Answered step by step

Verified Expert Solution

Question

1 Approved Answer

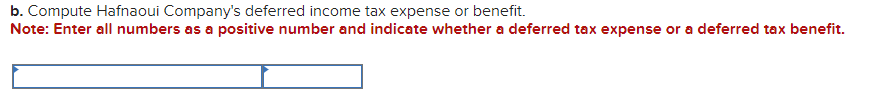

b. Compute Hafnaoui Company's deferred income tax expense or benefit. Note: Enter all numbers as a positive number and indicate whether a deferred tax expense

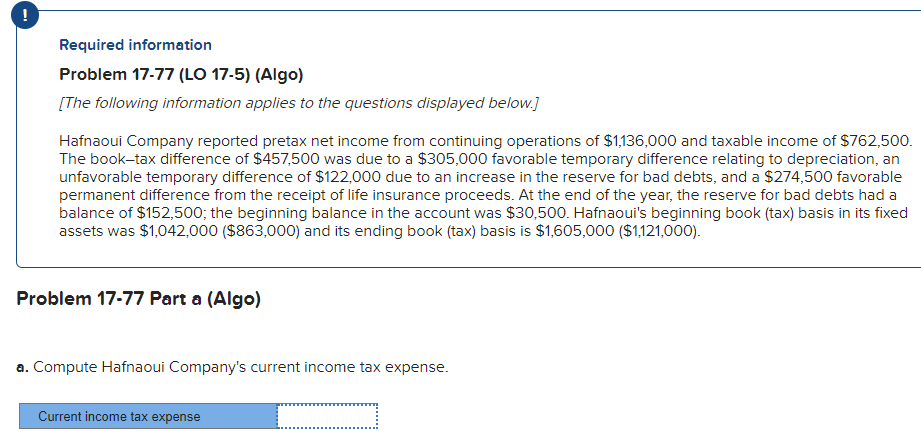

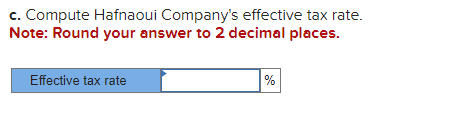

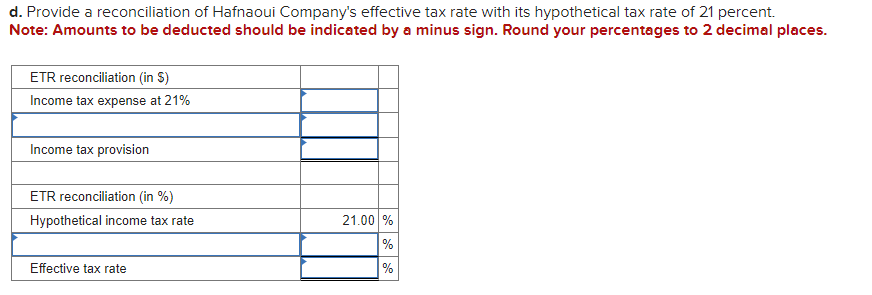

b. Compute Hafnaoui Company's deferred income tax expense or benefit. Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit. d. Provide a reconciliation of Hafnaoui Company's effective tax rate with its hypothetical tax rate of 21 percent. Note: Amounts to be deducted should be indicated by a minus sign. Round your percentages to 2 decimal places. c. Compute Hafnaoui Company's effective tax rate. Note: Round your answer to 2 decimal places. Required information Problem 17-77 (LO 17-5) (Algo) [The following information applies to the questions displayed below.] Hafnaoui Company reported pretax net income from continuing operations of $1,136,000 and taxable income of $762,500. The book-tax difference of $457,500 was due to a $305,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $122,000 due to an increase in the reserve for bad debts, and a $274,500 favorable permanent difference from the receipt of life insurance proceeds. At the end of the year, the reserve for bad debts had a balance of $152,500; the beginning balance in the account was $30,500. Hafnaoui's beginning book (tax) basis in its fixed assets was $1,042,000($863,000) and its ending book (tax) basis is $1,605,000($1,121,000). Problem 17.77 Part a (Algo) a. Compute Hafnaoui Company's current income tax expense

b. Compute Hafnaoui Company's deferred income tax expense or benefit. Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit. d. Provide a reconciliation of Hafnaoui Company's effective tax rate with its hypothetical tax rate of 21 percent. Note: Amounts to be deducted should be indicated by a minus sign. Round your percentages to 2 decimal places. c. Compute Hafnaoui Company's effective tax rate. Note: Round your answer to 2 decimal places. Required information Problem 17-77 (LO 17-5) (Algo) [The following information applies to the questions displayed below.] Hafnaoui Company reported pretax net income from continuing operations of $1,136,000 and taxable income of $762,500. The book-tax difference of $457,500 was due to a $305,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $122,000 due to an increase in the reserve for bad debts, and a $274,500 favorable permanent difference from the receipt of life insurance proceeds. At the end of the year, the reserve for bad debts had a balance of $152,500; the beginning balance in the account was $30,500. Hafnaoui's beginning book (tax) basis in its fixed assets was $1,042,000($863,000) and its ending book (tax) basis is $1,605,000($1,121,000). Problem 17.77 Part a (Algo) a. Compute Hafnaoui Company's current income tax expense Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started