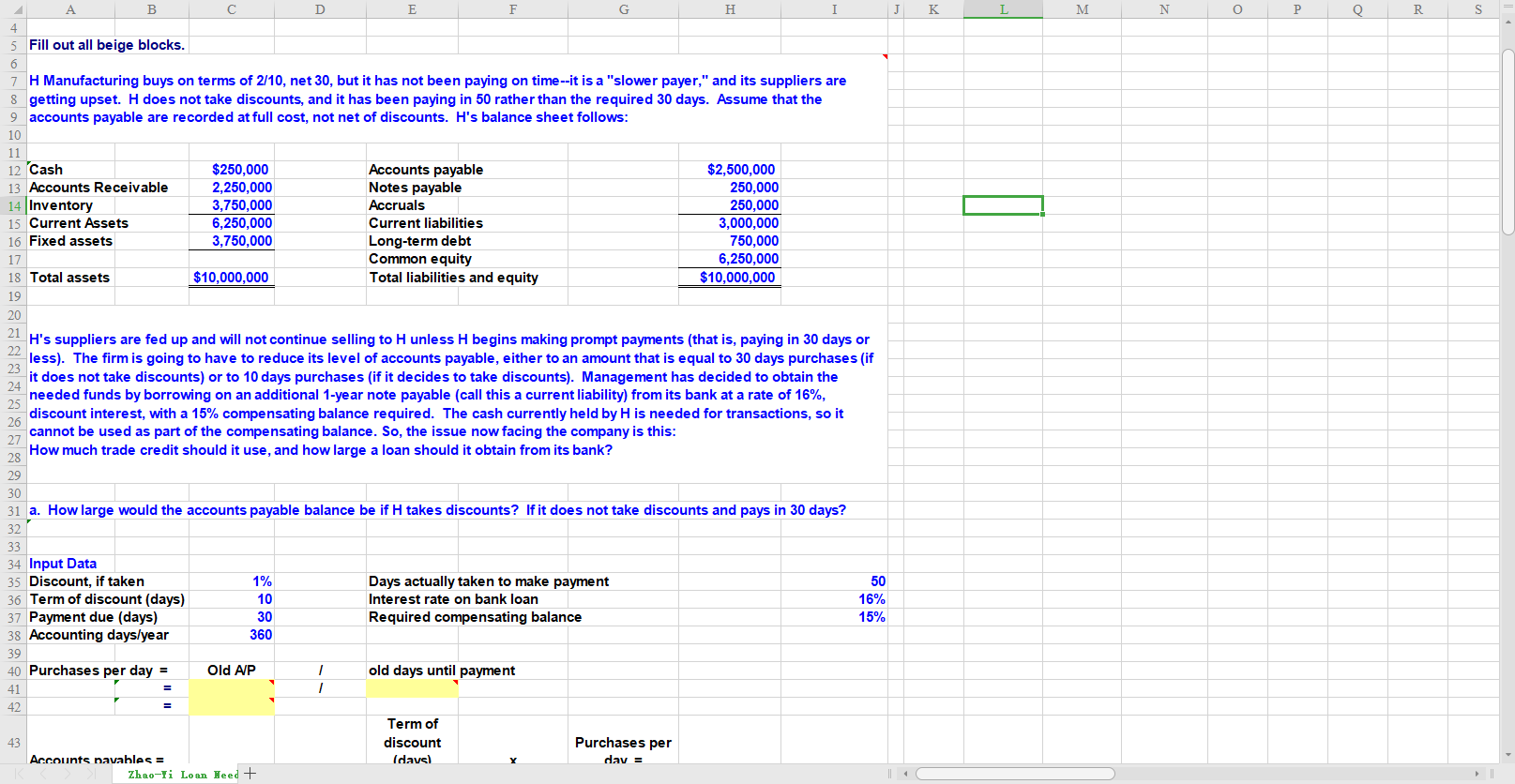

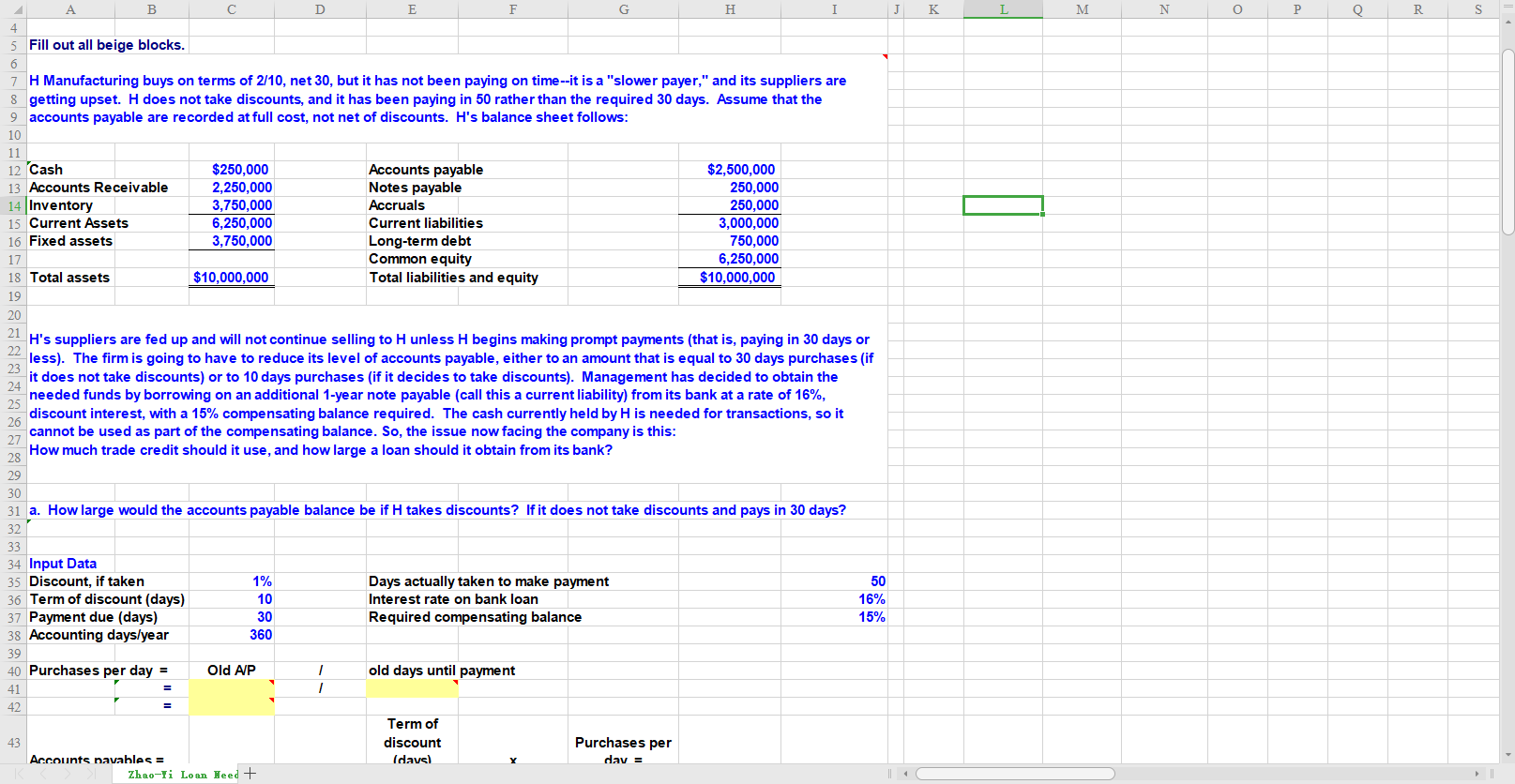

B D E K L M N O P Q R S 5 Fill out all beige blocks. 6 O 7 H Manufacturing buys on terms of 2/10, net 30, but it has not been paying on time--it is a "slower payer," and its suppliers are 8 getting upset. H does not take discounts, and it has been paying in 50 rather than the required 30 days. Assume that the 9 accounts payable are recorded at full cost, not net of discounts. H's balance sheet follows: 10 11 12 Cash $250,000 Accounts payable $2,500,000 13 Accounts Receivable 2,250,000 Notes payable 250,000 14 Inventory 3,750,000 Accruals 250,000 15 Current Assets 6,250,000 Current liabilities 3,000,000 16 Fixed assets 3,750,000 Long-term debt 750,000 17 Common equity 6,250,000 18 Total assets $10,000,000 Total liabilities and equity $10,000,000 19 20 21 H's suppliers are fed up and will not continue selling to H unless H begins making prompt payments (that is, paying in 30 days or 22 less). The firm is going to have to reduce its level of accounts payable, either to an amount that is equal to 30 days purchases (if it does not take discounts) or to 10 days purchases (if it decides to take discounts). Management has decided to obtain the needed funds by borrowing on an additional 1-year note payable (call this a current liability) from its bank at a rate of 16%, discount interest, with a 15% compensating balance required. The cash