Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) Glove Sdn Bhd (GSB), a Malaysian tax resident manufacturing company, constructed its second factory building and a warehouse, and also acquired machinery, as part

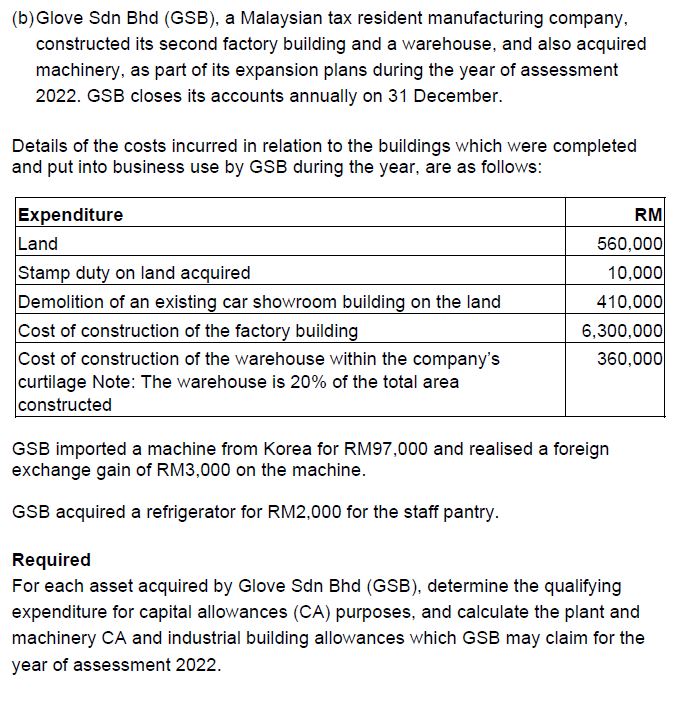

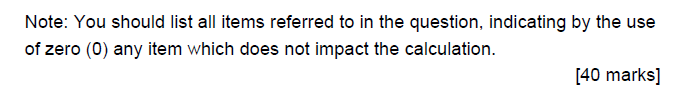

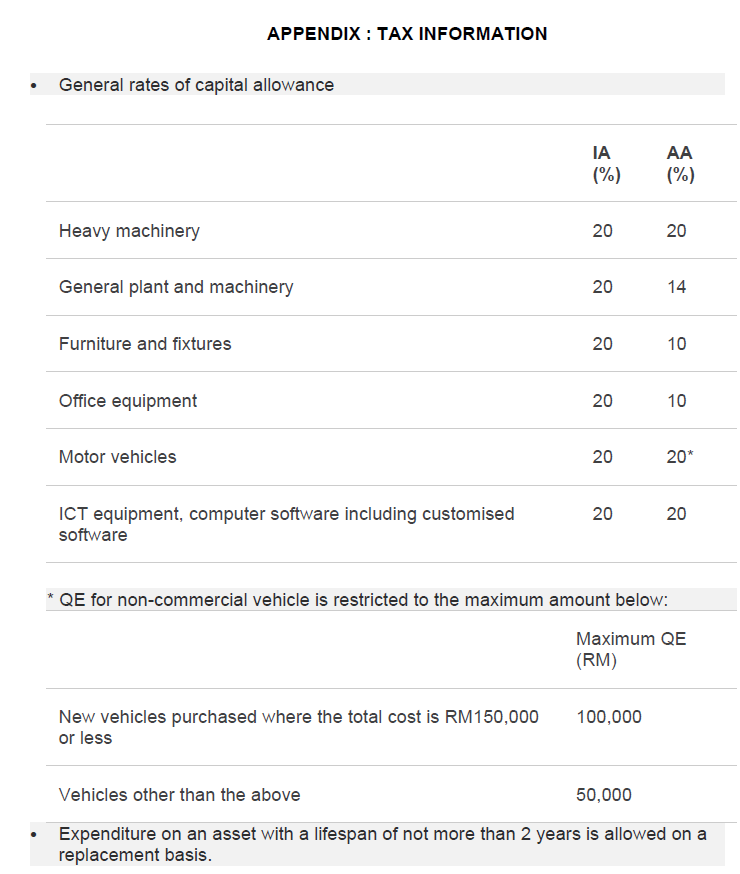

(b) Glove Sdn Bhd (GSB), a Malaysian tax resident manufacturing company, constructed its second factory building and a warehouse, and also acquired machinery, as part of its expansion plans during the year of assessment 2022. GSB closes its accounts annually on 31 December. Details of the costs incurred in relation to the buildings which were completed and put into business use by GSB during the year, are as follows: GSB imported a machine from Korea for RM97,000 and realised a foreign exchange gain of RM3,000 on the machine. GSB acquired a refrigerator for RM2,000 for the staff pantry. Required For each asset acquired by Glove Sdn Bhd (GSB), determine the qualifying expenditure for capital allowances (CA) purposes, and calculate the plant and machinery CA and industrial building allowances which GSB may claim for the year of assessment 2022 . Note: You should list all items referred to in the question, indicating by the use of zero ( 0 ) any item which does not impact the calculation. [40 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance \begin{tabular}{lll} \hline & IA(%) & AA(%) \\ \hline Heavy machinery & 20 & 20 \\ \hline General plant and machinery & 20 & 14 \\ \hline FurnitureandfixturesOfficeequipment & 20 & 10 \\ \hline MotorvehiclesICTequipment,computersoftwareincludingcustomisedsoftware & 20 & 10 \\ \hline \end{tabular} * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. END OF QUESTION PAPER (b) Glove Sdn Bhd (GSB), a Malaysian tax resident manufacturing company, constructed its second factory building and a warehouse, and also acquired machinery, as part of its expansion plans during the year of assessment 2022. GSB closes its accounts annually on 31 December. Details of the costs incurred in relation to the buildings which were completed and put into business use by GSB during the year, are as follows: GSB imported a machine from Korea for RM97,000 and realised a foreign exchange gain of RM3,000 on the machine. GSB acquired a refrigerator for RM2,000 for the staff pantry. Required For each asset acquired by Glove Sdn Bhd (GSB), determine the qualifying expenditure for capital allowances (CA) purposes, and calculate the plant and machinery CA and industrial building allowances which GSB may claim for the year of assessment 2022 . Note: You should list all items referred to in the question, indicating by the use of zero ( 0 ) any item which does not impact the calculation. [40 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance \begin{tabular}{lll} \hline & IA(%) & AA(%) \\ \hline Heavy machinery & 20 & 20 \\ \hline General plant and machinery & 20 & 14 \\ \hline FurnitureandfixturesOfficeequipment & 20 & 10 \\ \hline MotorvehiclesICTequipment,computersoftwareincludingcustomisedsoftware & 20 & 10 \\ \hline \end{tabular} * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. END OF QUESTION PAPER

