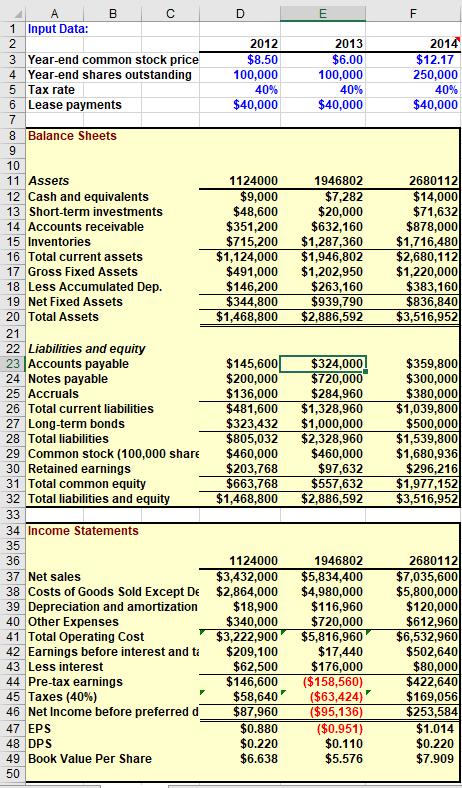

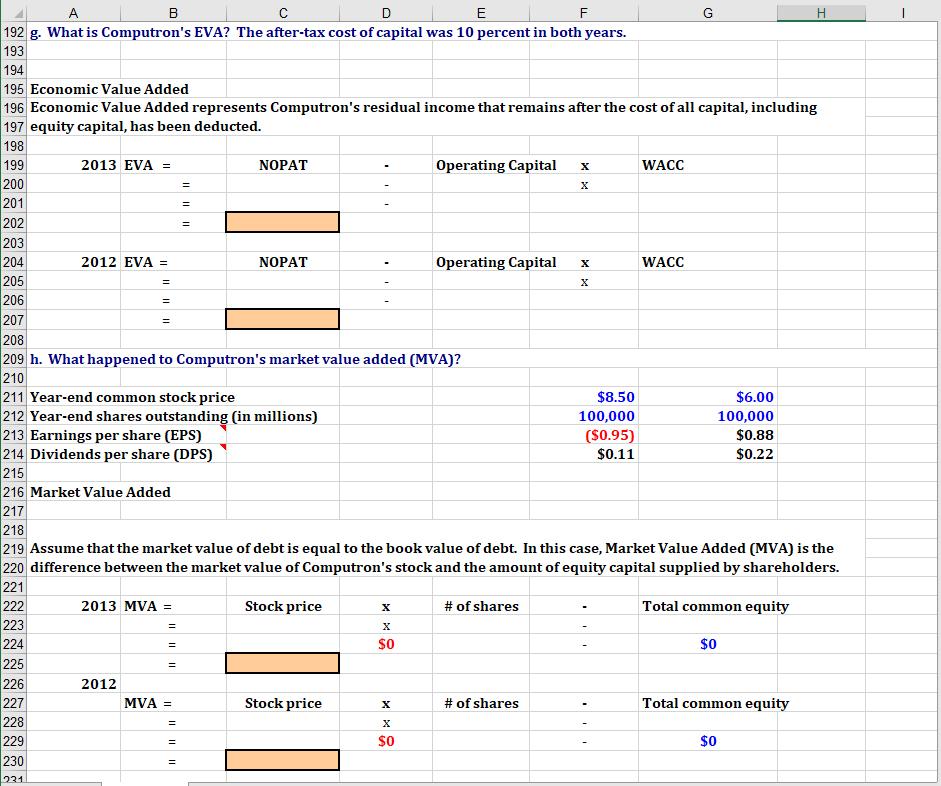

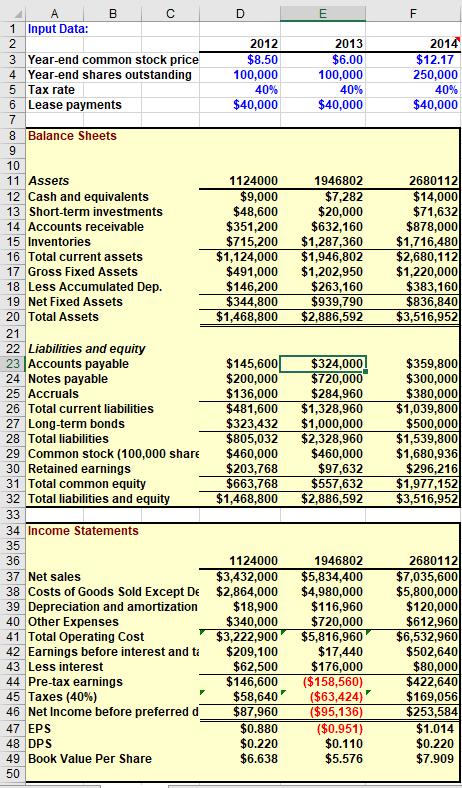

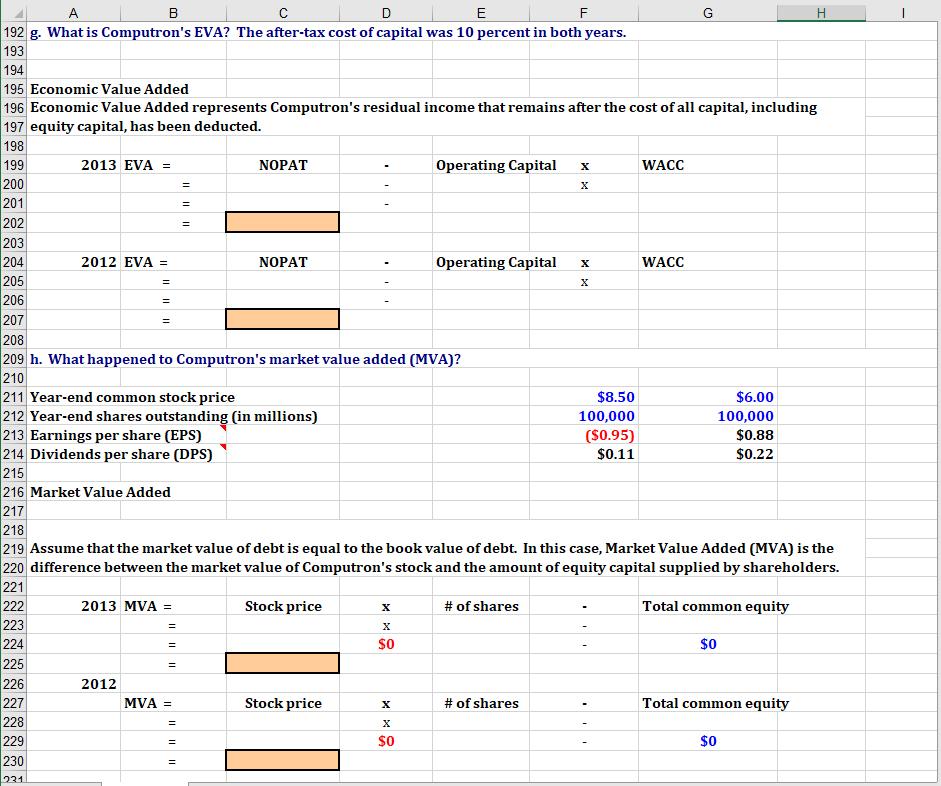

B E F 2013 $6.00 100,000 40% $40,000 2014 $12.17 250,000 40% $40,000 1946802 $7,282 $20,000 $632,160 $1,287,360 $1,946,802 $1,202,950 $263,160 $939,790 $2,886,592 2680112 $14,000 $71,6321 $878,000 $1,716,480 $2,680,112 $1,220,000 $383,160 $836,8401 $3,516,952 A B D 1 Input Data: 2 2012 3 Year-end common stock price $8.50 4 Year-end shares outstanding 100,000 5 Tax rate 40% 6 Lease payments $40,000 7 8 Balance Sheets 9 10 11 Assets 1124000 12 Cash and equivalents $9,000 13 Short-term investments $48,600 14 Accounts receivable $351,200 15 Inventories $715,200 16 Total current assets $1,124,000 17 Gross Fixed Assets $491,000 18 Less Accumulated Dep. $146,200 19 Net Fixed Assets $344,800 20 Total Assets $1,468,800 21 22 Liabilities and equity 23 Accounts payable $145,600 24 Notes payable $200,000 25 Accruals $136,000 26 Total current liabilities $481,600 27 Long-term bonds $323,432 28 Total liabilities $805,032 29 Common stock (100,000 share $460,000 30 Retained earnings $203,768 31 Total common equity $663,768 32 Total liabilities and equity $1,468,800 33 34 Income Statements 35 36 1124000 37 Net sales $3,432,000 38 Costs of Goods Sold Except De $2,864,000 39 Depreciation and amortization $18,900 40 Other Expenses $340,000 41 Total Operating cost $3,222,900 42 Earnings before interest and ta $209,100 43 Less interest $62,500 44 Pre-tax earnings $146,600 45 Taxes (40%) $58,640 46 Net Income before preferred d $87,960 47 EPS $0.880 48 DPS $0.220 49 Book