Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. In your analysis, calculate the overall break-even point in sales dollars and the cash break-even point. Also compute the degree of operating leverage, degree

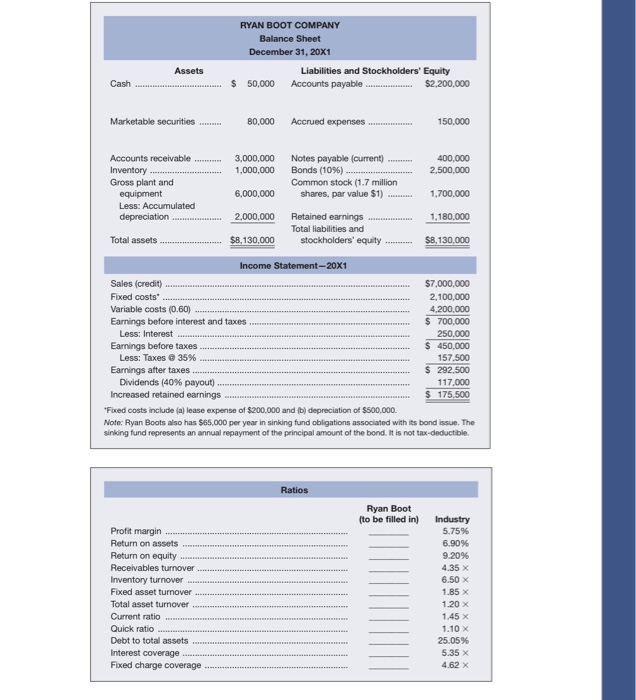

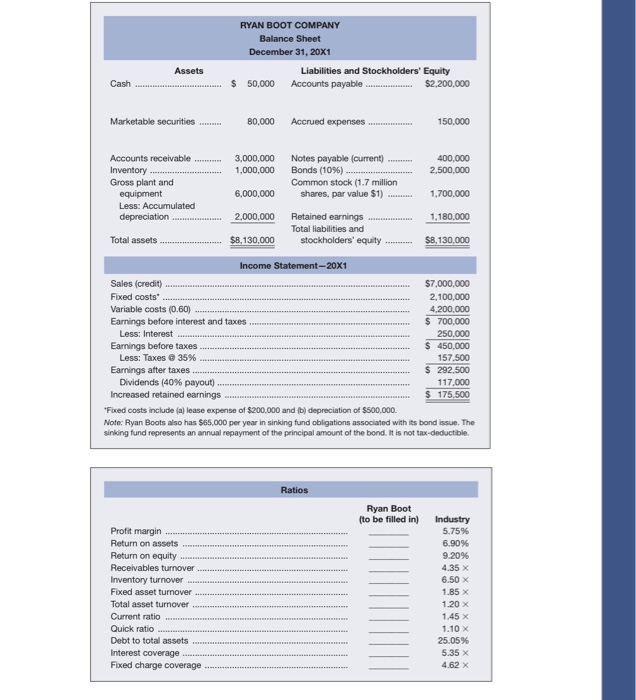

b. In your analysis, calculate the overall break-even point in sales dollars and the cash break-even point. Also compute the degree of operating leverage, degree of financial leverage, and degree of combined leverage. (Use footnote 2 for DOL and footnote 3 for DCL.) Use the information in norts and to discuss the risk associated with RYAN BOOT COMPANY Balance Sheet December 31, 20X1 Liabilities and Stockholders' Equity $ 50,000 Accounts payable.... $2,200,000 Assets Cash Marketable securities.... 80,000 Accrued expenses 150,000 3,000,000 1,000,000 400,000 2,500,000 Accounts receivable Inventory Gross plant and equipment Less: Accumulated depreciation 6,000,000 Notes payable (current) ... Bonds (10%) Common stock (1.7 million shares, par value $1) .......... Retained earnings Total liabilities and stockholders' equity 1,700,000 2,000,000 1,180,000 Total assets $8,130,000 $8,130,000 Income Statement-20X1 Sales (credit) $7,000,000 Fixed costs 2,100,000 Variable costs (0.60) 4,200,000 Earnings before interest and taxes $ 700.000 Less: Interest 250,000 Earnings before taxes $ 450,000 Less: Taxes @ 35% 157.500 Earnings after taxes $ 292,500 Dividends (40% payout) 117.000 Increased retained earnings $ 175,500 'Fixed costs include (a) lease expense of $200,000 and (b) depreciation of $500,000. Note: Ryan Boots also has $65,000 per year in sinking fund obligations associated with its bond issue. The sinking fund represents an annual repayment of the principal amount of the bond. It is not tax-deductible Ratios Ryan Boot (to be filled in) Profit margin Return on assets Return on equity Receivables turnover Inventory turnover Fixed asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Interest coverage Fixed charge coverage Industry 5.75% 6.90% 9.20% 4.35 x 6.50 x 1.85 x 1.20 x 1.45 X 1.10 X 25.05% 5.35 x 4.62 x

b. In your analysis, calculate the overall break-even point in sales dollars and the cash break-even point. Also compute the degree of operating leverage, degree of financial leverage, and degree of combined leverage. (Use footnote 2 for DOL and footnote 3 for DCL.) Use the information in norts and to discuss the risk associated with RYAN BOOT COMPANY Balance Sheet December 31, 20X1 Liabilities and Stockholders' Equity $ 50,000 Accounts payable.... $2,200,000 Assets Cash Marketable securities.... 80,000 Accrued expenses 150,000 3,000,000 1,000,000 400,000 2,500,000 Accounts receivable Inventory Gross plant and equipment Less: Accumulated depreciation 6,000,000 Notes payable (current) ... Bonds (10%) Common stock (1.7 million shares, par value $1) .......... Retained earnings Total liabilities and stockholders' equity 1,700,000 2,000,000 1,180,000 Total assets $8,130,000 $8,130,000 Income Statement-20X1 Sales (credit) $7,000,000 Fixed costs 2,100,000 Variable costs (0.60) 4,200,000 Earnings before interest and taxes $ 700.000 Less: Interest 250,000 Earnings before taxes $ 450,000 Less: Taxes @ 35% 157.500 Earnings after taxes $ 292,500 Dividends (40% payout) 117.000 Increased retained earnings $ 175,500 'Fixed costs include (a) lease expense of $200,000 and (b) depreciation of $500,000. Note: Ryan Boots also has $65,000 per year in sinking fund obligations associated with its bond issue. The sinking fund represents an annual repayment of the principal amount of the bond. It is not tax-deductible Ratios Ryan Boot (to be filled in) Profit margin Return on assets Return on equity Receivables turnover Inventory turnover Fixed asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Interest coverage Fixed charge coverage Industry 5.75% 6.90% 9.20% 4.35 x 6.50 x 1.85 x 1.20 x 1.45 X 1.10 X 25.05% 5.35 x 4.62 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started