Question

b. For each stock, show the monthly stock returns. g. Find the weights of Apple Inc., Rio Tinto Ltd and Cathay Pacific Airlines that will

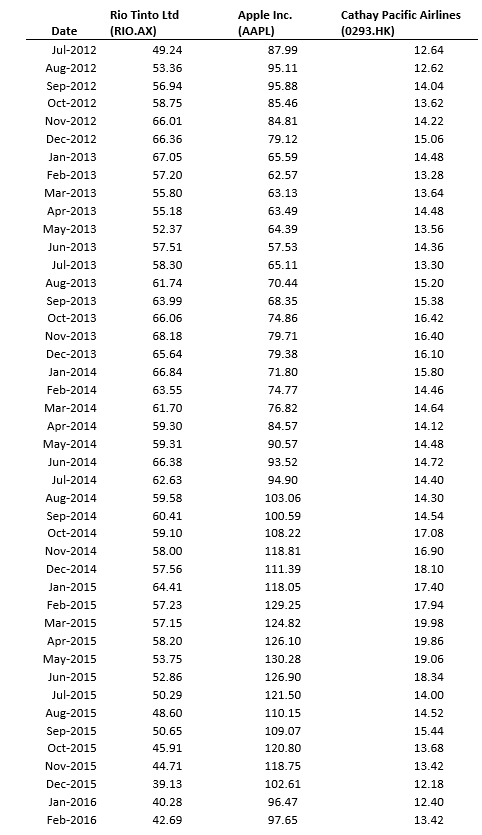

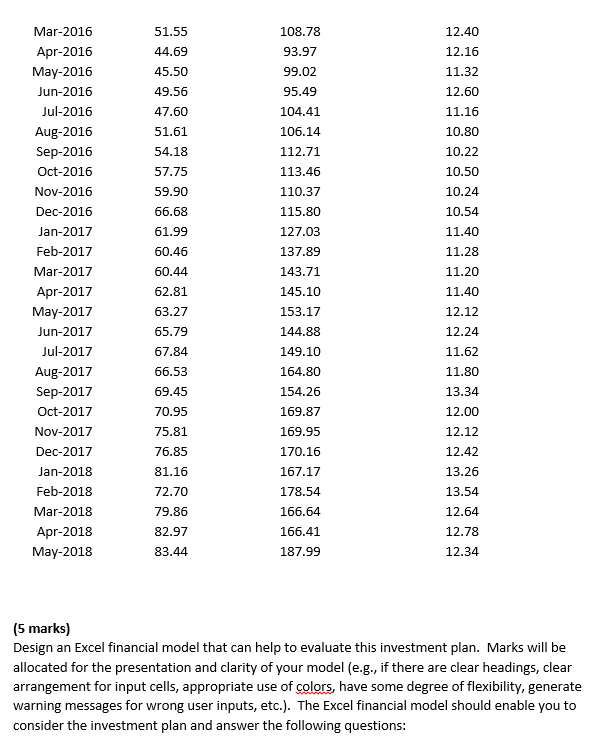

b. For each stock, show the monthly stock returns.

g. Find the weights of Apple Inc., Rio Tinto Ltd and Cathay Pacific Airlines that will provide a monthly return of greater than 0.8% with the lowest level of risk. There should be a minimum weighting of 10% for each stock. h. Plot a scatter diagram showing the portfolios from parts (e), (f) and (g), with the X-axis displaying standard deviation and the Y-axis displaying monthly returns. i. If the monthly risk-free rate is 0.12%, estimate the Sharpe ratio for the portfolios mentioned in parts (e), (f) and (g) and highlight the highest Sharpe ratio using conditional formatting.

