Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Find MV of equity and debt for B c) Fill the blank for the combined firm A + B d) What is MV equity

b) Find MV of equity and debt for B

c) Fill the blank for the combined firm A + B

d) What is MV equity and debt for A+B

e) Evaluate this merger

Please show the working and do not use excel. Thank you

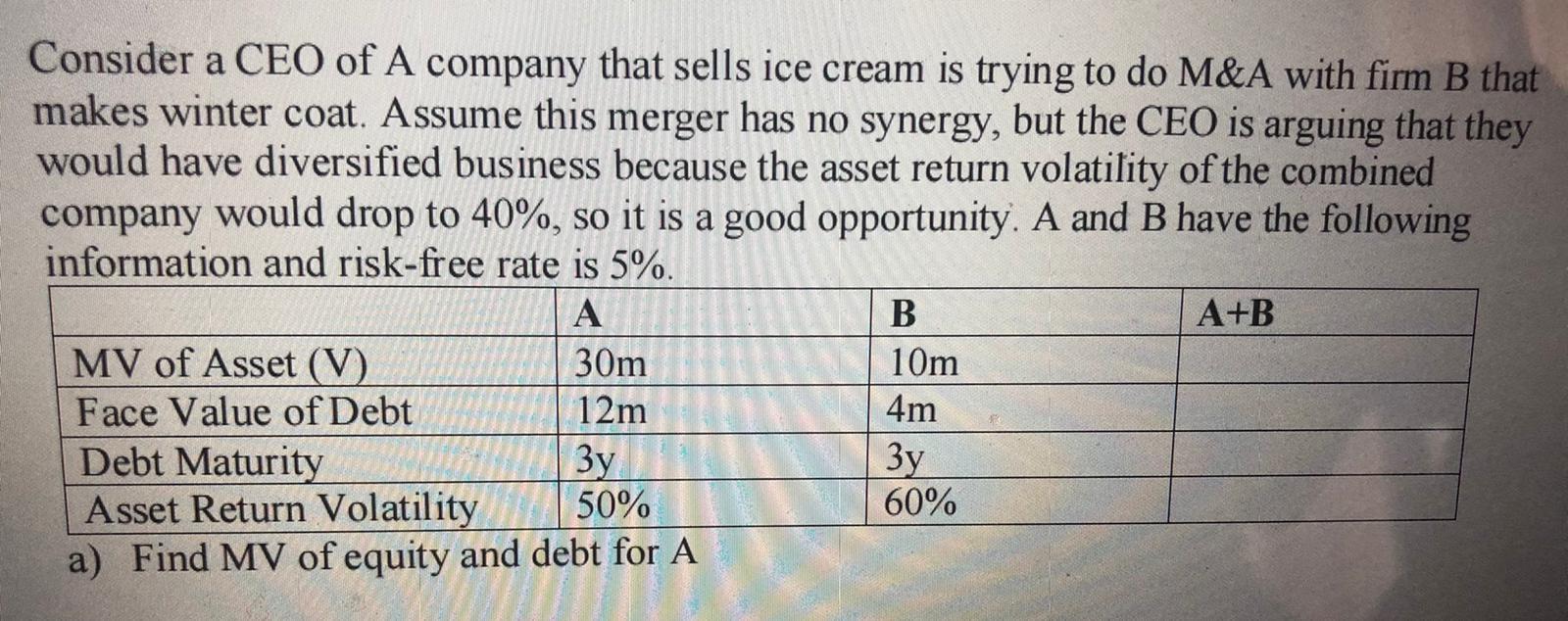

Consider a CEO of A company that sells ice cream is trying to do M&A with firm B that makes winter coat. Assume this merger has no synergy, but the CEO is arguing that they would have diversified business because the asset return volatility of the combined company would drop to 40%, so it is a good opportunity. A and B have the following information and risk-free rate is 5%. A B A+B MV of Asset (V) 30m 10m Face Value of Debt 12m 4m Debt Maturity 3y Asset Return Volatility 50% 60% a) Find MV of equity and debt for A Consider a CEO of A company that sells ice cream is trying to do M&A with firm B that makes winter coat. Assume this merger has no synergy, but the CEO is arguing that they would have diversified business because the asset return volatility of the combined company would drop to 40%, so it is a good opportunity. A and B have the following information and risk-free rate is 5%. A B A+B MV of Asset (V) 30m 10m Face Value of Debt 12m 4m Debt Maturity 3y Asset Return Volatility 50% 60% a) Find MV of equity and debt for AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started