Question

The major financial statements of Ten Peaks Coffee Company Inc. from its 2013 annual report are included in Exhibits 1-11A to C. Note that its

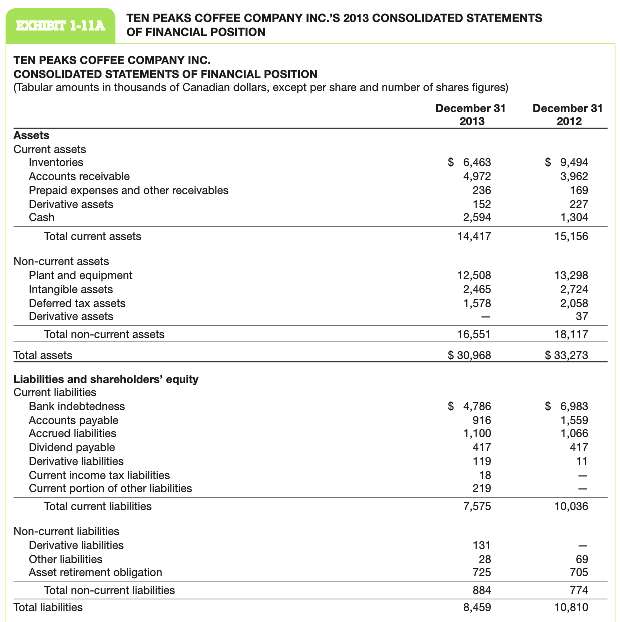

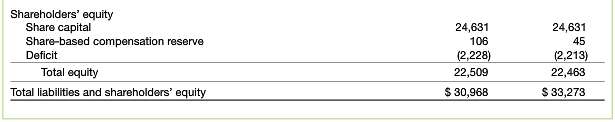

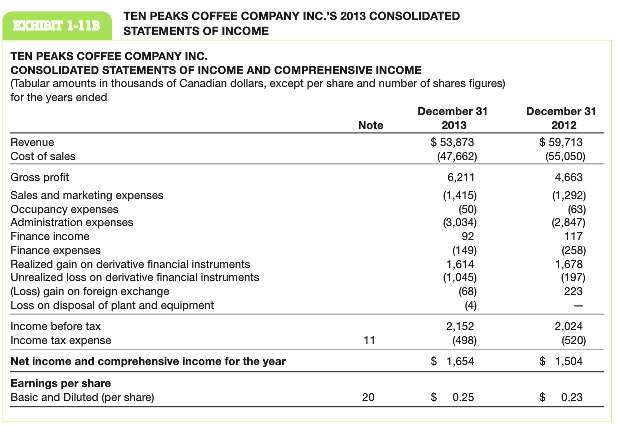

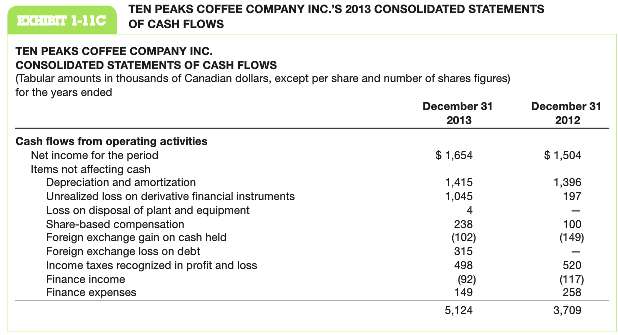

The major financial statements of Ten Peaks Coffee Company Inc. from its 2013 annual report are included in Exhibits 1-11A to C. Note that its fiscal year end is December 31, 2013.

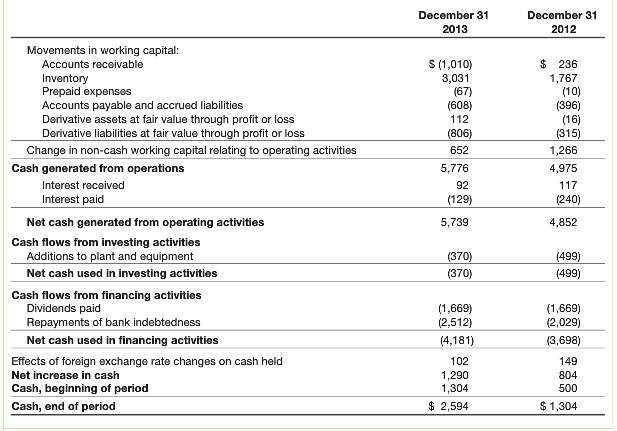

Required:a. Find the following amounts in the statements:i. Total sales for fiscal year 2013ii. Total cost of sales for fiscal year 2013iii. Sales and marketing expenses for fiscal year 2012iv. Finance expenses for fiscal year 2013v. Income tax expense for fiscal year 2013vi. Net income for fiscal year 2013vii. Inventories at the end of fiscal year 2013viii. Accounts payable at the beginning of fiscal year 2013ix. Shareholders?? equity at the end of fiscal year 2013x. Deficit at the beginning of fiscal year 2013xi. Cash provided from operating activities in fiscal year 2013xii. Cash payments to acquire plant and equipment in fiscal year 2013xiii. Cash used in the repayment of debt in fiscal year 2013xiv. Cash used to pay dividends in fiscal year 2013b. Does Ten Peaks finance its business primarily with debt or with shareholders?? equity? Support your answer with appropriate data.c. Did Ten Peaks have a net inflow or a net outflow of cash from financing activities in 2013? What about from its investing activities?d. Does Ten Peaks use a classified statement of financial position? Explain.?

