Question

B. Make journal entries related to interest expense and changes in fair value for 12/31/2019 and 12/312020 under three assumptions (i) the bond investment is

B. Make journal entries related to interest expense and changes in fair value for 12/31/2019 and 12/312020 under three assumptions (i) the bond investment is classified as HTM, (ii) the investment is classified as AFS, and (iii) the investment is classified as trading security. Indicate whether any gains or losses are in NI or OCI.

|

| Dates | Accounts | Dr | Cr |

|

|

|

|

|

|

| i.HTM | 12/31/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12/31/2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ii.AFS | 12/31/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12/31/2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| iii.TS | 12/31/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12/31/2020 |

|

|

|

|

|

|

|

|

|

please show detailed explanation with calculations

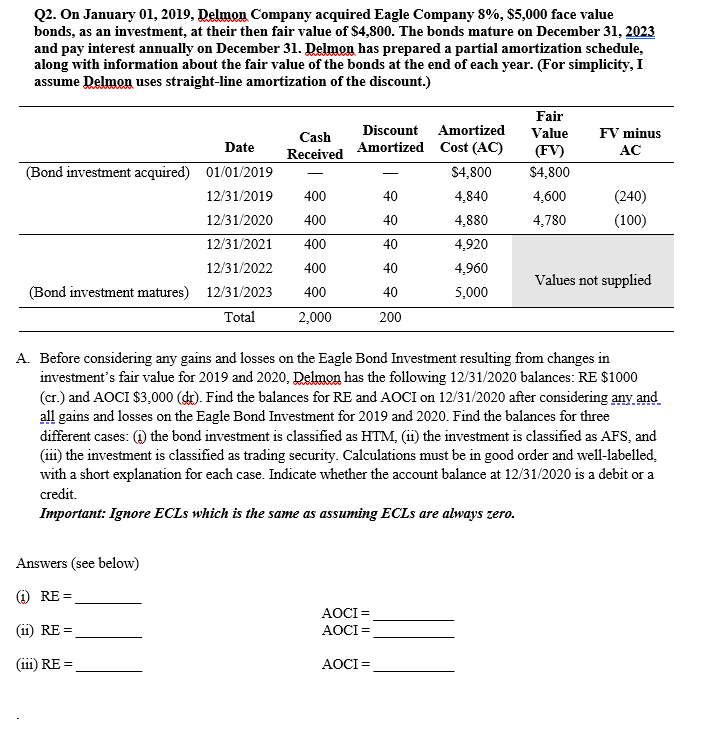

Q2. On January 01, 2019, Delmon Company acquired Eagle Company 8%,$5,000 face value bonds, as an investment, at their then fair value of $4,800. The bonds mature on December 31,2023 and pay interest annually on December 31 . Delmon has prepared a partial amortization schedule, along with information about the fair value of the bonds at the end of each year. (For simplicity, I assume Delmon uses straight-line amortization of the discount.) A. Before considering any gains and losses on the Eagle Bond Investment resulting from changes in investment's fair value for 2019 and 2020, Delmon has the following 12/31/2020 balances: RE $1000 (cr.) and AOCI $3,000(dr). Find the balances for RE and AOCI on 12/31/2020 after considering any and all gains and losses on the Eagle Bond Investment for 2019 and 2020. Find the balances for three different cases: (i) the bond investment is classified as HTM, (ii) the investment is classified as AFS, and (iii) the investment is classified as trading security. Calculations must be in good order and well-labelled, with a short explanation for each case. Indicate whether the account balance at 12/31/2020 is a debit or a credit. Important: Ignore ECLs which is the same as assuming ECLs are always zero. Answers (see below) (i) RE=. Q2. On January 01, 2019, Delmon Company acquired Eagle Company 8%,$5,000 face value bonds, as an investment, at their then fair value of $4,800. The bonds mature on December 31,2023 and pay interest annually on December 31 . Delmon has prepared a partial amortization schedule, along with information about the fair value of the bonds at the end of each year. (For simplicity, I assume Delmon uses straight-line amortization of the discount.) A. Before considering any gains and losses on the Eagle Bond Investment resulting from changes in investment's fair value for 2019 and 2020, Delmon has the following 12/31/2020 balances: RE $1000 (cr.) and AOCI $3,000(dr). Find the balances for RE and AOCI on 12/31/2020 after considering any and all gains and losses on the Eagle Bond Investment for 2019 and 2020. Find the balances for three different cases: (i) the bond investment is classified as HTM, (ii) the investment is classified as AFS, and (iii) the investment is classified as trading security. Calculations must be in good order and well-labelled, with a short explanation for each case. Indicate whether the account balance at 12/31/2020 is a debit or a credit. Important: Ignore ECLs which is the same as assuming ECLs are always zero. Answers (see below) (i) RE=Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started