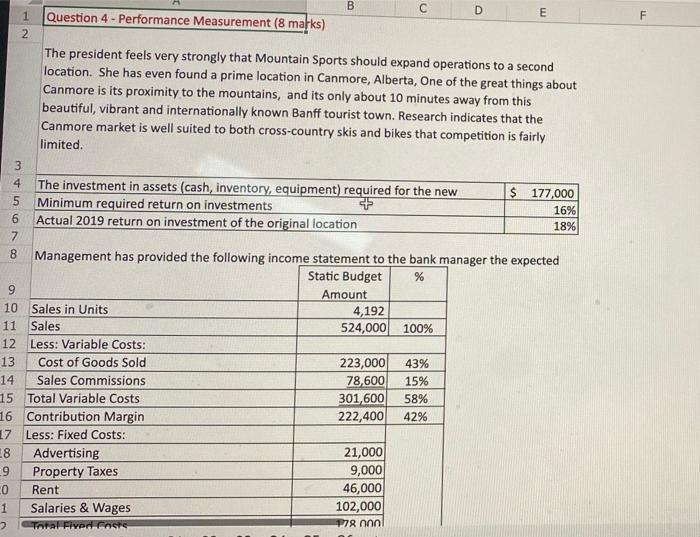

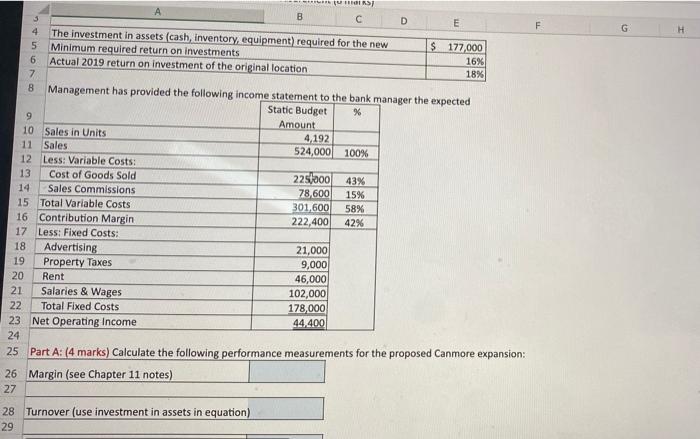

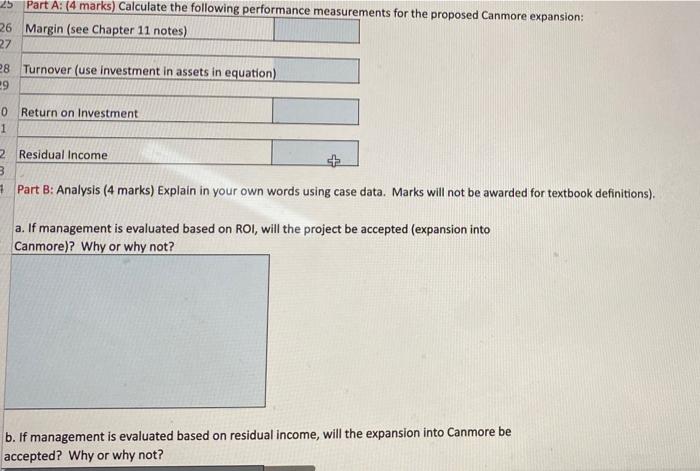

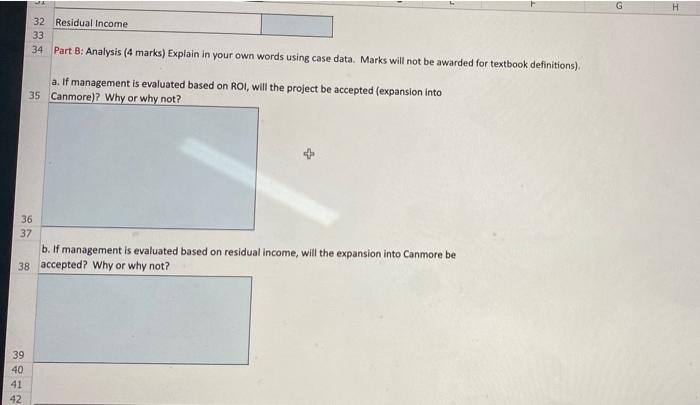

B D 1 E Question 4 - Performance Measurement (8 marks) N The president feels very strongly that Mountain Sports should expand operations to a second location. She has even found a prime location in Canmore, Alberta, One of the great things about Canmore is its proximity to the mountains, and its only about 10 minutes away from this beautiful, vibrant and internationally known Banff tourist town. Research indicates that the Canmore market is well suited to both cross-country skis and bikes that competition is fairly limited 3 4 The investment in assets (cash, inventory, equipment) required for the new $ 177,000 5 Minimum required return on investments 16% 6 Actual 2019 return on investment of the original location 18% 7 8 Management has provided the following income statement to the bank manager the expected Static Budget % 9 Amount 10 Sales in Units 4,192 11 Sales 524,000 100% 12 Less: Variable Costs: 13 Cost of Goods Sold 223,000 43% 14 Sales Commissions 78,600 15% 15 Total Variable Costs 301,600 58% 16 Contribution Margin 222,400 42% 17 Less: Fixed Costs: 18 Advertising 21,000 -9 Property Taxes 9,000 0 Rent 46,000 1 Salaries & Wages 102,000 2 TATA Five Cnete P78 non ! F G H RS A B D E 4 The investment in assets (cash, inventory, equipment required for the new 5 Minimum required return on investments $ 177,000 6 16% Actual 2019 return on investment of the original location 7 18% 8 Management has provided the following income statement to the bank manager the expected Static Budget % 9 Amount 10 Sales in Units 4,192 11 Sales 524,000 100% 12 Less: Variable Costs: 13 Cost of Goods Sold 225000 43% 14 Sales Commissions 78,600 15% 15 Total Variable Costs 301,600 58% 16 Contribution Margin 222,400 42% 17 Less: Fixed Costs: 18 Advertising 21,000 19 Property Taxes 9,000 20 Rent 46,000 21 Salaries & Wages 102,000 22 Total Fixed Costs 178,000 23 Net Operating Income 44.400 24 25 Part A: (4 marks) Calculate the following performance measurements for the proposed Canmore expansion: 26 Margin (see Chapter 11 notes) 27 28 Turnover (use investment in assets in equation) 29 25 Part A: (4 marks) Calculate the following performance measurements for the proposed Canmore expansion: 26 Margin (see Chapter 11 notes) 27 28 Turnover (use investment in assets in equation) 29 0 Return on Investment 1 2 Residual Income + 3 7 Part B: Analysis (4 marks) Explain in your own words using case data. Marks will not be awarded for textbook definitions) a. If management is evaluated based on ROI, will the project be accepted (expansion into Canmore)? Why or why not? b. If management is evaluated based on residual income, will the expansion into Canmore be accepted? Why or why not? H 32 Residual Income 33 34 Part B: Analysis (4 marks) Explain in your own words using case data. Marks will not be awarded for textbook definitions), a. If management is evaluated based on ROI, will the project be accepted (expansion into 35 Canmore)? Why or why not? 36 37 b. If management is evaluated based on residual income, will the expansion into Canmore be 38 accepted? Why or why not? 39 40 41 42