Answered step by step

Verified Expert Solution

Question

1 Approved Answer

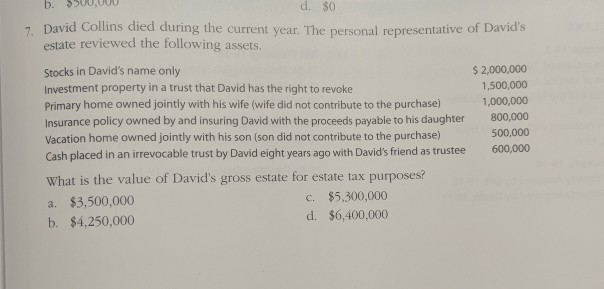

b. d. $0 7 David Collins died during the current year. The personal representative of David's estate reviewed the following assets. $2,000,000 1,500,000 Stocks in

b. d. $0 7 David Collins died during the current year. The personal representative of David's estate reviewed the following assets. $2,000,000 1,500,000 Stocks in David's name only Investment property in a trust that David has the right to revoke 1,000,000 Primary home owned jointly with his wife (wife did not contribute to the purchase) Insurance policy owned by and insuring David with the proceeds payable to his daughter 800,000 500,000 Vacation home owned jointly with his son (son did not contribute to the purchase) 600,000 Cash placed in an irrevocable trust by David eight years ago with David's friend as trustee What is the value of David's gross estate for estate tax purposes? c. $5,300,000 d. $6,400,000 a. $3,500,000 b. $4,250,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started