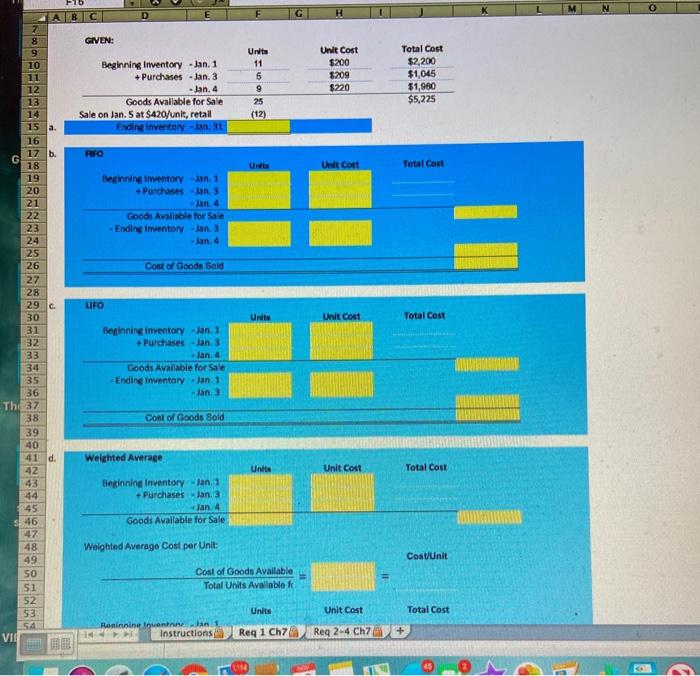

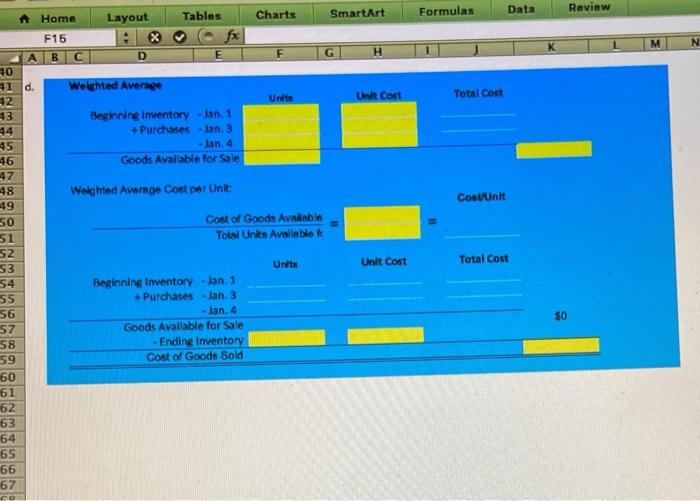

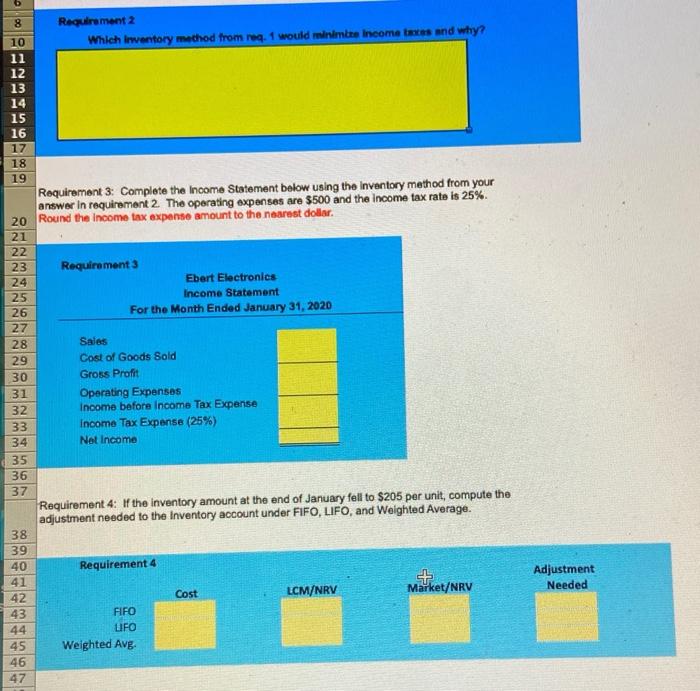

B H 7 GIVEN: Unit 11 5 9 25 (12) Unit Cost $200 $209 $220 Beginning Inventory - Jan. 1 + Purchases - Jan. 3 - Jan. 4 Goods Available for Sale Sale on Jan. at $420/unit, retail Ending inventory-an. 31 Total Cost $2,200 $1,045 $1,980 $5,225 fra UNE Unit Cost Total Cost Beginning inventory an. 1 Purchases and Jan. 4 Goods Available for Sale -Ending Inventory lan 3 lan, 4 Cost of Goods Sold UFO Units Unit Cost Total Cost 9 10 11 12 13 14 15 a 16 17 b. G 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 The 37 38 39 40 41 d. 42 43 44 45 S. 46 47 48 49 50 51 52 53 5.4 VIA Beginning inventory Jan. 1 + Purchases - jan 3 - Jan. 4 Goods Available for Sale Ending Inventory lan 1 - lan 3 Cont of Goods Sold Weighted Average Unte Unit Cost Total Cost Beginning Inventory jan. 1 + Purchases jan 3 Jan. 4 Goods Available for Sale Weighted Average Cost per Unit: Cont/unit Cost of Goods Available Total Units Available Units Unit Cost Total Cost 14 Reannine Innlan Instructions Req 1 Ch7 Req 2-4 Ch7 184 Charts SmartArt Formulas Data Review N Home Layout Tables F15 A B C C D E 10 41 d. Weighted Average 42 43 Beginning inventory - ian. 1 44 + Purchases - lan 3 45 lan 4 46 Goods Available for Sale Unit Cost Total Cost Units 47 Weighted Avongo Cost per Unit Coat Unit Cost of Goods Available Total Units Available Units Unit Cost Total Cost 48 49 SO 51 52 53 54 SS 56 57 58 59 60 61 62 63 64 65 66 67 CO Beginning Inventory - Jan 1 Purchases - Jan. 3 - lan 4 Goods Available for Sale -Ending Inventory Cost of Goods Sold $0 8 Requirement 2 10 Which Inventory method from 4.1 would minimtre Income taxes and why? 11 12 13 14 15 16 17 18 19 Requirement 3: Complete the income Statement below using the Inventory method from your answer in requirement 2. The operating expenses are $500 and the income tax rate is 25% 20 Round the income tax expense amount to the nearest dollar 21 22 23 Requirements 24 Ebert Electronics 25 Income Statement 26 For the Month Ended January 31, 2020 27 28 Sales 29 Cost of Goods Sold 30 Gross Profit 31 Operating Expenses 32 Income before Income Tax Expense 33 Income Tax Expense (25%) 34 Net Income 35 36 37 Requirement 4: If the inventory amount at the end of January fell to $205 per unit, compute the adjustment needed to the Inventory account under FIFO, LIFO, and Weighted Average. 38 39 40 Requirement 4 41 42 Cost LCM/NRV Market/NRV 43 FIFO 44 LIFO 45 Weighted Avg 46 47 Adjustment Needed