Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B ???? DE table [ [ G , H , I,J , K , L , M , N ] ] Project Two Problem

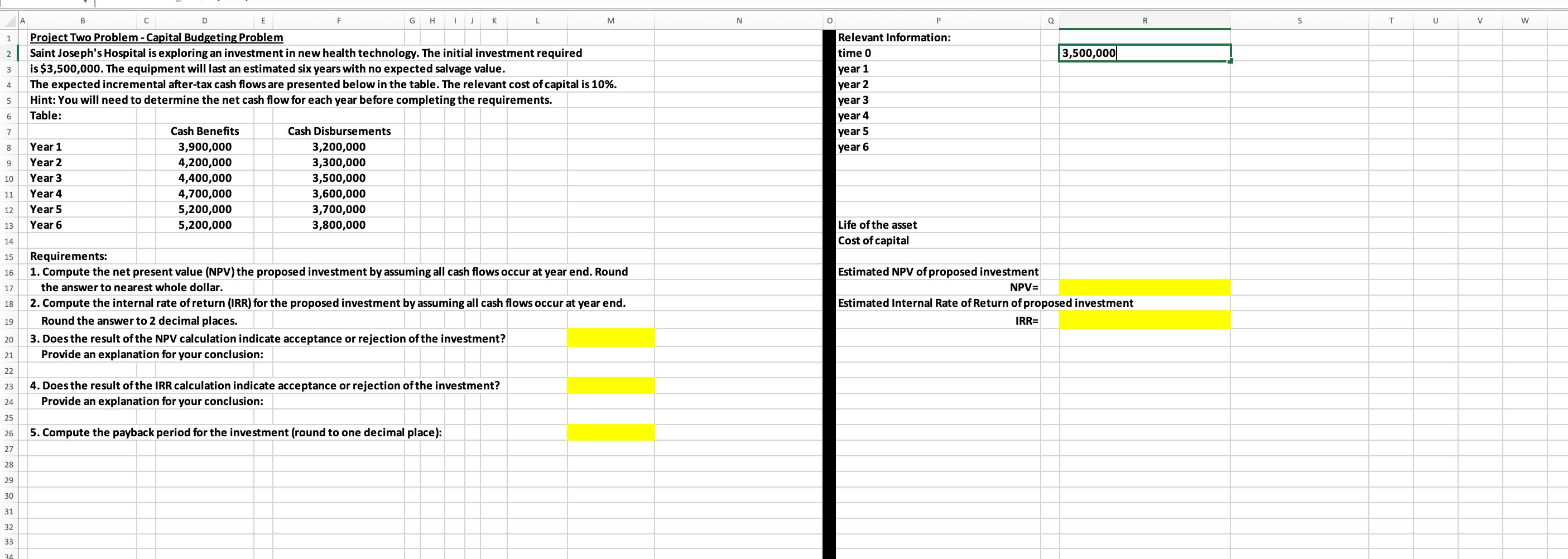

BDEtableGHI,JKLMNProject Two Problem Capital Budgeting Problemis $ The equipment will last an estimated six years with no expected salvage value.The expected incremental aftertax cash flows are presented below in the table. The relevant cost of capital is Hint: You will need to determine the net cash flow for each year before completing the requirements.Table:Year Year Year Year Year Year Cash BenefitsCash DisbursementsCost of capitalRequirements:Compute the net present value NPV the proposed investment by assuming all cash flows occur at year end. Roundthe answer to nearest whole dollar.Compute the internal rate of return IRR for the proposed investment by assuming all cash flows occur at year end.Round the answer to decimal places.Does the result of the NPV calculation indicate acceptance or rejection of the investment?Provide an explanation for your conclusion:Does the result of the IRR calculation indicate acceptance or rejection of the investment?Provide an explanation for your conclusion:Compute the payback period for the investment round to one decimal place:Add equations that used to solve

A B D E F G H I J K L M N P Q 1 Project Two Problem - Capital Budgeting Problem Relevant Information: 2 Saint Joseph's Hospital is exploring an investment in new health technology. The initial investment required 3 is $3,500,000. The equipment will last an estimated six years with no expected salvage value. 5 6 The expected incremental after-tax cash flows are presented below in the table. The relevant cost of capital is 10%. Hint: You will need to determine the net cash flow for each year before completing the requirements. Table: 7 Cash Benefits Cash Disbursements 8 Year 1 9 Year 2 3,900,000 4,200,000 3,200,000 time 0 year 1 year 2 year 3 year 4 year 5 year 6 |3,500,000 3,300,000 10 Year 3 4,400,000 3,500,000 11 Year 4 4,700,000 3,600,000 12 Year 5 5,200,000 13 Year 6 5,200,000 3,700,000 3,800,000 14 15 16 17 18 19 20 21 Requirements: 1. Compute the net present value (NPV) the proposed investment by assuming all cash flows occur at year end. Round the answer to nearest whole dollar. 2. Compute the internal rate of return (IRR) for the proposed investment by assuming all cash flows occur at year end. Round the answer to 2 decimal places. 3. Does the result of the NPV calculation indicate acceptance or rejection of the investment? Provide an explanation for your conclusion: Life of the asset Cost of capital Estimated NPV of proposed investment NPV= Estimated Internal Rate of Return of proposed investment IRR= 22 23 24 4. Does the result of the IRR calculation indicate acceptance or rejection of the investment? Provide an explanation for your conclusion: 25 26 5. Compute the payback period for the investment (round to one decimal place): 27 28 29 30 31 32 33 34 R S T U V W

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you sent is a capital budgeting problem that asks you to calculate the Net Present Value NPV Internal Rate of Return IRR and payback period for a new health technology investment at Saint Jo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started