Question

(b) Consider the following investment: you buy 1 share of the Call Option of GameCock stock at $1 and 1 share of the Put

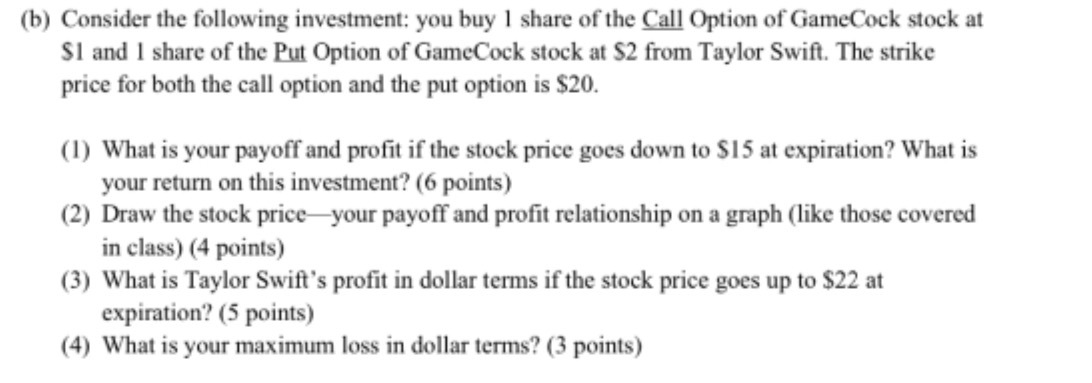

(b) Consider the following investment: you buy 1 share of the Call Option of GameCock stock at $1 and 1 share of the Put Option of GameCock stock at $2 from Taylor Swift. The strike price for both the call option and the put option is $20. (1) What is your payoff and profit if the stock price goes down to $15 at expiration? What is your return on this investment? (6 points) (2) Draw the stock price your payoff and profit relationship on a graph (like those covered in class) (4 points) (3) What is Taylor Swift's profit in dollar terms if the stock price goes up to $22 at expiration? (5 points) (4) What is your maximum loss in dollar terms? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 If the stock price remains at 52 your payoff and profit from call option would be zero since the s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App