(b) Glove Sdn Bhd (GSB), a Malaysian tax resident manufacturing company, constructed its second factory building and a warehouse, and also acquired machinery, as part of its expansion plans during the year of assessment 2022. GSB closes its accounts annually on 31 December. Details of the costs incurred in relation to the buildings which were completed and put into business use by GSB during the year, are as follows: GSB imported a machine from Korea for RM97,000 and realised a foreign exchange gain of RM3,000 on the machine. GSB acquired a refrigerator for RM2,000 for the staff pantry. Required For each asset acquired by Glove Sdn Bhd (GSB), determine the qualifying expenditure for capital allowances (CA) purposes, and calculate the plant and machinery CA and industrial building allowances which GSB may claim for the year of assessment 2022 . Note: You should list all items referred to in the question, indicating by the use of zero ( 0 ) any item which does not impact the calculation. [40 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance \begin{tabular}{lll} \hline & IA(%) & AA(%) \\ \hline Heavy machinery & 20 & 20 \\ \hline General plant and machinery & 20 & 14 \\ \hline FurnitureandfixturesOfficeequipment & 20 & 10 \\ \hline MotorvehiclesICTequipment,computersoftwareincludingcustomisedsoftware & 20 & 10 \\ \hline \end{tabular} * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. END OF QUESTION PAPER (b) Glove Sdn Bhd (GSB), a Malaysian tax resident manufacturing company, constructed its second factory building and a warehouse, and also acquired machinery, as part of its expansion plans during the year of assessment 2022. GSB closes its accounts annually on 31 December. Details of the costs incurred in relation to the buildings which were completed and put into business use by GSB during the year, are as follows: GSB imported a machine from Korea for RM97,000 and realised a foreign exchange gain of RM3,000 on the machine. GSB acquired a refrigerator for RM2,000 for the staff pantry. Required For each asset acquired by Glove Sdn Bhd (GSB), determine the qualifying expenditure for capital allowances (CA) purposes, and calculate the plant and machinery CA and industrial building allowances which GSB may claim for the year of assessment 2022 . Note: You should list all items referred to in the question, indicating by the use of zero ( 0 ) any item which does not impact the calculation. [40 marks] APPENDIX : TAX INFORMATION - General rates of capital allowance \begin{tabular}{lll} \hline & IA(%) & AA(%) \\ \hline Heavy machinery & 20 & 20 \\ \hline General plant and machinery & 20 & 14 \\ \hline FurnitureandfixturesOfficeequipment & 20 & 10 \\ \hline MotorvehiclesICTequipment,computersoftwareincludingcustomisedsoftware & 20 & 10 \\ \hline \end{tabular} * QE for non-commercial vehicle is restricted to the maximum amount below: Maximum QE (RM) New vehicles purchased where the total cost is RM150,000 100,000 or less Vehicles other than the above 50,000 - Expenditure on an asset with a lifespan of not more than 2 years is allowed on a replacement basis. END OF QUESTION PAPER Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started