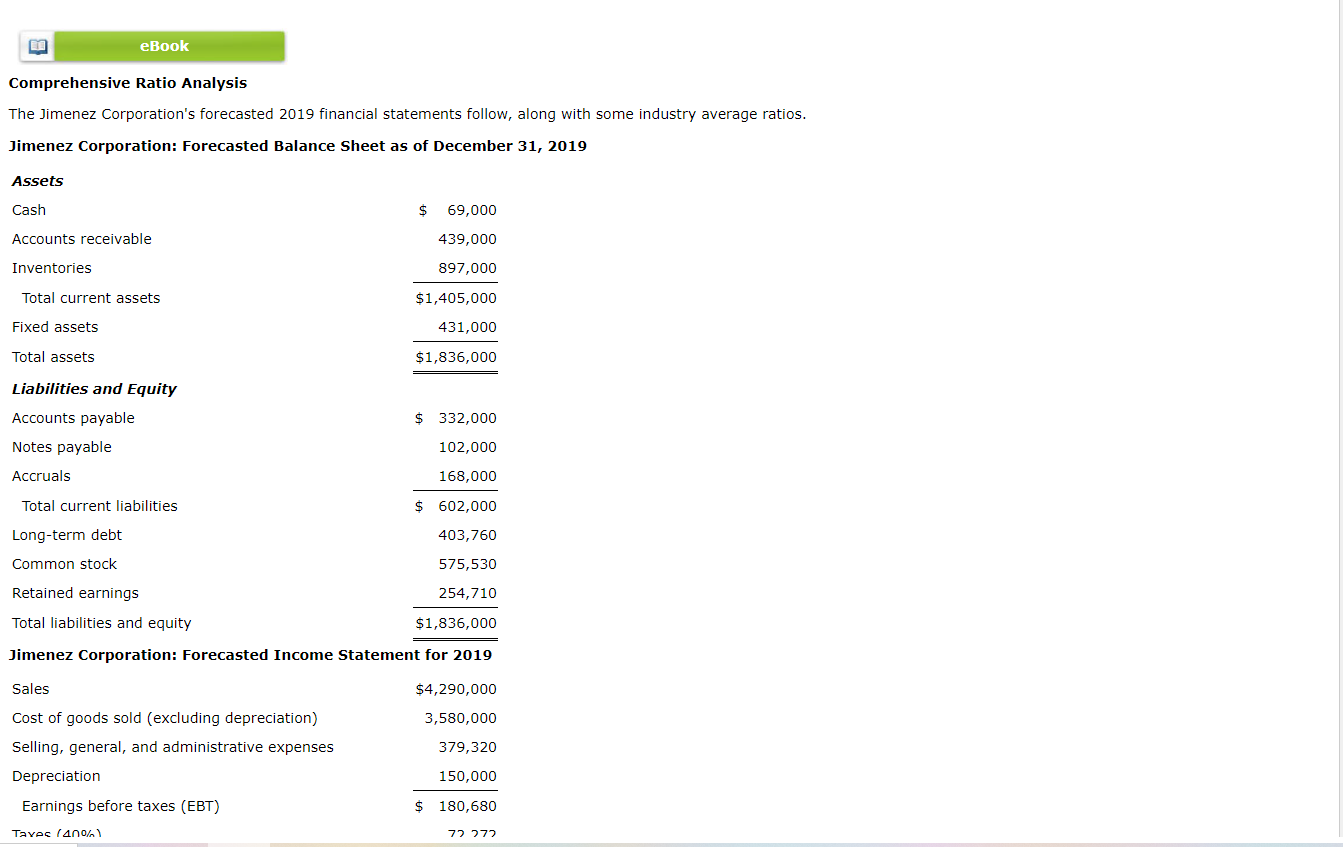

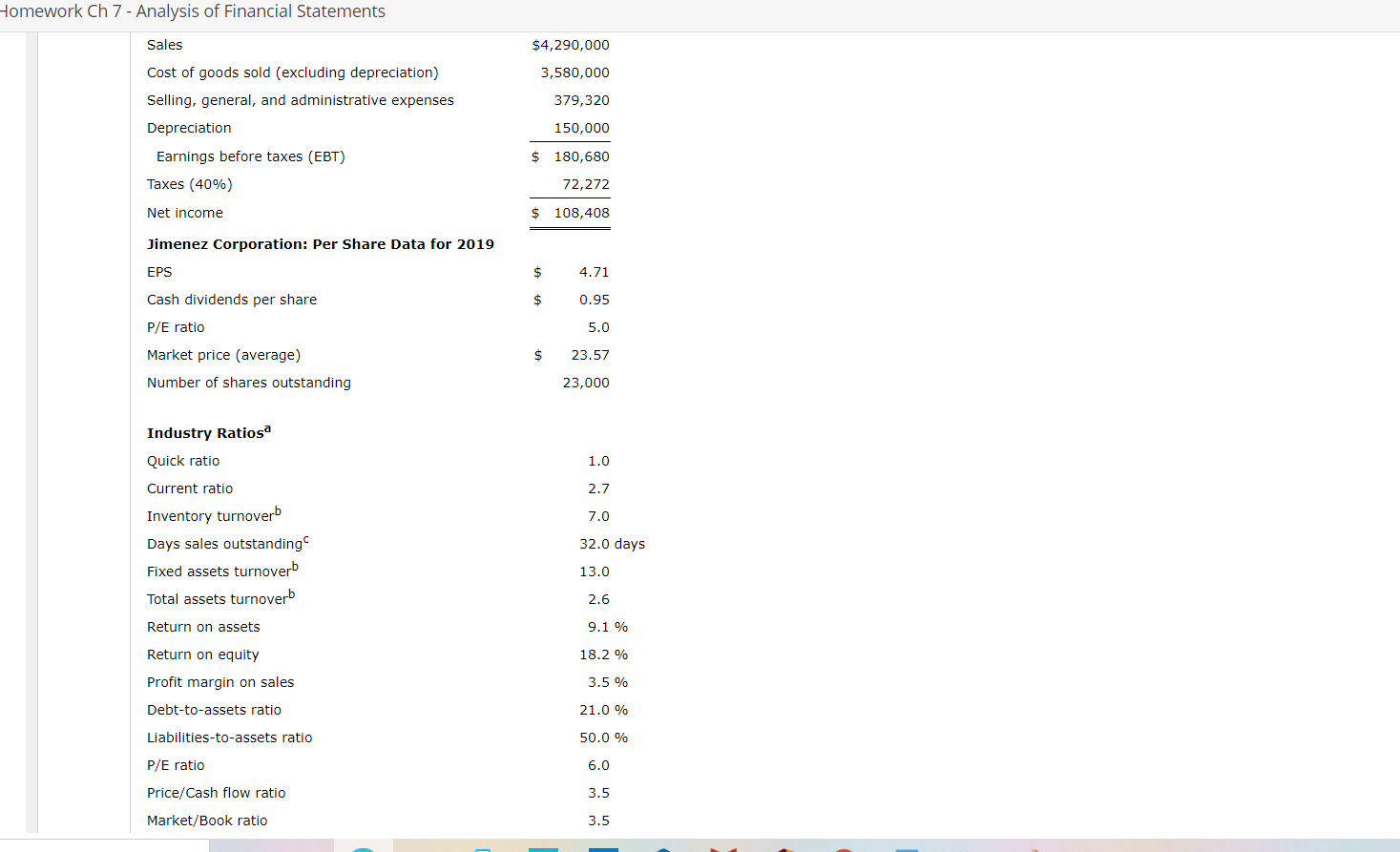

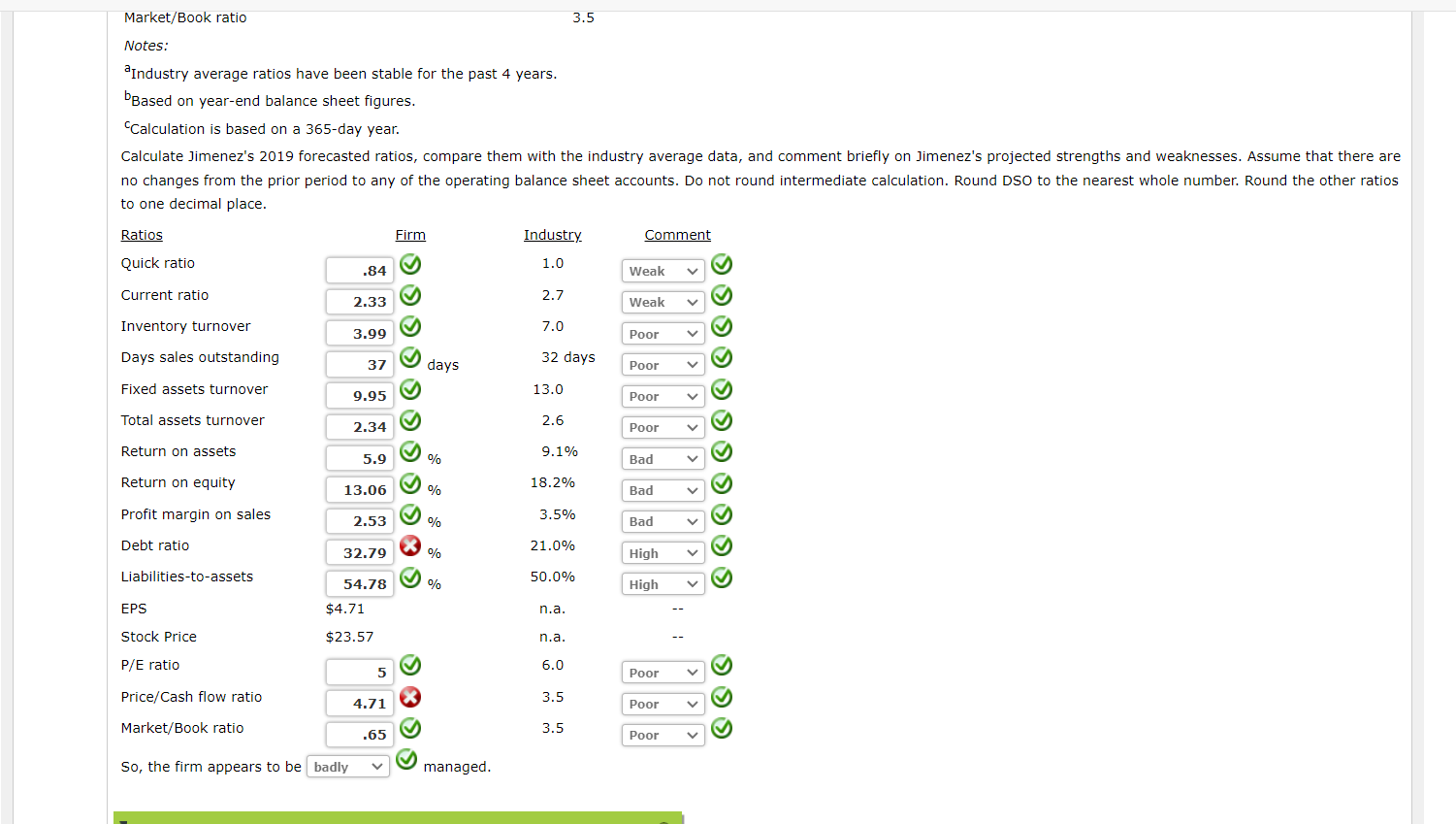

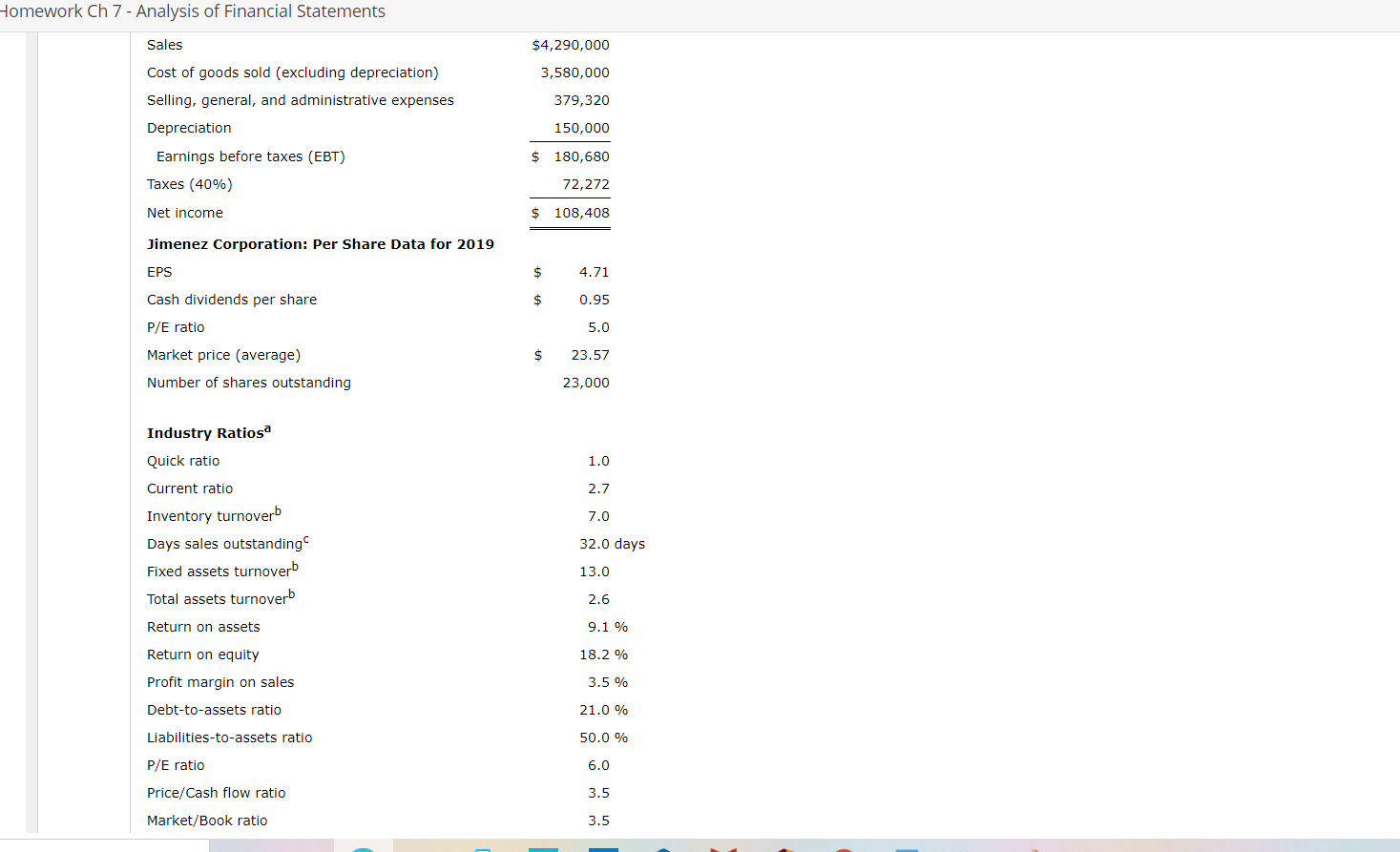

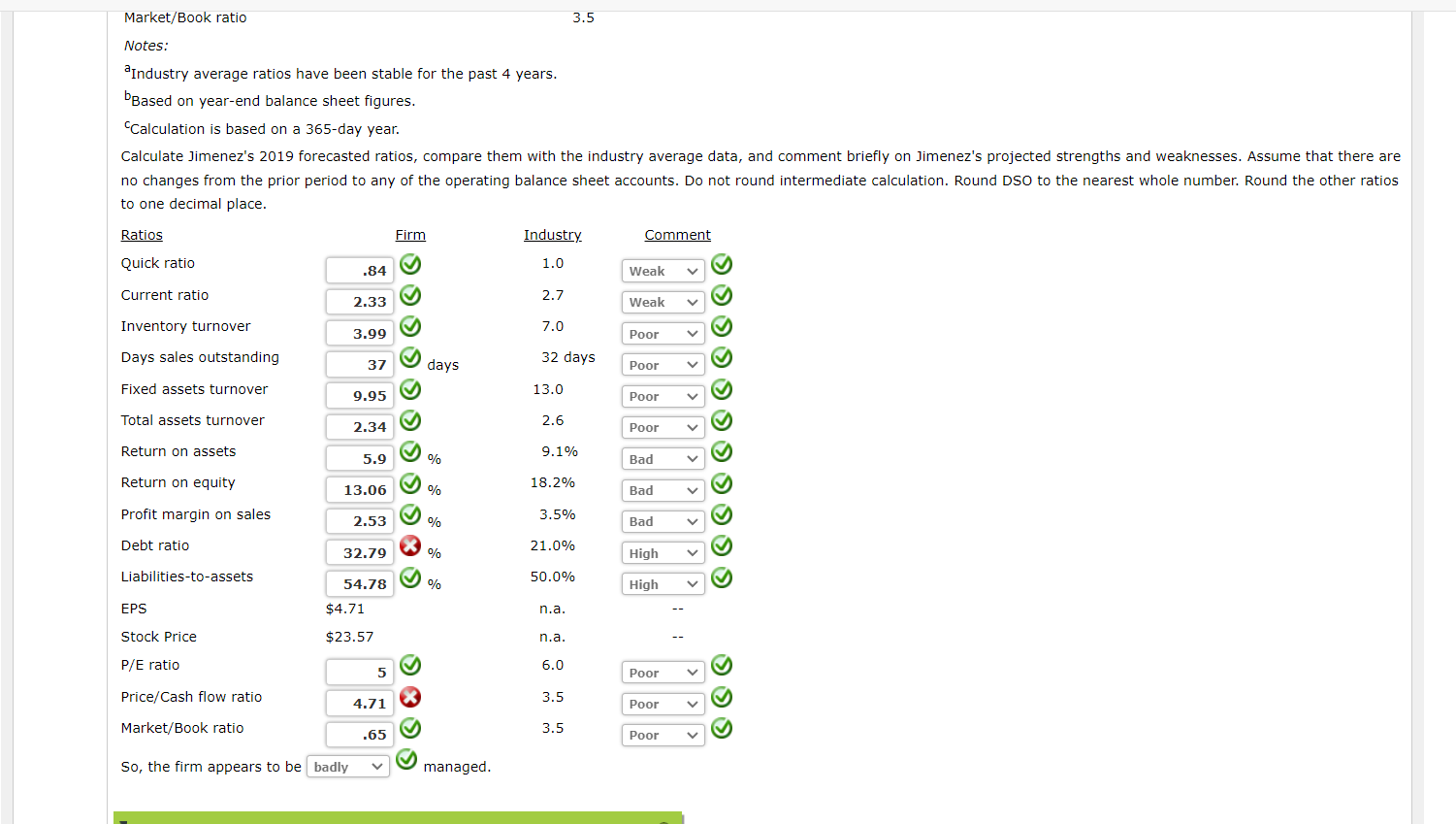

B eBook Comprehensive Ratio Analysis The Jimenez Corporation's forecasted 2019 financial statements follow, along with some industry average ratios. Jimenez Corporation: Forecasted Balance Sheet as of December 31, 2019 Assets Cash $ 69,000 Accounts receivable 439,000 Inventories 897,000 Total current assets $1,405,000 Fixed assets 431,000 Total assets $1,836,000 Liabilities and Equity Accounts