EXHIBIT 1-11A TEN PEAKS COFFEE COMPANY INC. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (Tabular amounts in thousands of Canadian dollars, except per share and number of shares figures) Assets Current assets Inventories. Accounts receivable Prepaid expenses and other receivables Derivative assets Cash Total current assets Non-current assets TEN PEAKS COFFEE COMPANY INC.'S 2013 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Plant and equipment Intangible assets Deferred tax assets Derivative assets Total non-current assets Total assets Liabilities and shareholders' equity Current liabilities Bank indebtedness Accounts payable Accrued liabilities Dividend payable Derivative liabilities Current income tax liabilities Current portion of other liabilities Total current liabilities Non-current liabilities Derivative liabilities Other liabilities Asset retirement obligation Total non-current liabilities Total liabilities December 31 2013 $ 6,463 4,972 236 152 2,594 14,417 12,508 2,465 1,578 16,551 $ 30,968 $ 4,786 916 1,100 417 119 18 219 7,575 131 28 725 884 8,459 December 31 2012 $ 9,494 3,962 169 227 1,304 15,156 13,298 2,724 2,058 37 18,117 $ 33,273 $ 6,983. 1,559 1,066 417 11 10,036 69 705 774 10,810 Shareholders' equity Share capital Share-based compensation reserve Deficit Total equity Total liabilities and shareholders' equity 24,631 106 (2,228) 22,509 $ 30,968 24,631 45 (2,213) 22,463 $ 33,273 EXHIBIT 1-118 TEN PEAKS COFFEE COMPANY INC.'S 2013 CONSOLIDATED STATEMENTS OF INCOME TEN PEAKS COFFEE COMPANY INC. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Tabular amounts in thousands of Canadian dollars, except per share and number of shares figures) for the years ended Revenue Cost of sales Gross profit Sales and marketing expenses Occupancy expenses Administration expenses Finance income Finance expenses Realized gain on derivative financial instruments Unrealized loss on derivative financial instruments (Loss) gain on foreign exchange Loss on disposal of plant and equipment Income before tax Income tax expense Net income and comprehensive income for the year Earnings per share Basic and Diluted (per share) Note 11 20 December 31 2013 $ 53,873 (47,662) 6,211 (1,415) (50) (3,034) 92 (149) 1,614 (1,045) (68) (4) 2,152 (498) $ 1,654 $ 0.25 December 31 2012 $ 59,713 (55,050) 4,663 (1,292) (63) (2,847) 117 (258) $ 1,678 (197) 223 2,024 (520) $1.504 0.23 EXHIBIT 1-11C TEN PEAKS COFFEE COMPANY INC.'S 2013 CONSOLIDATED STATEMENTS OF CASH FLOWS TEN PEAKS COFFEE COMPANY INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Tabular amounts in thousands of Canadian dollars, except per share and number of shares figures) for the years ended Cash flows from operating activities Net income for the period Items not affecting cash Depreciation and amortization Unrealized loss on derivative financial instruments Loss on disposal of plant and equipment Share-based compensation Foreign exchange gain on cash held Foreign exchange loss on debt Income taxes recognized in profit and loss Finance income Finance expenses December 31 2013 $ 1,654 1,415 1,045 4 238 (102) 315 498 (92) 149 5,124 December 31 2012 $ 1,504 1,396 197 100 (149) 520 (117) 258 3,709 Movements in working capital: Accounts receivable Inventory Prepaid expenses Accounts payable and accrued liabilities Derivative assets at fair value through profit or loss Derivative liabilities at fair value through profit or loss Change in non-cash working capital relating to operating activities Cash generated from operations Interest received Interest paid Net cash generated from operating activities Cash flows from investing activities Additions to plant and equipment Net cash used in investing activities Cash flows from financing activities Dividends paid Repayments of bank indebtedness Net cash used in financing activities Effects of foreign exchange rate changes on cash held Net increase in cash Cash, beginning of period Cash, end of period December 31 2013 S (1,010) 3,031 (67) (608) 112 (806) 652 5,776 92 (129) 5,739 (370) (370) (1,669) (2,512) (4,181) 102 1,290 1,304 $ 2,594 December 31 2012 $ 236 1,767 (10) (396) (16) (315) 1,266 4,975 117 (240) 4,852 (499) (499) (1,669) (2,029) (3,698) 149 804 500 $1,304

Step by Step Solution

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Find the following amounts in the statements i Total sales for fiscal year 2013 Total Sales for fiscal year 2013 6211 Revenue 53873 Cost of Sales 4766...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started