Answered step by step

Verified Expert Solution

Question

1 Approved Answer

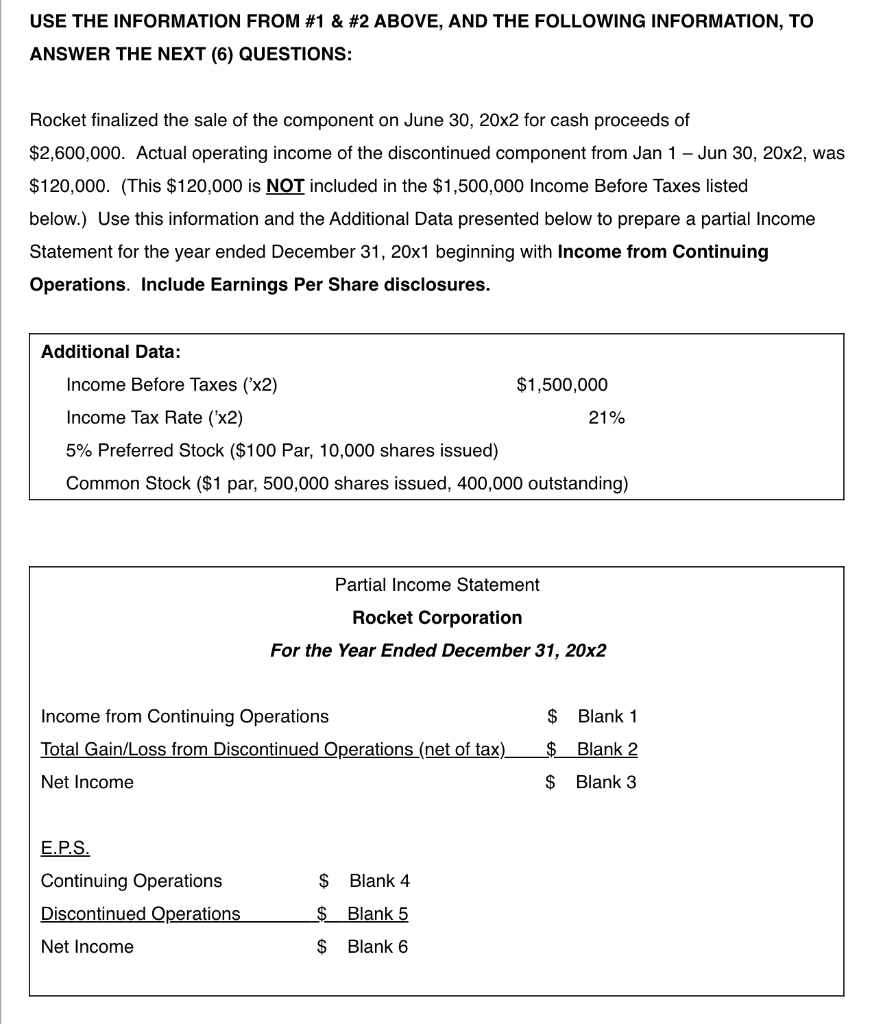

b. Determine the Total Gain/Loss from Discontinued Operations (net) $_____________________ c. Determine Net Income $_____________________ d. Determine EPS Continuing Operations $_____________________ e. Determine EPS Discontinued

b. Determine the Total Gain/Loss from Discontinued Operations (net) $_____________________

b. Determine the Total Gain/Loss from Discontinued Operations (net) $_____________________

