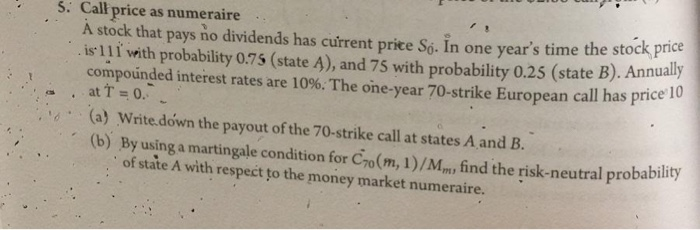

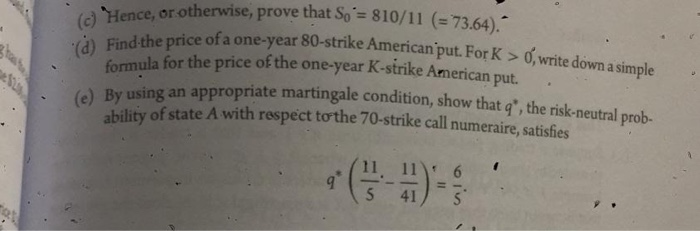

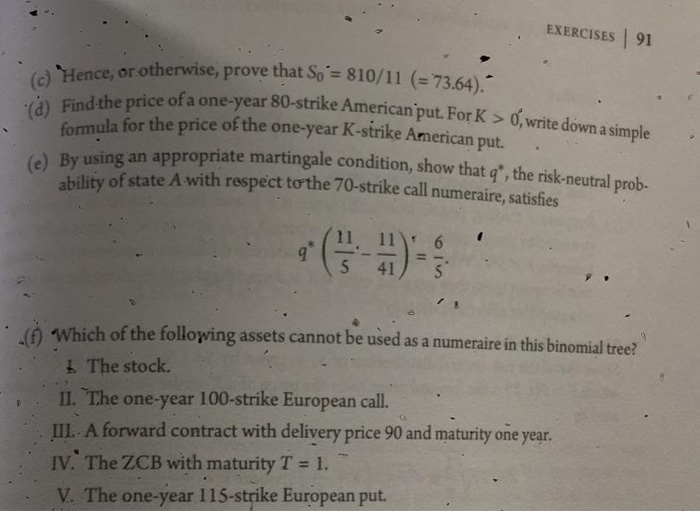

B IDO 5. Call price as numeraire A stock that pays no dividends has current prite So. In one year's time the stock price is 111 with probability 0.75 (state A), and 75 with probability 0.25 (state B). Annua compounded interest rates are 10%. The one-year 70-strike European call has price . at T = 0. (a) Write down the payout of the 70-strike call at states A and B. (b) By using a martingale condition for Com, 1)/M. find the risk-neutral probability of state A with respect to the money market numeraire. vear 80-strike American put. For K > 0, write down a simple 'Hence, or otherwise, prove that so = 810/11 ( 364) Find the price of a one-year 80-strike American for the price of the one-year K-strike American put. . n appropriate martingale condition, show that q*, the risk-neutral prob- (e) By using an appropriate martingale shility of state A with respect to the 70-strike call numeraire, satie EXERCISES 91 of a one-year 80-strike American put. For K > 0, write down a simple Hence, or otherwise, prove that So = 810/11 (= 73.64) - d) Find the price of a one-year 80-strike formula for the price of the one-year K-strike And (e) By using an appropriate martin an appropriate martingale condition, show that g, the risk-neutral prob- of state A with respect to the 70-strike call numeraire, satisfies ( Which of the following assets cannot be used as a numeraire in this binomial tree? The stock. II. The one-year 100-strike European call. IIL A forward contract with delivery price 90 and maturity one year. IV. The ZCB with maturity T = 1. V. The one-year 115-strike European put. B IDO 5. Call price as numeraire A stock that pays no dividends has current prite So. In one year's time the stock price is 111 with probability 0.75 (state A), and 75 with probability 0.25 (state B). Annua compounded interest rates are 10%. The one-year 70-strike European call has price . at T = 0. (a) Write down the payout of the 70-strike call at states A and B. (b) By using a martingale condition for Com, 1)/M. find the risk-neutral probability of state A with respect to the money market numeraire. vear 80-strike American put. For K > 0, write down a simple 'Hence, or otherwise, prove that so = 810/11 ( 364) Find the price of a one-year 80-strike American for the price of the one-year K-strike American put. . n appropriate martingale condition, show that q*, the risk-neutral prob- (e) By using an appropriate martingale shility of state A with respect to the 70-strike call numeraire, satie EXERCISES 91 of a one-year 80-strike American put. For K > 0, write down a simple Hence, or otherwise, prove that So = 810/11 (= 73.64) - d) Find the price of a one-year 80-strike formula for the price of the one-year K-strike And (e) By using an appropriate martin an appropriate martingale condition, show that g, the risk-neutral prob- of state A with respect to the 70-strike call numeraire, satisfies ( Which of the following assets cannot be used as a numeraire in this binomial tree? The stock. II. The one-year 100-strike European call. IIL A forward contract with delivery price 90 and maturity one year. IV. The ZCB with maturity T = 1. V. The one-year 115-strike European put