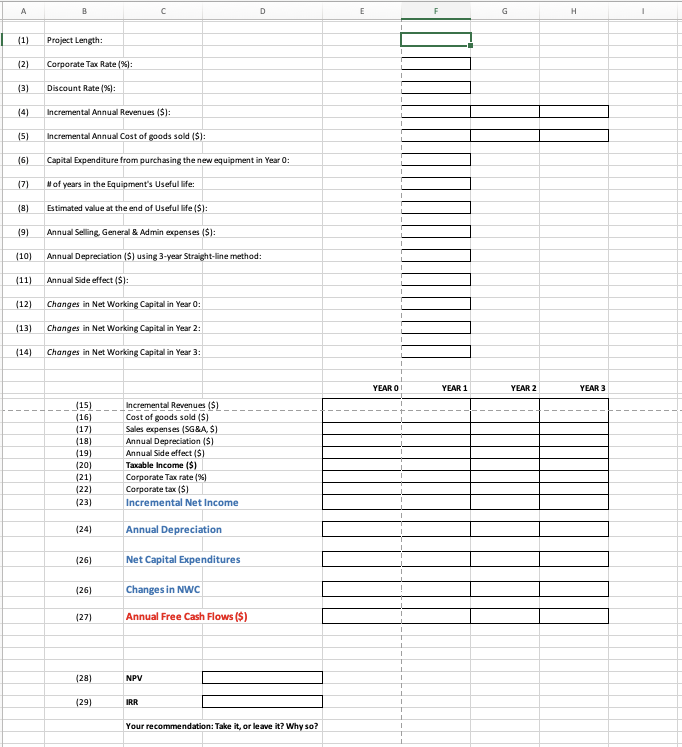

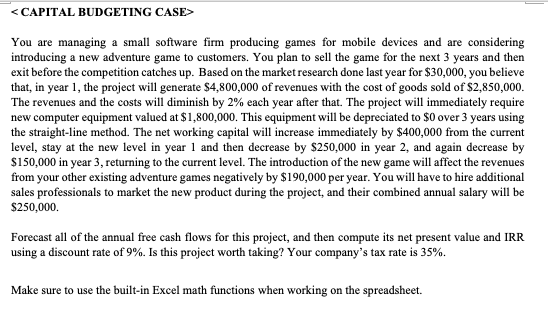

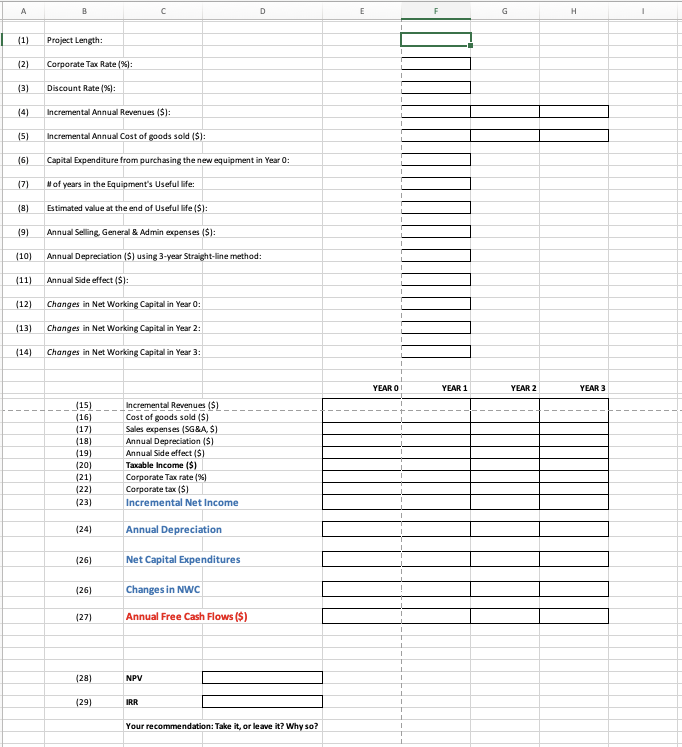

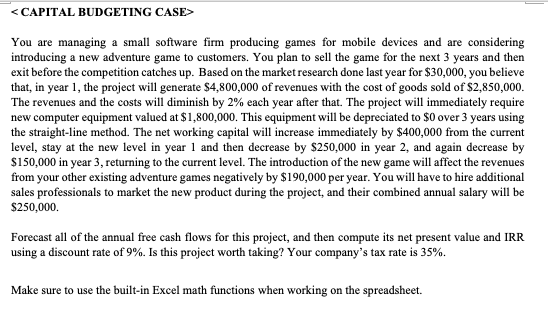

B D E E G H (1) Project Length: (2) Corporate Tax Rate(%): (3) Discount Rate(%): (4) Incremental Annual Revenues ($): (5) Incremental Annual Cost of goods sold ($): (6) Capital Expenditure from purchasing the new equipment in Year O: Hof years in the Equipment's Useful life: (7) (8) Estimated value at the end of Useful life ($): (9) Annual Selling, General & Admin expenses ($): (10) Annual Depreciation ($) using 3-year Straight-line method: (11) Annual Side effect (S): (12) Changes in Net Working Capital in Year : (13) Changes in Net Working Capital in Year 2: (14) Changes in Net Working Capital in Year 3: YEAR O YEAR 1 YEAR 2 YEAR 3 (15) (16) (17) (18) (19) (20) (21) (22) (23) Incremental Revenues ($) Cost of goods sold ($) Sales expenses (SG&A, S) Annual Depreciation (S) Annual Side effect ($) Taxable income ($) Corporate Tax rate (%) Corporate tax ($) Incremental Net Income (24) Annual Depreciation (26) Net Capital Expenditures (26) Changes in NWC (27) Annual Free Cash Flows ($) (28) NPV (29) IRR Your recommendation: Take it, or leave it? Why so?

You are managing a small software firm producing games for mobile devices and are considering introducing a new adventure game to customers. You plan to sell the game for the next 3 years and then exit before the competition catches up. Based on the market research done last year for $30,000, you believe that, in year 1, the project will generate $4,800,000 of revenues with the cost of goods sold of $2,850,000. The revenues and the costs will diminish by 2% each year after that. The project will immediately require new computer equipment valued at $1,800,000. This equipment will be depreciated to $0 over 3 years using the straight-line method. The net working capital will increase immediately by $400,000 from the current level, stay at the new level in year 1 and then decrease by $250,000 in year 2, and again decrease by $150,000 in year 3, returning to the current level. The introduction of the new game will affect the revenues from your other existing adventure games negatively by $190,000 per year. You will have to hire additional sales professionals to market the new product during the project, and their combined annual salary will be $250,000 Forecast all of the annual free cash flows for this project, and then compute its net present value and IRR using a discount rate of 9%. Is this project worth taking? Your company's tax rate is 35%. Make sure to use the built-in Excel math functions when working on the spreadsheet