c. Determine Net Income $_____________________

d. Determine EPS Continuing Operations $_____________________

e. Determine EPS Discontinued Operations $_____________________

f. Determine EPS Net Income $_____________________

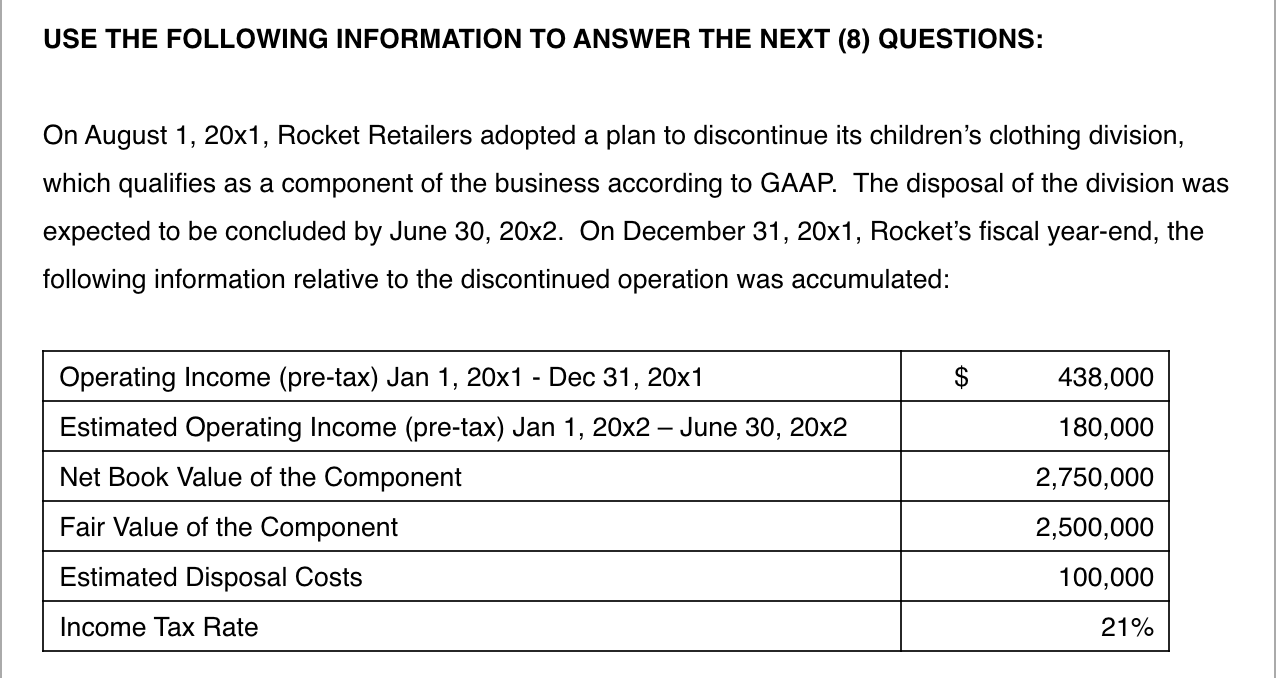

USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (8) QUESTIONS: On August 1, 20x1, Rocket Retailers adopted a plan to discontinue its children's clothing division, which qualifies as a component of the business according to GAAP. The disposal of the division was expected to be concluded by June 30, 20x2. On December 31, 20x1, Rocket's fiscal year-end, the following information relative to the discontinued operation was accumulated: $ Operating Income (pre-tax) Jan 1, 20x1 - Dec 31, 20x1 Estimated Operating Income (pre-tax) Jan 1, 20x2 June 30, 20x2 Net Book Value of the Component Fair Value of the Component Estimated Disposal Costs Income Tax Rate 438,000 180,000 2,750,000 2,500,000 100,000 21% USE THE INFORMATION FROM #1 & #2 ABOVE, AND THE FOLLOWING INFORMATION, TO ANSWER THE NEXT (6) QUESTIONS: Rocket finalized the sale of the component on June 30, 20x2 for cash proceeds of $2,600,000. Actual operating income of the discontinued component from Jan 1 - Jun 30, 20x2, was $120,000. (This $120,000 is NOT included in the $1,500,000 Income Before Taxes listed below.) Use this information and the Additional Data presented below to prepare a partial Income Statement for the year ended December 31, 20x1 beginning with Income from Continuing Operations. Include Earnings Per Share disclosures. Additional Data: Income Before Taxes (x2) $1,500,000 Income Tax Rate ('x2) 21% 5% Preferred Stock ($100 Par, 10,000 shares issued) Common Stock ($1 par, 500,000 shares issued, 400,000 outstanding) Partial Income Statement Rocket Corporation For the Year Ended December 31, 20x2 Income from Continuing Operations Total Gain/Loss from Discontinued Operations (net of tax) Net Income $ $ $ Blank 1 Blank 2 Blank 3 E.P.S. Continuing Operations Discontinued Operations Net Income $ $ Blank 4 Blank 5 $ Blank 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started