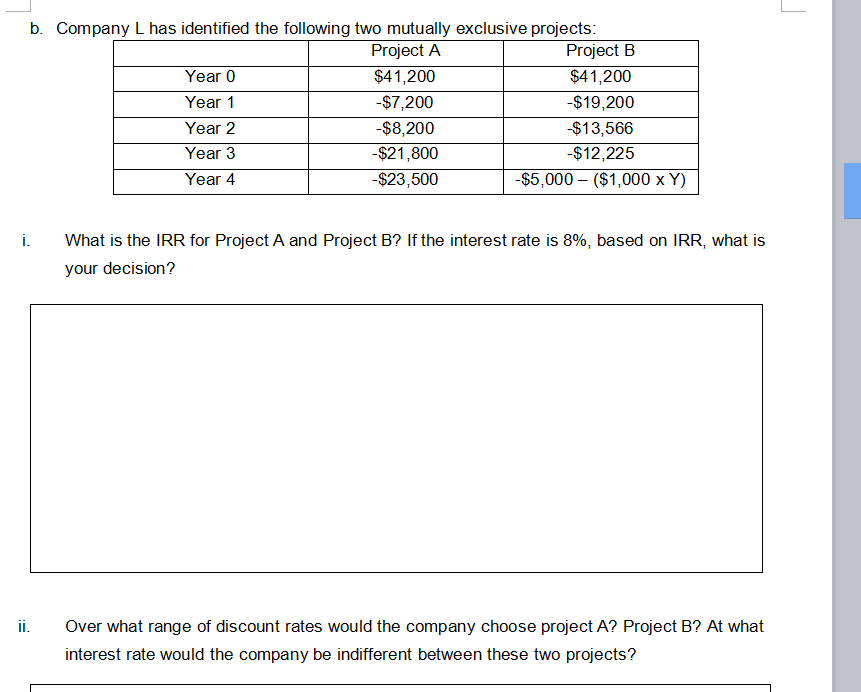

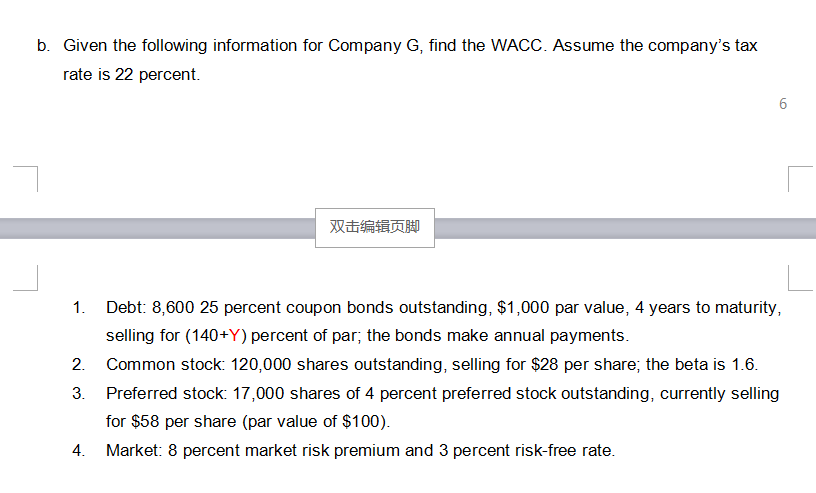

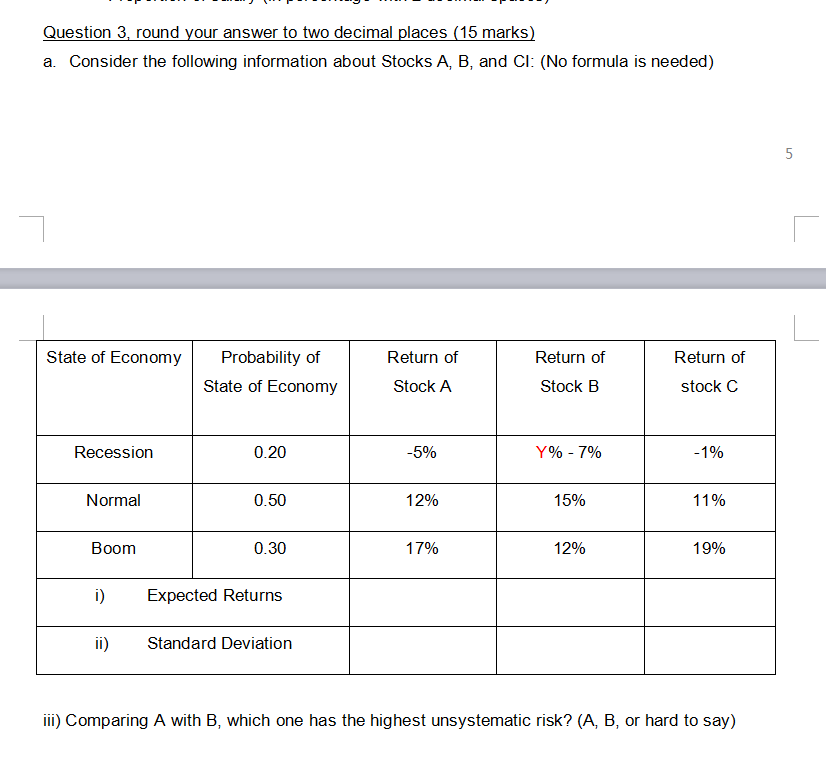

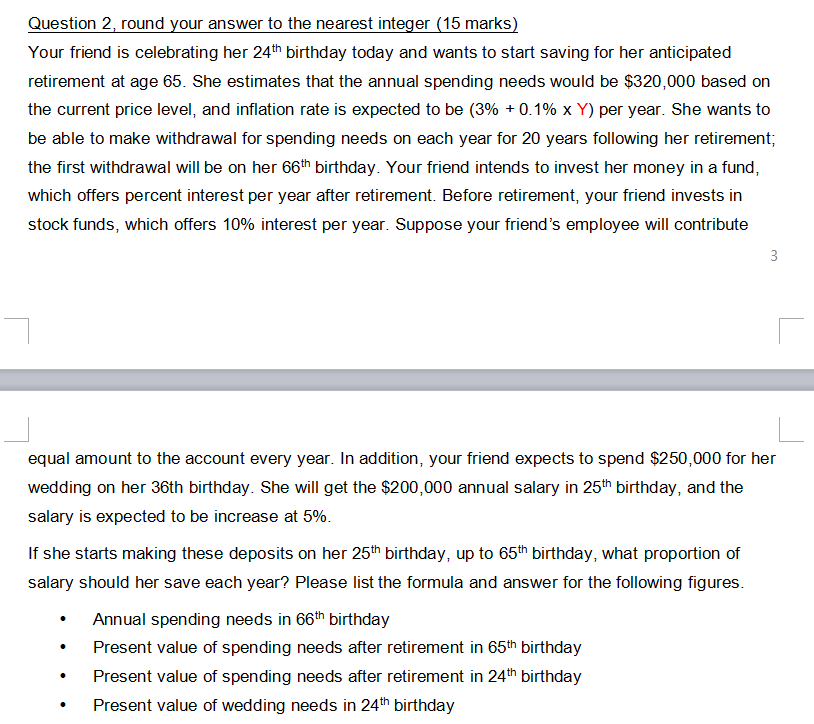

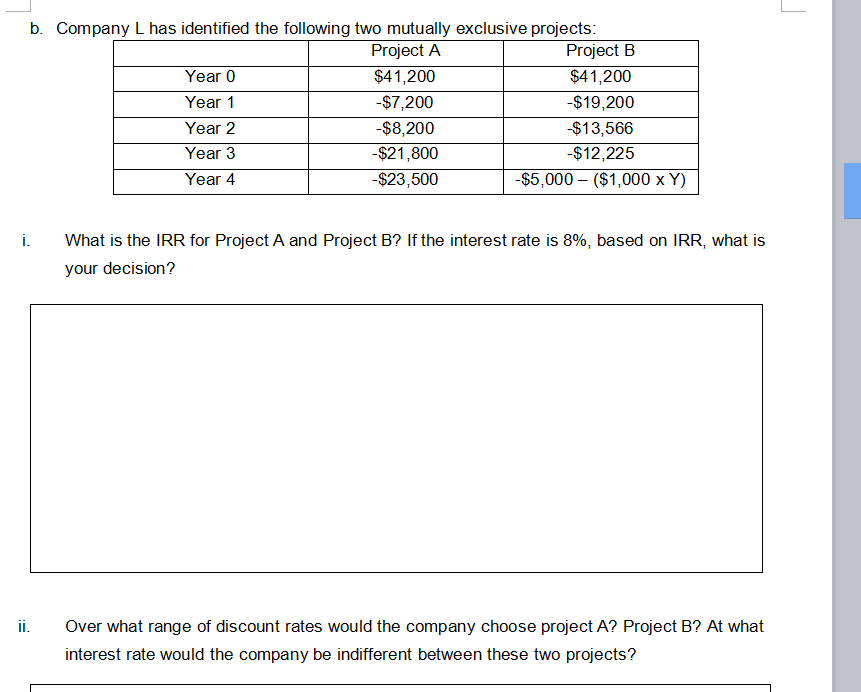

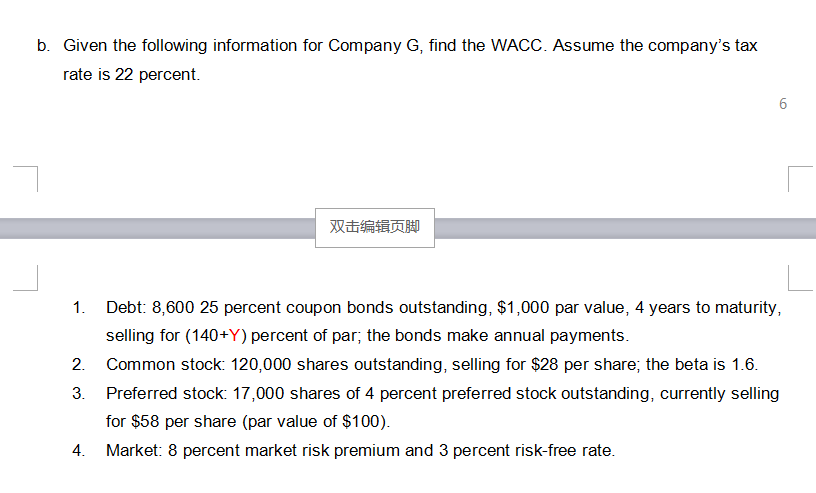

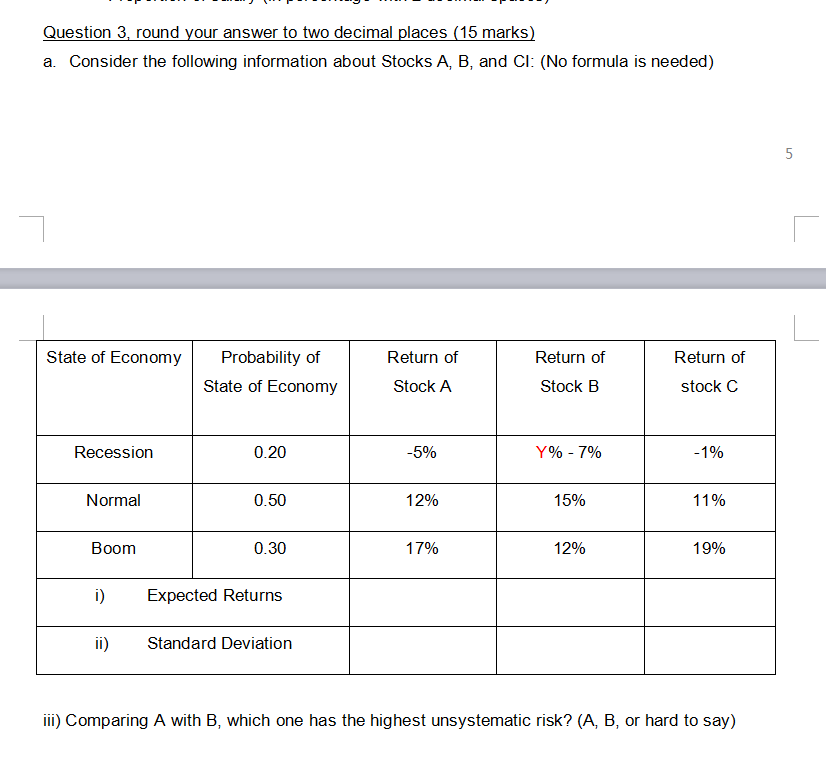

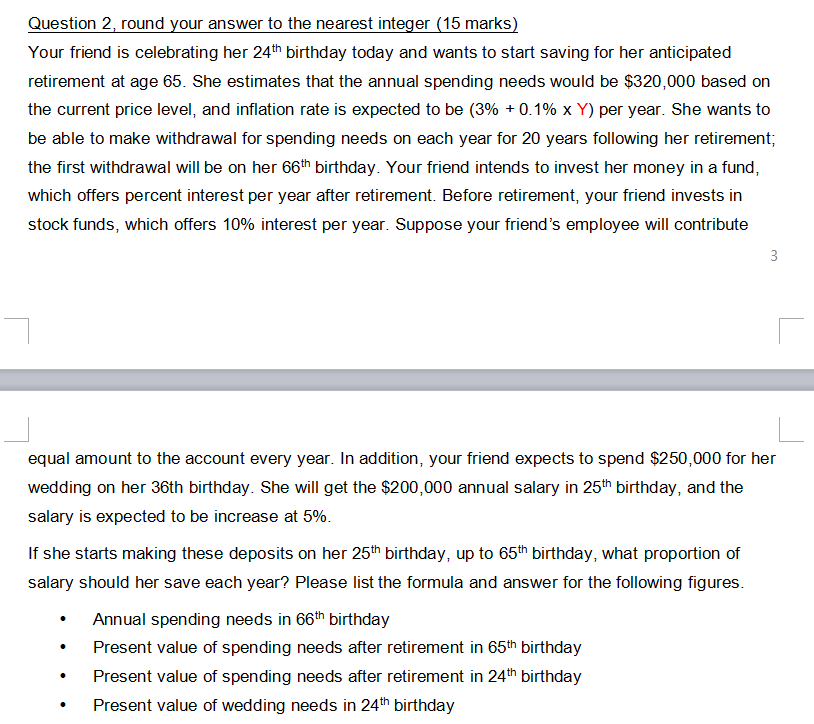

b. Company L has identified the following two mutually exclusive projects: Project A Project B Year 0 $41,200 $41,200 Year 1 -$7,200 -$19,200 Year 2 -$8,200 $13,566 Year 3 -$21,800 $12,225 Year 4 -$23,500 -$5,000 - ($1,000 x Y) i. What is the IRR for Project A and Project B? If the interest rate is 8%, based on IRR, what is your decision? ii. Over what range of discount rates would the company choose project A? Project B? At what interest rate would the company be indifferent between these two projects? b. Given the following information for Company G, find the WACC. Assume the company's tax rate is 22 percent. 6 1. Debt: 8,600 25 percent coupon bonds outstanding, $1,000 par value, 4 years to maturity, selling for (140+Y) percent of par; the bonds make annual payments. 2. Common stock: 120,000 shares outstanding, selling for $28 per share; the beta is 1.6. 