Apple Inc. (AAPL) 87.99 95.11 95.88 Cathay Pacific Airlines (0293.HK) 12.64 12.62 14.04 13.62 14.22 15.06 79.12 63.49 65.11 70.44 15.20 15.38 16.42 Date Jul-2012 Aug-2012 Sep-2012 Oct-2012 Nov-2012 Dec-2012 Jan-2013 Feb-2013 Mar-2013 Apr-2013 May-2013 Jun-2013 Jul-2013 Aug-2013 Sep-2013 Oct-2013 Nov-2013 Dec-2013 Jan-2014 Feb-2014 Mar-2014 Apr-2014 May-2014 Jun-2014 Jul-2014 Aug-2014 Sep-2014 Oct-2014 Nov-2014 Dec-2014 Jan-2015 Feb-2015 Mar-2015 Apr-2015 May-2015 Jun-2015 Jul-2015 Aug-2015 Sep-2015 Oct-2015 Nov-2015 Dec-2015 Jan-2016 Feb-2016 Rio Tinto Ltd (RIO.AX) 49.24 53.36 56.94 58.75 66.01 66.36 67.05 57.20 55.80 55.18 52.37 57.51 58.30 61.74 63.99 66.06 68.18 65.64 66.84 63.55 61.70 59.30 59.31 66.38 62.63 59.58 60.41 59.10 58.00 57.56 64.41 57.23 57.15 58.20 53.75 52.86 50.29 48.60 50.65 45.91 44.71 39.13 40.28 42.69 16.40 16.10 15.80 14.46 14.64 14.12 14.48 14.72 14.40 14.30 14.54 17.08 16.90 17.40 94.90 103.06 100.59 108.22 118.81 111.39 118.05 129.25 124.82 126.10 130.28 126.90 121.50 110.15 109.07 120.80 118.75 102.61 96.47 97.65 19.06 13.68 13.42 12.18 12.40 13.42 51.55 12.40 12.16 44.69 11.32 Mar-2016 Apr-2016 May-2016 Jun-2016 Jul-2016 Aug-2016 Sep-2016 Oct-2016 Nov-2016 Dec-2016 Jan-2017 Feb-2017 Mar-2017 Apr-2017 May-2017 Jun-2017 Jul-2017 Aug-2017 Sep-2017 Oct-2017 Nov-2017 Dec-2017 Jan-2018 Feb-2018 Mar-2018 Apr-2018 May-2018 45.50 49.56 47.60 51.61 54.18 57.75 59.90 66.68 61.99 60.46 60.44 62.81 63.27 65.79 67.84 66.53 69.45 70.95 75.81 76.85 81.16 72.70 108.78 93.97 99.02 95.49 104.41 106.14 112.71 113.46 110.37 115.80 127.03 137.89 143.71 145.10 153.17 144.88 149.10 164.80 154.26 169.87 169.95 170.16 167.17 178.54 166.64 166.41 187.99 12.60 11.16 10.80 10.22 10.50 10.24 10.54 11.40 11.28 11.20 11.40 12.12 12.24 11.62 11.80 13.34 12.00 12.12 12.42 13.26 13.54 12.64 12.78 12.34 79.86 82.97 83.44 (5 marks) Design an Excel financial model that can help to evaluate this investment plan. Marks will be allocated for the presentation and clarity of your model (e.g., if there are clear headings, clear arrangement for input cells, appropriate use of colors, have some degree of flexibility, generate warning messages for wrong user inputs, etc.). The Excel financial model should enable you to consider the investment plan and answer the following questions: Apple Inc. (AAPL) 87.99 95.11 95.88 Cathay Pacific Airlines (0293.HK) 12.64 12.62 14.04 13.62 14.22 15.06 79.12 63.49 65.11 70.44 15.20 15.38 16.42 Date Jul-2012 Aug-2012 Sep-2012 Oct-2012 Nov-2012 Dec-2012 Jan-2013 Feb-2013 Mar-2013 Apr-2013 May-2013 Jun-2013 Jul-2013 Aug-2013 Sep-2013 Oct-2013 Nov-2013 Dec-2013 Jan-2014 Feb-2014 Mar-2014 Apr-2014 May-2014 Jun-2014 Jul-2014 Aug-2014 Sep-2014 Oct-2014 Nov-2014 Dec-2014 Jan-2015 Feb-2015 Mar-2015 Apr-2015 May-2015 Jun-2015 Jul-2015 Aug-2015 Sep-2015 Oct-2015 Nov-2015 Dec-2015 Jan-2016 Feb-2016 Rio Tinto Ltd (RIO.AX) 49.24 53.36 56.94 58.75 66.01 66.36 67.05 57.20 55.80 55.18 52.37 57.51 58.30 61.74 63.99 66.06 68.18 65.64 66.84 63.55 61.70 59.30 59.31 66.38 62.63 59.58 60.41 59.10 58.00 57.56 64.41 57.23 57.15 58.20 53.75 52.86 50.29 48.60 50.65 45.91 44.71 39.13 40.28 42.69 16.40 16.10 15.80 14.46 14.64 14.12 14.48 14.72 14.40 14.30 14.54 17.08 16.90 17.40 94.90 103.06 100.59 108.22 118.81 111.39 118.05 129.25 124.82 126.10 130.28 126.90 121.50 110.15 109.07 120.80 118.75 102.61 96.47 97.65 19.06 13.68 13.42 12.18 12.40 13.42 51.55 12.40 12.16 44.69 11.32 Mar-2016 Apr-2016 May-2016 Jun-2016 Jul-2016 Aug-2016 Sep-2016 Oct-2016 Nov-2016 Dec-2016 Jan-2017 Feb-2017 Mar-2017 Apr-2017 May-2017 Jun-2017 Jul-2017 Aug-2017 Sep-2017 Oct-2017 Nov-2017 Dec-2017 Jan-2018 Feb-2018 Mar-2018 Apr-2018 May-2018 45.50 49.56 47.60 51.61 54.18 57.75 59.90 66.68 61.99 60.46 60.44 62.81 63.27 65.79 67.84 66.53 69.45 70.95 75.81 76.85 81.16 72.70 108.78 93.97 99.02 95.49 104.41 106.14 112.71 113.46 110.37 115.80 127.03 137.89 143.71 145.10 153.17 144.88 149.10 164.80 154.26 169.87 169.95 170.16 167.17 178.54 166.64 166.41 187.99 12.60 11.16 10.80 10.22 10.50 10.24 10.54 11.40 11.28 11.20 11.40 12.12 12.24 11.62 11.80 13.34 12.00 12.12 12.42 13.26 13.54 12.64 12.78 12.34 79.86 82.97 83.44 (5 marks) Design an Excel financial model that can help to evaluate this investment plan. Marks will be allocated for the presentation and clarity of your model (e.g., if there are clear headings, clear arrangement for input cells, appropriate use of colors, have some degree of flexibility, generate warning messages for wrong user inputs, etc.). The Excel financial model should enable you to consider the investment plan and answer the following questionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started