Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. if part of the debt in (a)* above.... (b) is considered to calculate (a) The following are information about the company's account receivable during

b. if part of the debt in (a)* above....

(b) is considered to calculate (a)

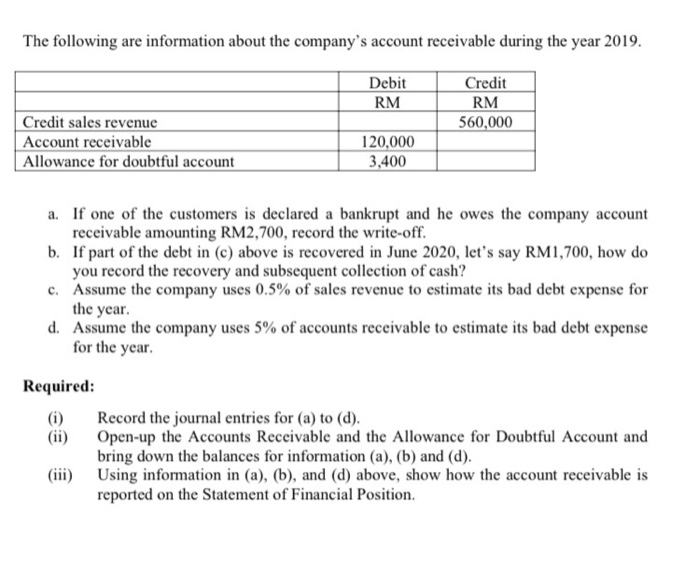

The following are information about the company's account receivable during the year 2019. Debit RM Credit RM 560,000 Credit sales revenue Account receivable Allowance for doubtful account 120,000 3,400 a. If one of the customers is declared a bankrupt and he owes the company account receivable amounting RM2,700, record the write-off. b. If part of the debt in (e) above is recovered in June 2020, let's say RM1,700, how do you record the recovery and subsequent collection of cash? c. Assume the company uses 0.5% of sales revenue to estimate its bad debt expense for the year. d. Assume the company uses 5% of accounts receivable to estimate its bad debt expense for the year. Required: (i) Record the journal entries for (a) to (d). Open-up the Accounts Receivable and the Allowance for Doubtful Account and bring down the balances for information (a), (b) and (d). (iii) Using information in (a), (b), and (d) above, show how the account receivable is reported on the Statement of Financial Position Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started