3. Preferred stock: 17,000 shares of 4 percent preferred stock outstanding, currently selling for $58 per share (par value of $100). 4. Market: 8 percent market risk premium and 3 percent risk-free rate. Question 3, round your answer to two decimal places (15 marks) a. Consider the following information about Stocks A, B, and Cl: (No formula is needed) 5 State of Economy Probability of State of Economy Return of Stock A Return of Stock B Return of stock C Recession 0.20 -5% Y%-7% -1% Normal 0.50 12% 15% 11% Boom 0.30 17% 12% 19% i) Expected Returns ii) Standard Deviation iii) Comparing A with B, which one has the highest unsystematic risk? (A, B, or hard to say) Question 2, round your answer to the nearest integer (15 marks) Your friend is celebrating her 24th birthday today and wants to start saving for her anticipated retirement at age 65. She estimates that the annual spending needs would be $320,000 based on the current price level, and inflation rate is expected to be (3% +0.1% x Y) per year. She wants to be able to make withdrawal for spending needs on each year for 20 years following her retirement; the first withdrawal will be on her 66th birthday. Your friend intends to invest her money in a fund, which offers percent interest per year after retirement. Before retirement, your friend invests in stock funds, which offers 10% interest per year. Suppose your friend's employee will contribute 3 equal amount to the account every year. In addition, your friend expects to spend $250,000 for her wedding on her 36th birthday. She will get the $200,000 annual salary in 25th birthday, and the salary is expected to be increase at 5%. If she starts making these deposits on her 25th birthday, up to 65th birthday, what proportion of salary should her save each year? Please list the formula and answer for the following figures. Annual spending needs in 66th birthday Present value of spending needs after retirement in 65th birthday Present value of spending needs after retirement in 24th birthday Present value of wedding needs in 24th birthday b. Company L has identified the following two mutually exclusive projects: Project A Project B Year 0 $41,200 $41,200 Year 1 -$7,200 -$19,200 Year 2 -$8,200 $13,566 Year 3 -$21,800 $12,225 Year 4 -$23,500 -$5,000 - ($1,000 x Y) i. What is the IRR for Project A and Project B? If the interest rate is 8%, based on IRR, what is your decision? ii. Over what range of discount rates would the company choose project A? Project B? At what interest rate would the company be indifferent between these two projects? b. Given the following information for Company G, find the WACC. Assume the company's tax rate is 22 percent. 