Answered step by step

Verified Expert Solution

Question

1 Approved Answer

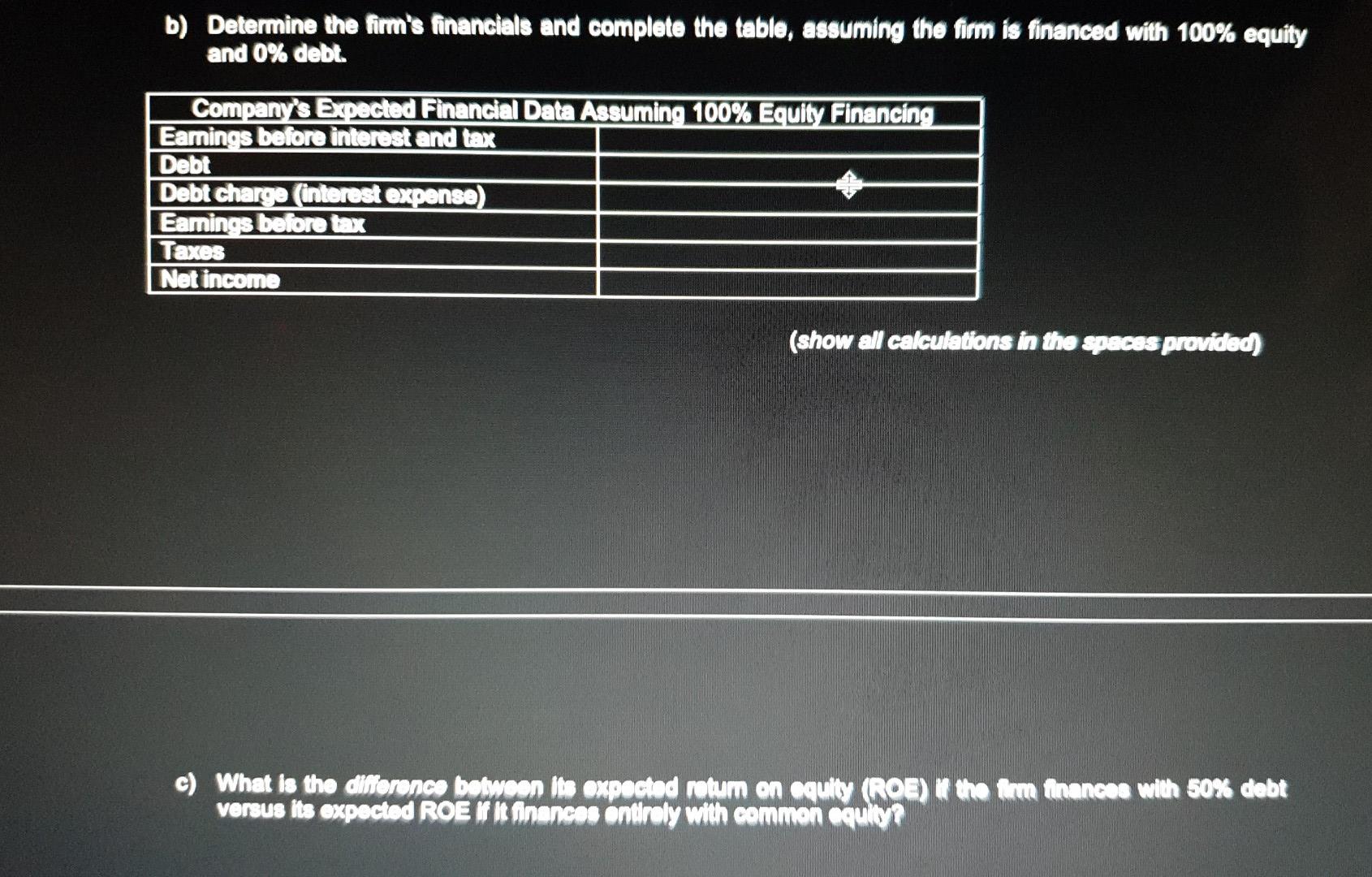

b) Determine the firm's financials and complete the table, assuming the firm is financed with 100% equity and 0% debt. Company's Expected Financial Data Assuming

b) Determine the firm's financials and complete the table, assuming the firm is financed with 100% equity and 0% debt. Company's Expected Financial Data Assuming 100% Equity Financing Eamings before interest and tax Debt Debt charge (interest expense) Earnings before tax Taxes Net income (show all calculations in the spaces provided) c) What is the difference between its expected return on equity (ROE) in the firm finances with 50% debt versus its expected ROE If It Ainances entirely with common equity? b) Determine the firm's financials and complete the table, assuming the firm is financed with 100% equity and 0% debt. Company's Expected Financial Data Assuming 100% Equity Financing Eamings before interest and tax Debt Debt charge (interest expense) Earnings before tax Taxes Net income (show all calculations in the spaces provided) c) What is the difference between its expected return on equity (ROE) in the firm finances with 50% debt versus its expected ROE If It Ainances entirely with common equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started