currently held by H is needed for transactions, so it 26 cannot be used as part of the compensating balance. So, the issue now facing the company is this: How much trade credit should it use, and how large a loan should it obtain from its bank? 28 29 30 31 a. How large would the accounts payable balance be if H takes discounts? If it does not take discounts and pays in 30 days? 32 33 34 Input Data 35 Discount, if taken 1% Days actually taken to make payment 50 36 Term of discount (days) 10 Interest rate on bank loan 16% 37 Payment due (days) 30 Required compensating balance 15% 38 Accounting days/year 360 39 40 Purchases per day = Old A/P old days until payment 41 42 Term of discount Purchases per Accounts payables = (davs! dav = Zhao-Ti Loan leed + 43 B D E K L M N O P Q R S 5 Fill out all beige blocks. 6 O 7 H Manufacturing buys on terms of 2/10, net 30, but it has not been paying on time--it is a "slower payer," and its suppliers are 8 getting upset. H does not take discounts, and it has been paying in 50 rather than the required 30 days. Assume that the 9 accounts payable are recorded at full cost, not net of discounts. H's balance sheet follows: 10 11 12 Cash $250,000 Accounts payable $2,500,000 13 Accounts Receivable 2,250,000 Notes payable 250,000 14 Inventory 3,750,000 Accruals 250,000 15 Current Assets 6,250,000 Current liabilities 3,000,000 16 Fixed assets 3,750,000 Long-term debt 750,000 17 Common equity 6,250,000 18 Total assets $10,000,000 Total liabilities and equity $10,000,000 19 20 21 H's suppliers are fed up and will not continue selling to H unless H begins making prompt payments (that is, paying in 30 days or 22 less). The firm is going to have to reduce its level of accounts payable, either to an amount that is equal to 30 days purchases (if it does not take discounts) or to 10 days purchases (if it decides to take discounts). Management has decided to obtain the needed funds by borrowing on an additional 1-year note payable (call this a current liability) from its bank at a rate of 16%, discount interest, with a 15% compensating balance required. The cash currently held by H is needed for transactions, so it 26 cannot be used as part of the compensating balance. So, the issue now facing the company is this: How much trade credit should it use, and how large a loan should it obtain from its bank? 28 29 30 31 a. How large would the accounts payable balance be if H takes discounts? If it does not take discounts and pays in 30 days? 32 33 34 Input Data 35 Discount, if taken 1% Days actually taken to make payment 50 36 Term of discount (days) 10 Interest rate on bank loan 16% 37 Payment due (days) 30 Required compensating balance 15% 38 Accounting days/year 360 39 40 Purchases per day = Old A/P old days until payment 41 42 Term of discount Purchases per Accounts payables = (davs! dav = Zhao-Ti Loan leed + 43