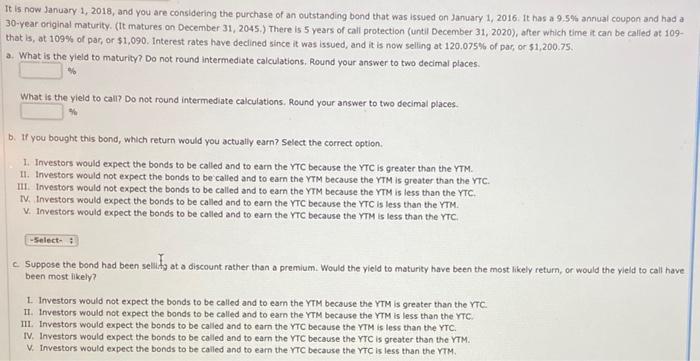

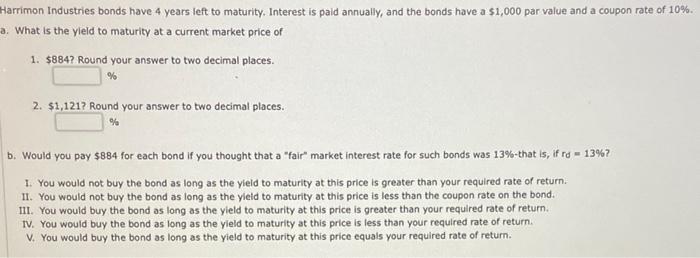

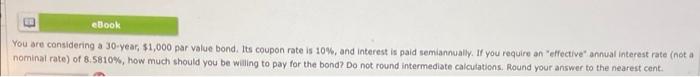

b. If you bought this bond, which return would you actually earn? Select the correct option. 1. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. 11. Investors would not expect the bonds to be called and to eam the YTM because the YTM is greater than the YTC. III. Investors would not expect the bonds to be called and to eam the YTM because the YTM is less than the YTC. TV. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. V. Investors would expect the bonds to be called and to earn the YTC because the YTM is less than the YTC. c. Suppose the bond had been sellitg at a discount rather than a premium. Would the yield to maturity have been the most likely return, or would the yield to call have been most likely? 1. Investors would not expect the bonds to be called and to eam the YTM because the YTM is greater than the YTC: II. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the rTC. III. Investors would expect the bonds to be called and to earn the YTC because the YTM is less than the YTC. IV. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. V. Investors would expect the bonds to be called and to eam the YTC because the YTC is less than the YTM. Harrimon Industries bonds have 4 years left to maturity, Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 10%. 3. What is the yleld to maturity at a current market price of 1. 5884? Round your answer to two decimal places. % 2. $1,121 ? Round your answer to two decimal places. b. Would you pay $884 for each bond if you thought that a "fair" market interest rate for such bonds was 13% that is, if rd =13% ? 1. You would not buy the bond as long as the yieid to maturity at this price is greater than your required rate of return. II. You would not buy the bond as long as the yieid to maturity at this price is less than the coupon rate on the bond. III. You would buy the bond as long as the yield to maturity at this price is greater than your required rate of return. IV. You would buy the bond as long as the yield to maturity at this price is less than your required rate of return. V. You would buy the bond as long as the yield to maturity at this price equals your required rate of return. You are considering a j0-year, $1,000 par value bond. Its coupon rate is 10%, and interest is paid semiannually. If you require an "effective" annual interest rate (not a nominal rate) of 8.5810%, how much should you be wialing to pay for the bond? Do not round intermediate calcutations. Round your answer to the nearest cent