payable Notes payable $ 332,000 102,000 Accruals 168,000 Total current liabilities $ 602,000 Long-term debt 403,760 Common stock 575,530 Retained earnings 254,710 Total liabilities and equity $1,836,000 Jimenez Corporation: Forecasted Income Statement for 2019 Sales $4,290,000 3,580,000 Cost of goods sold (excluding depreciation) Selling, general, and administrative expenses Depreciation 379,320 150,000 $ 180,680 Earnings before taxes (EBT) Taves (400 72 272 Homework Ch 7 - Analysis of Financial Statements $4,290,000 3,580,000 379,320 Sales Cost of goods sold (excluding depreciation) Selling, general, and administrative expenses Depreciation Earnings before taxes (EBT) Taxes (40%) 150,000 $ 180,680 72,272 Net income $ 108,408 Jimenez Corporation: Per Share Data for 2019 EPS $ 4.71 $ 0.95 5.0 Cash dividends per share E P/E ratio Market price (average) Number of shares outstanding $ 23.57 23,000 1.0 2.7 Industry Ratiosa Quick ratio Current ratio Inventory turnoverb Days sales outstanding Fixed assets turnoverb Total assets turnoverb 7.0 32.0 days 13.0 2.6 Return on assets 9.1 % 18.2 % Return on equity Profit margin on sales Debt-to-assets ratio 3.5 % 21.0 % Liabilities-to-assets ratio 50.0 % P/E ratio 6.0 