Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Bright Sky Ltd, is a well-known pharmaceutical research company with laboratories throughout the world. They have just announced a $1.50 per share

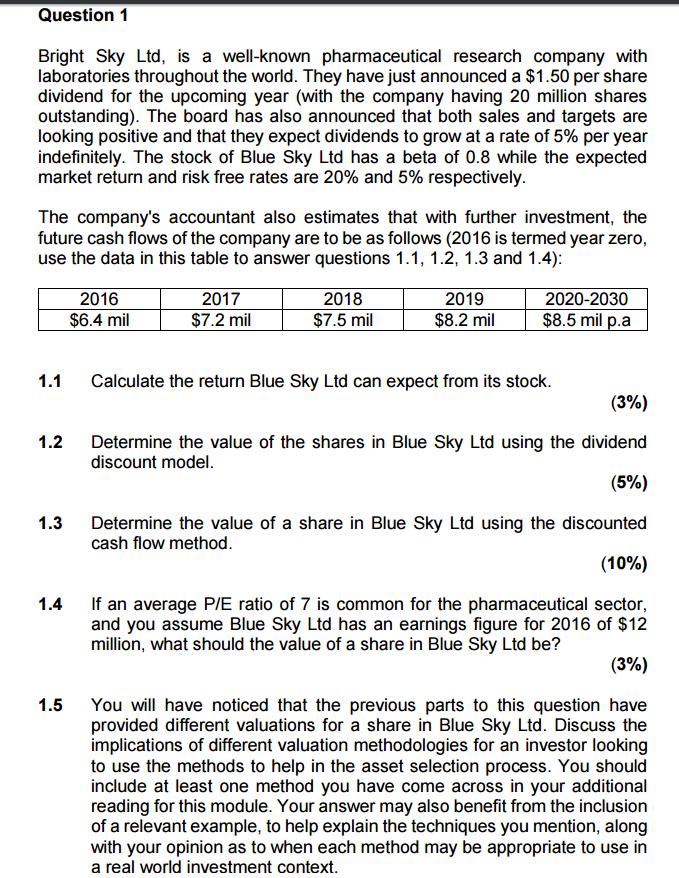

Question 1 Bright Sky Ltd, is a well-known pharmaceutical research company with laboratories throughout the world. They have just announced a $1.50 per share dividend for the upcoming year (with the company having 20 million shares outstanding). The board has also announced that both sales and targets are looking positive and that they expect dividends to grow at a rate of 5% per year indefinitely. The stock of Blue Sky Ltd has a beta of 0.8 while the expected market return and risk free rates are 20% and 5% respectively. The company's accountant also estimates that with further investment, the future cash flows of the company are to be as follows (2016 is termed year zero, use the data in this table to answer questions 1.1, 1.2, 1.3 and 1.4): 1.1 1.2 1.3 1.4 1.5 2016 $6.4 mil 2017 $7.2 mil 2018 $7.5 mil 2019 $8.2 mil 2020-2030 $8.5 mil p.a Calculate the return Blue Sky Ltd can expect from its stock. (3%) Determine the value of the shares in Blue Sky Ltd using the dividend discount model. (5%) Determine the value of a share in Blue Sky Ltd using the discounted cash flow method. (10%) If an average P/E ratio of 7 is common for the pharmaceutical sector, and you assume Blue Sky Ltd has an earnings figure for 2016 of $12 million, what should the value of a share in Blue Sky Ltd be? (3%) You will have noticed that the previous parts to this question have provided different valuations for a share in Blue Sky Ltd. Discuss the implications of different valuation methodologies for an investor looking to use the methods to help in the asset selection process. You should include at least one method you have come across in your additional reading for this module. Your answer may also benefit from the inclusion of a relevant example, to help explain the techniques you mention, along with your opinion as to when each method may be appropriate to use in a real world investment context.

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

11 Calculate the return Blue Sky Lid can expect from its stock 3 The expected return from Blue Sky Lids stock can be calculated using the Capital Asset Pricing Model CAPM CAPM Rf Erm Rf where Rf the r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started