Question

(b) Lisa, aged 79 and in good health, asks your advice on minimizing the inheritance tax payable on her estate. Lisa is widowed and

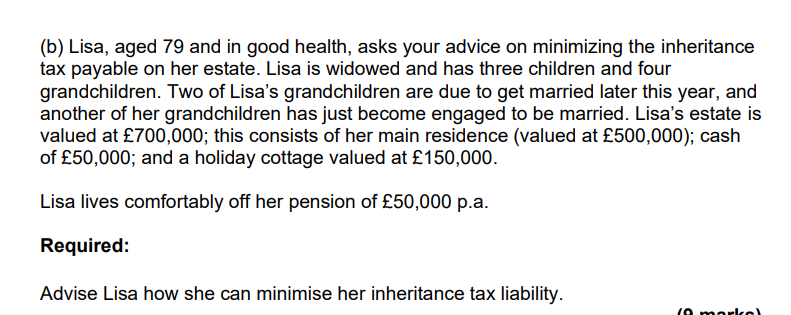

(b) Lisa, aged 79 and in good health, asks your advice on minimizing the inheritance tax payable on her estate. Lisa is widowed and has three children and four grandchildren. Two of Lisa's grandchildren are due to get married later this year, and another of her grandchildren has just become engaged to be married. Lisa's estate is valued at 700,000; this consists of her main residence (valued at 500,000); cash of 50,000; and a holiday cottage valued at 150,000. Lisa lives comfortably off her pension of 50,000 p.a. Required: Advise Lisa how she can minimise her inheritance tax liability. (9 markel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To minimize inheritance tax liability Lisa can consider the following strategies 1 Utilize the Nil Rate Band NRB In the UK each individual has a NRB w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Finance Act 2021

Authors: Alan Melville

27th Edition

1292406720, 978-1292406725

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App