Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) GHI plc's rDebt is 7.35%. Its debt-to-equity ratio is 0.5, and its current levered equity beta is 1.5. The current risk-free rate in the

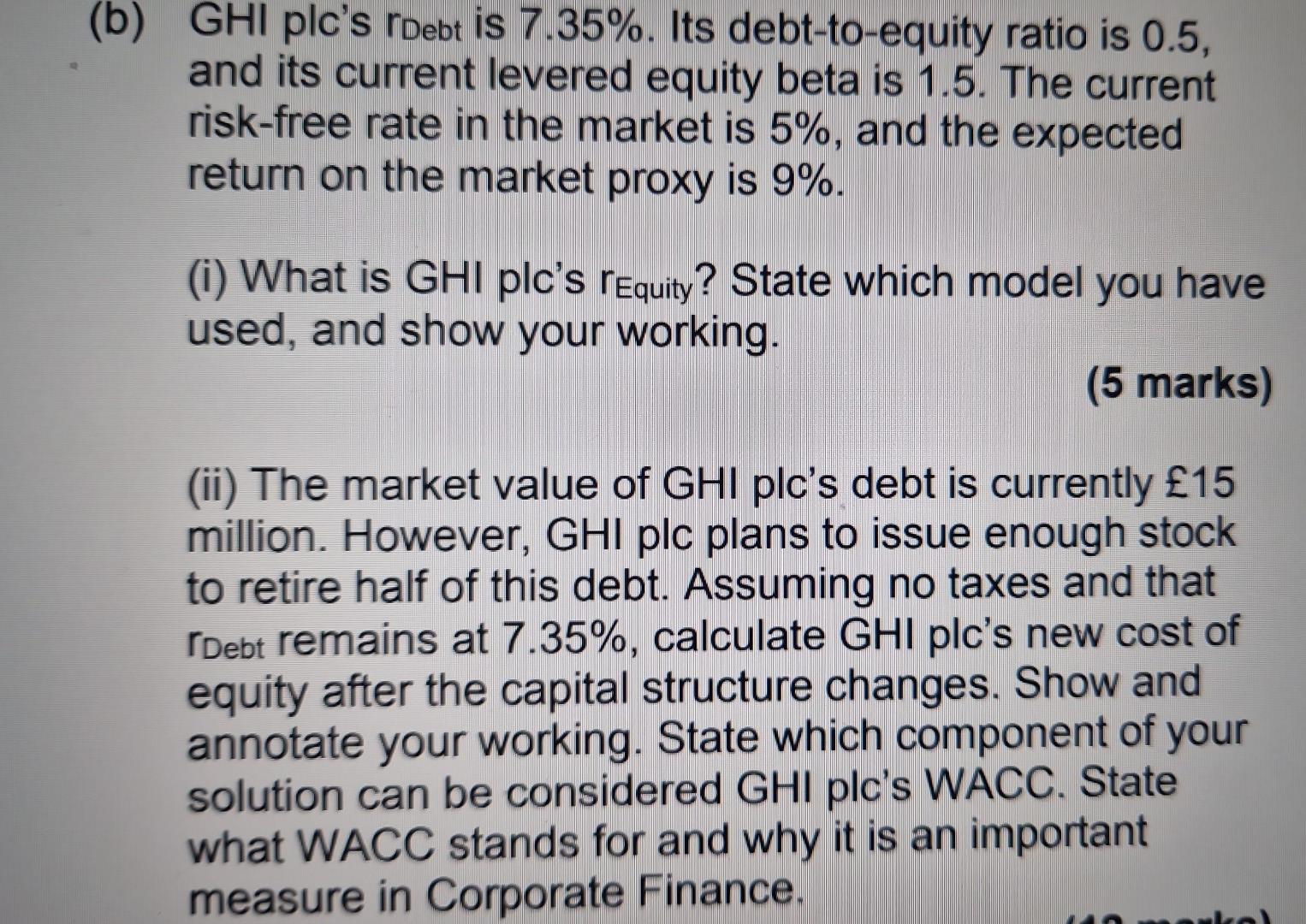

(b) GHI plc's rDebt is 7.35%. Its debt-to-equity ratio is 0.5, and its current levered equity beta is 1.5. The current risk-free rate in the market is 5%, and the expected return on the market proxy is 9%. (i) What is GHI plc's rEquity? State which model you have used, and show your working. (5 marks) (ii) The market value of GHI plc's debt is currently 15 million. However, GHI plc plans to issue enough stock to retire half of this debt. Assuming no taxes and that Debt remains at 7.35%, calculate GHI plc's new cost of equity after the capital structure changes. Show and annotate your working. State which component of your solution can be considered GHI plc's WACC. State what WACC stands for and why it is an important measure in Corporate Finance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started