Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. Klasik Bhd leased a packaging machine for three (3) years to a newly established company, AB Bhd in 2018. The lease agreement requires

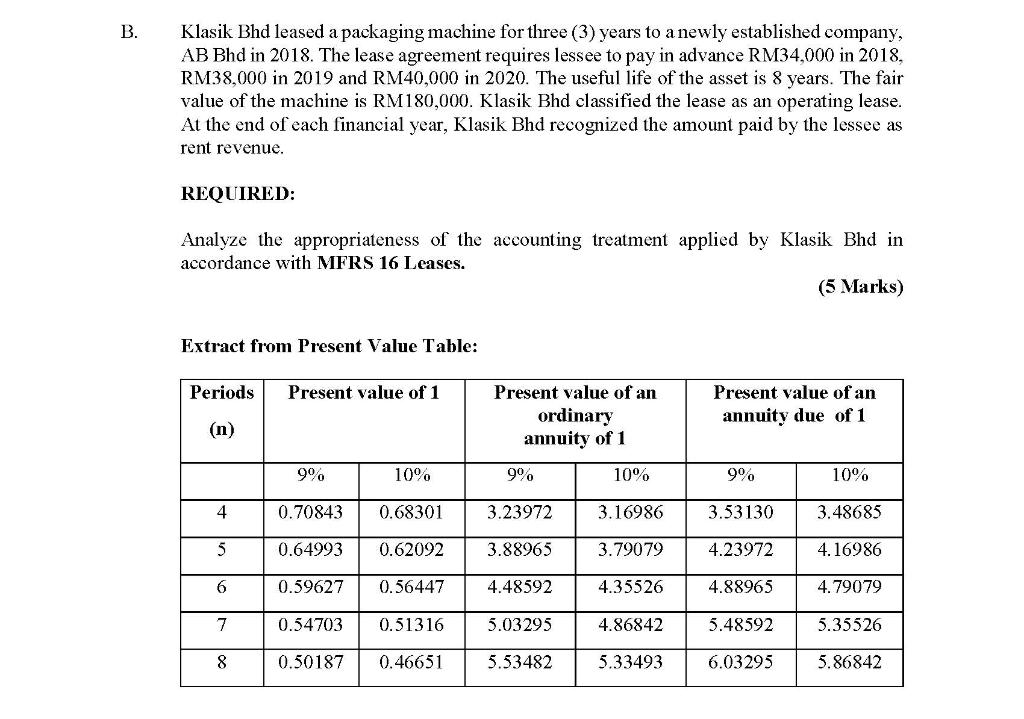

B. Klasik Bhd leased a packaging machine for three (3) years to a newly established company, AB Bhd in 2018. The lease agreement requires lessee to pay in advance RM34,000 in 2018, RM38,000 in 2019 and RM40,000 in 2020. The useful life of the asset is 8 years. The fair value of the machine is RM180,000. Klasik Bhd classified the lease as an operating lease. At the end of each financial year, Klasik Bhd recognized the amount paid by the lessee as rent revenue. REQUIRED: Analyze the appropriateness of the accounting treatment applied by Klasik Bhd in accordance with MFRS 16 Leases. Extract from Present Value Table: (5 Marks) Periods Present value of 1 (n) Present value of an ordinary annuity of 1 Present value of an annuity due of 1 9% 10% 9% 10% 9% 10% 4 0.70843 0.68301 3.23972 3.16986 3.53130 3.48685 5 0.64993 0.62092 3.88965 3.79079 4.23972 4.16986 6 0.59627 0.56447 4.48592 4.35526 4.88965 4.79079 7 0.54703 0.51316 5.03295 4.86842 5.48592 5.35526 8 0.50187 0.46651 5.53482 5.33493 6.03295 5.86842

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started