Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) General Motors Co, a listed company producing motor cars, wants to acquire Car & General Co, an engineering company involved in producing innovative devices

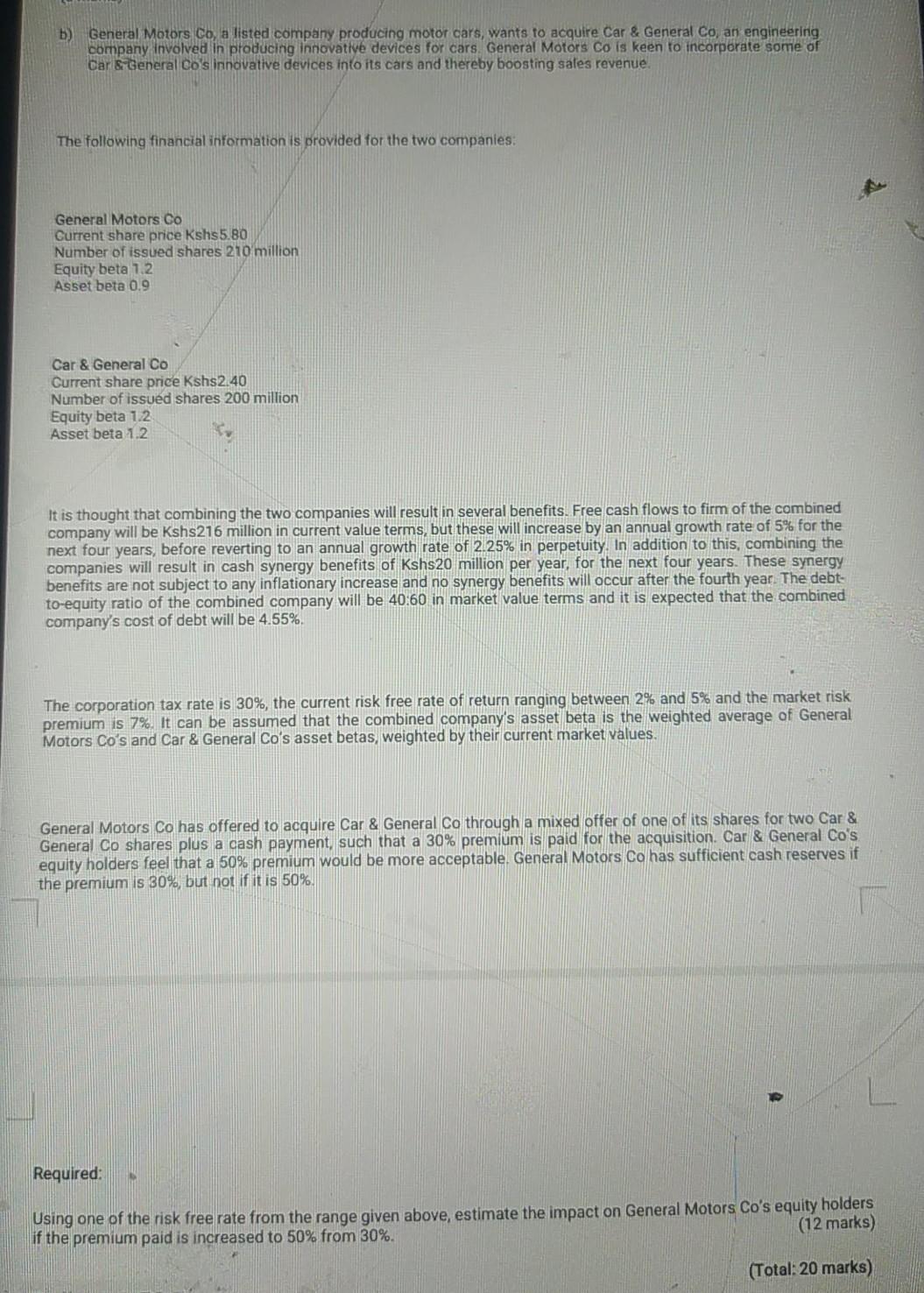

b) General Motors Co, a listed company producing motor cars, wants to acquire Car & General Co, an engineering company involved in producing innovative devices for cars. General Motors Co is keen to incorporate some of Car & General Co's innovative devices into its cars and thereby boosting sales revenue. The following financial information is provided for the two companies: General Motors Co Current share price Kshs 5.80 Number of issued shares 210 million Equity beta 1.2 Asset beta 0.9 Car & General Co Current share price Kshs2.40 Number of issued shares 200 million Equity beta 1.2 Asset beta 1.2 It is thought that combining the two companies will result in several benefits. Free cash flows to firm of the combined company will be Kshs216 million in current value terms, but these will increase by an annual growth rate of 5% for the next four years, before reverting to an annual growth rate of 2.25% in perpetuity. In addition to this, combining the companies will result in cash synergy benefits of Kshs20 million per year, for the next four years. These synergy benefits are not subject to any inflationary increase and no synergy benefits will occur after the fourth year. The debt- to-equity ratio of the combined company will be 40:60 in market value terms and it is expected that the combined company's cost of debt will be 4.55%. The corporation tax rate is 30%, the current risk free rate of return ranging between 2% and 5% and the market risk premium is 7%. It can be assumed that the combined company's asset beta is the weighted average of General Motors Co's and Car & General Co's asset betas, weighted by their current market values General Motors Co has offered to acquire Car & General Co through a mixed offer of one of its shares for two Car & General Co shares plus a cash payment, such that a 30% premium is paid for the acquisition. Car & General Co's equity holders feel that a 50% premium would be more acceptable. General Motors Co has sufficient cash reserves if the premium is 30%, but not if it is 50%. Required: Using one of the risk free rate from the range given above, estimate the impact on General Motors Co's equity holders if the premium paid is increased to 50% from 30%. (12 marks) (Total: 20 marks) b) General Motors Co, a listed company producing motor cars, wants to acquire Car & General Co, an engineering company involved in producing innovative devices for cars. General Motors Co is keen to incorporate some of Car & General Co's innovative devices into its cars and thereby boosting sales revenue. The following financial information is provided for the two companies: General Motors Co Current share price Kshs 5.80 Number of issued shares 210 million Equity beta 1.2 Asset beta 0.9 Car & General Co Current share price Kshs2.40 Number of issued shares 200 million Equity beta 1.2 Asset beta 1.2 It is thought that combining the two companies will result in several benefits. Free cash flows to firm of the combined company will be Kshs216 million in current value terms, but these will increase by an annual growth rate of 5% for the next four years, before reverting to an annual growth rate of 2.25% in perpetuity. In addition to this, combining the companies will result in cash synergy benefits of Kshs20 million per year, for the next four years. These synergy benefits are not subject to any inflationary increase and no synergy benefits will occur after the fourth year. The debt- to-equity ratio of the combined company will be 40:60 in market value terms and it is expected that the combined company's cost of debt will be 4.55%. The corporation tax rate is 30%, the current risk free rate of return ranging between 2% and 5% and the market risk premium is 7%. It can be assumed that the combined company's asset beta is the weighted average of General Motors Co's and Car & General Co's asset betas, weighted by their current market values General Motors Co has offered to acquire Car & General Co through a mixed offer of one of its shares for two Car & General Co shares plus a cash payment, such that a 30% premium is paid for the acquisition. Car & General Co's equity holders feel that a 50% premium would be more acceptable. General Motors Co has sufficient cash reserves if the premium is 30%, but not if it is 50%. Required: Using one of the risk free rate from the range given above, estimate the impact on General Motors Co's equity holders if the premium paid is increased to 50% from 30%. (12 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started