Question

B) DEF Inc. is currently paying its suppliers on time but faces a liquidity crunch and must decide between borrowing from a bank at

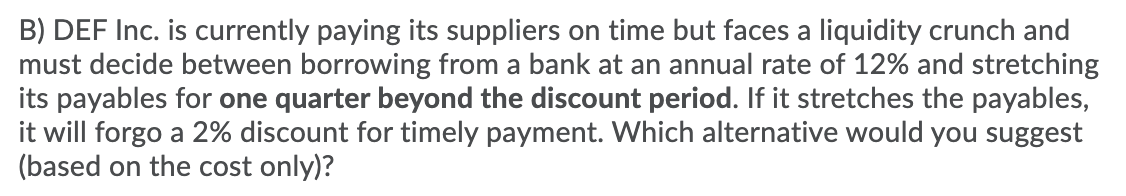

B) DEF Inc. is currently paying its suppliers on time but faces a liquidity crunch and must decide between borrowing from a bank at an annual rate of 12% and stretching its payables for one quarter beyond the discount period. If it stretches the payables, it will forgo a 2% discount for timely payment. Which alternative would you suggest (based on the cost only)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the most costeffective alternative for DEF Inc lets calculate the effective annual cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

17th edition

007802577X, 978-0078025778

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App