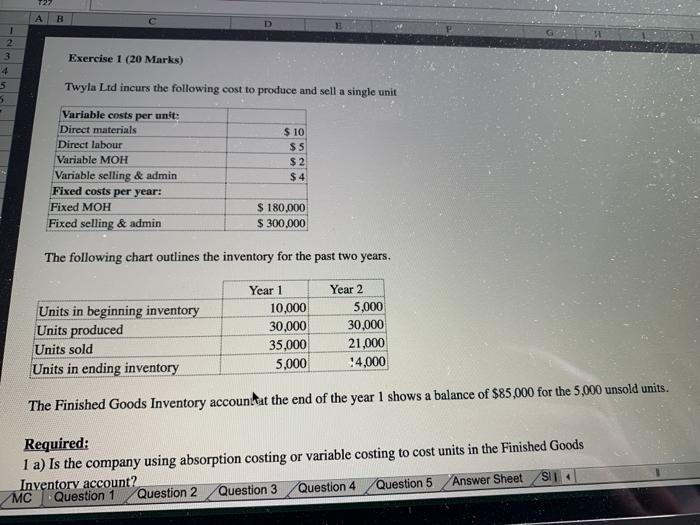

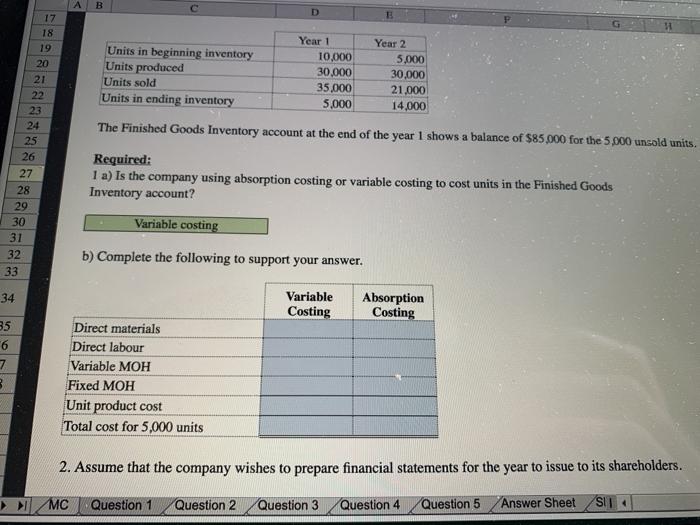

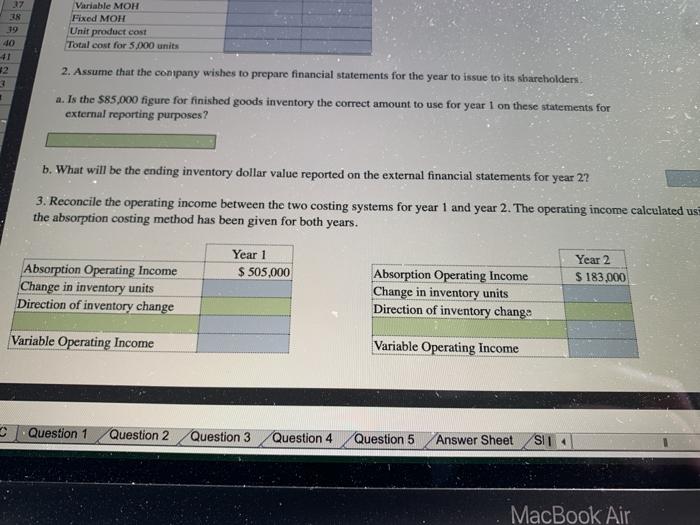

B Exercise 1 (20 Marks) 1 2 3 4 5 5 Twyla Ltd incurs the following cost to produce and sell a single unit $ 10 $5 $ 2 Variable costs per unit: Direct materials Direct labour Variable MOH Variable selling & admin Fixed costs per year: Fixed MOH Fixed selling & admin $4 $ 180,000 $ 300,000 The following chart outlines the inventory for the past two years. Units in beginning inventory Units produced Units sold Units in ending inventory Year 1 10,000 30,000 35,000 5,000 Year 2 5,000 30,000 21,000 $4,000 The Finished Goods Inventory account at the end of the year 1 shows a balance of $85,000 for the 5,000 unsold units. Required: 1 a) Is the company using absorption costing or variable costing to cost units in the Finished Goods Inventory account? MC Question 1 Question 2 Question 3 Question 4 Question 5 Answer Sheet SIT B D Year 1 Year 2 Units in beginning inventory 10.000 5.000 Units produced 30.000 30.000 Units sold 35.000 21.000 Units in ending inventory 5,000 14.000 The Finished Goods Inventory account at the end of the year 1 shows a balance of $85.000 for the 5.000 unsold units. 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Required: 1 a) Is the company using absorption costing or variable costing to cost units in the Finished Goods Inventory account? Variable costing b) Complete the following to support your answer. 34 Variable Costing Absorption Costing 35 6 7 Direct materials Direct labour Variable MOH Fixed MOH Unit product cost Total cost for 5,000 units 3 2. Assume that the company wishes to prepare financial statements for the year to issue to its shareholders. MC Question 1 Question 2 Question 3 Question 4 Question 5 Answer Sheet SUL 27 338 Variable MOH Fixed MOH Unit product cost Total cost for 5.000 units 40 41 #2 2. Assume that the contpany wishes to prepare financial statements for the year to issue to its shareholders a. Is the $85,000 figure for finished goods inventory the correct amount to use for year 1 on these statements for external reporting purposes? b. What will be the ending inventory dollar value reported on the external financial statements for year 2? 3. Reconcile the operating income between the two costing systems for year 1 and year 2. The operating income calculated us the absorption costing method has been given for both years. Year 1 $ 505,000 Year 2 $ 183,000 Absorption Operating Income Change in inventory units Direction of inventory change Absorption Operating Income Change in inventory units Direction of inventory change Variable Operating Income Variable Operating Income Question 1 Question 2 Question 3 Question 4 Question 5 Answer Sheet SIT MacBook Air