Value Per Share $6.638 50 $324,000! $720,000 $284,960 $1,328,960 $1,000,000 $2,328,960 $460,000 $97,632 $557,632 $2,886,592 $359,800 $300,000 $380,000 $1,039,800 $500,000 $1,539,800 $1,680,936 $296,216 $1,977,152 $3,516,952 1946802 $5,834,400 $4,980,000 $116,960 $720,000 $5,816,960 $17,440 $176,000 ($158,560) ($63,424) ($95,136) ($0.951) $0.110 $5.576 2680112 $7,035,600 $5,800,000 $120,000 $612,9601 $6,532,960 $502,640 $80,0001 $422,640 $169,056 $253,584 $1.014 $0.220 $7.909 B G . X 11 11 11 IIIIIIII A D E IF H 192 g. What is Computron's EVA? The after-tax cost of capital was 10 percent in both years. 193 194 195 Economic Value Added 196 Economic Value Added represents Computron's residual income that remains after the cost of all capital, including 197 equity capital, has been deducted. 198 199 2013 EVA = NOPAT Operating Capital WACC 200 201 202 203 204 2012 EVA = NOPAT Operating Capital WACC 205 206 207 208 209 h. What happened to Computron's market value added (MVA)? 210 211 Year-end common stock price $8.50 $6.00 212 Year-end shares outstanding in millions) 100,000 100,000 213 Earnings per share (EPS) ($0.95) $0.88 214 Dividends per share (DPS) $0.11 $0.22 215 216 Market Value Added 217 218 219 Assume that the market value of debt is equal to the book value of debt. In this case, Market Value Added (MVA) is the 220 difference between the market value of Computron's stock and the amount of equity capital supplied by shareholders. 221 222 2013 MVA = Stock price # of shares Total common equity 223 224 SO $0 225 226 2012 227 MVA = Stock price # of shares Total common equity 228 229 $0 $0 230 X = = | 11 | 11 221