Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. Does this business appear to be a retailer, a manufacturer, or a service company? How can you tell? c. What business do you believe

b. Does this business appear to be a retailer, a manufacturer, or a service company? How can you tell?

c. What business do you believe they are in? Again, what tells you this?

d. Can you calculate gross profit for this company? Why or why not?

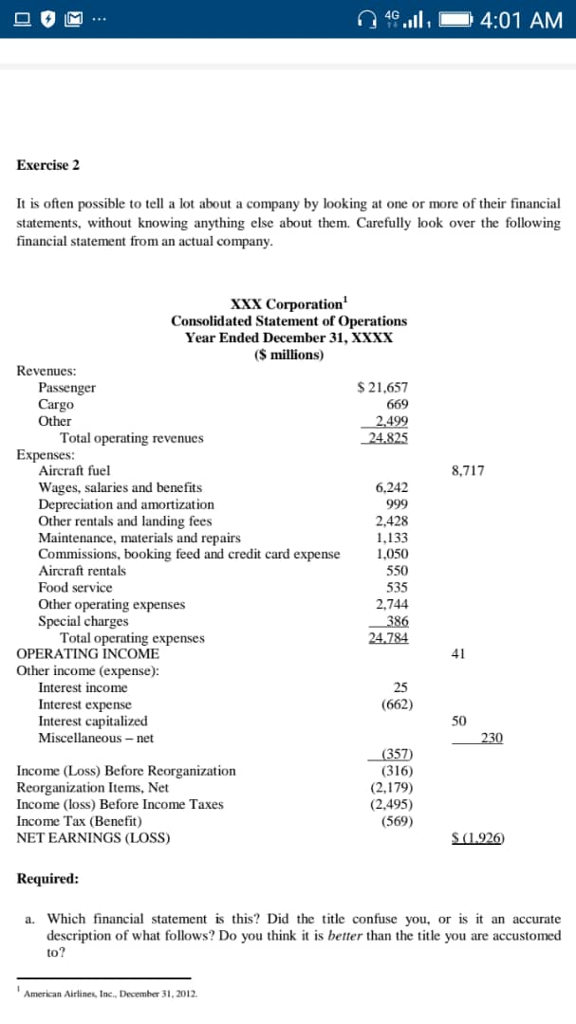

4G.l 4:01 AM Exercise2 It is often possible to tell a lot abo statements, without knowing anything else about them. Carefully look over the following financial statement from an actual company ut a company by looking at one or more of their financial xxx Corporation' Consolidated Statement of Operations Year Ended December 31, XXXX (S millions) Revenues: Passenger Cargo Other $21.657 669 Total operating revenues 24.825 Expenses Aircraft fuel Wages, salaries and benefits Depreciation and amortization Other rentals and landing fees Maintenance, materials and repairs Commissions, booking feed and credit card expense Aircraft rentals Food service Other operating expenses Special charges 8,717 6.242 2,428 1.133 1,050 550 535 2,744 Total operating expenses 24.784 OPERATING INCOME Other income (expense): Interest income Interest expense Interest capitalized Miscellaneous- net 25 (662) 50 Income (Loss) Before Reorganization Reorganization Items, Net Income (loss) Before Income Taxes Income Tax (Benefit) NET EARNINGS (LOSS) (316) (2.179) (2,495) (569) (1926 Required a. Which financial statement is this? Did the title confuse you, or is it an accurate description of what follows? Do you think it is better than the title you are accustomed to? American Airlines, Inc., December 31, 2012Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started