6 1. Debt: 8,600 25 percent coupon bonds outstanding, $1,000 par value, 4 years to maturity, selling for (140+Y) percent of par; the bonds make annual payments. 2. Common stock: 120,000 shares outstanding, selling for $28 per share; the beta is 1.6. 3. Preferred stock: 17,000 shares of 4 percent preferred stock outstanding, currently selling for $58 per share (par value of $100). 4. Market: 8 percent market risk premium and 3 percent risk-free rate. Question 3, round your answer to two decimal places (15 marks) a. Consider the following information about Stocks A, B, and Cl: (No formula is needed) 5 State of Economy Probability of State of Economy Return of Stock A Return of Stock B Return of stock C Recession 0.20 -5% Y%-7% -1% Normal 0.50 12% 15% 11% Boom 0.30 17% 12% 19% i) Expected Returns ii) Standard Deviation iii) Comparing A with B, which one has the highest unsystematic risk? (A, B, or hard to say) Question 2, round your answer to the nearest integer (15 marks) Your friend is celebrating her 24th birthday today and wants to start saving for her anticipated retirement at age 65. She estimates that the annual spending needs would be $320,000 based on the current price level, and inflation rate is expected to be (3% +0.1% x Y) per year. She wants to be able to make withdrawal for spending needs on each year for 20 years following her retirement; the first withdrawal will be on her 66th birthday. Your friend intends to invest her money in a fund, which offers percent interest per year after retirement. Before retirement, your friend invests in stock funds, which offers 10% interest per year. Suppose your friend's employee will contribute 3 equal amount to the account every year. In addition, your friend expects to spend $250,000 for her wedding on her 36th birthday. She will get the $200,000 annual salary in 25th birthday, and the salary is expected to be increase at 5%. If she starts making these deposits on her 25th birthday, up to 65th birthday, what proportion of salary should her save each year? Please list the formula and answer for the following figures. Annual spending needs in 66th birthday Present value of spending needs after retirement in 65th birthday Present value of spending needs after retirement in 24th birthday Present value of wedding needs in 24th birthday