Price/Cash flow ratio 3.5 Market/Book ratio 3.5 Market/Book ratio 3.5 Notes: Industry average ratios have been stable for the past 4 years. Based on year-end balance sheet figures. Calculation is based on a 365-day year. Calculate Jimenez's 2019 forecasted ratios, compare them with the industry average data, and comment briefly on Jimenez's projected strengths and weaknesses. Assume that there are no changes from the prior period to any of the operating balance sheet accounts. Do not round intermediate calculation. Round DSO to the nearest whole number. Round the other ratios to one decimal place. Ratios Firm Industry Comment Quick ratio 1.0 .84 Weak Current ratio 2.33 2.7 Weak V Inventory turnover 7.0 3.99 Poor Days sales outstanding days 32 days 37 Poor Fixed assets turnover 13.0 9.95 Poor GOGGGGGGGGGE Total assets turnover 2.6 G & B B B B B B B B G 2.34 Poor Return on assets 9.1% 5.9 % Bad Return on equity 13.06 % 18.2% Bad Profit margin on sales 2.53 3.5% % Bad Debt ratio 32.79 21.0% % High Liabilities-to-assets 50.0% 54.78 % High EPS $4.71 n.a. Stock Price $23.57 n.a. P/E ratio 6.0 5 Poor Price/Cash flow ratio 4.71 3.5 Poor 000 Market/Book ratio .65 3.5 Poor So, the firm appears to be badly managed