Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Paper Bark Limited announced a bid to take over Coal Minor Pty Limited. Paper Bark Pty Limited has 3 million shares outstanding, selling

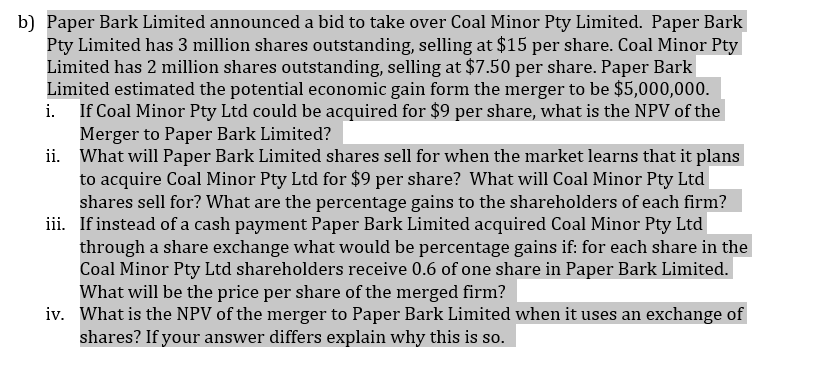

b) Paper Bark Limited announced a bid to take over Coal Minor Pty Limited. Paper Bark Pty Limited has 3 million shares outstanding, selling at $15 per share. Coal Minor Pty Limited has 2 million shares outstanding, selling at $7.50 per share. Paper Bark Limited estimated the potential economic gain form the merger to be $5,000,000. i. If Coal Minor Pty Ltd could be acquired for $9 per share, what is the NPV of the Merger to Paper Bark Limited? ii. What will Paper Bark Limited shares sell for when the market learns that it plans to acquire Coal Minor Pty Ltd for $9 per share? What will Coal Minor Pty Ltd shares sell for? What are the percentage gains to the shareholders of each firm? iii. If instead of a cash payment Paper Bark Limited acquired Coal Minor Pty Ltd through a share exchange what would be percentage gains if: for each share in the Coal Minor Pty Ltd shareholders receive 0.6 of one share in Paper Bark Limited. What will be the price per share of the merged firm? iv. What is the NPV of the merger to Paper Bark Limited when it uses an exchange of shares? If your answer differs explain why this is so.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the questions one by one i To find the NPV of the merger to Paper Bark Limited we need to calculate the cost of acquiring Coal Minor Pty Ltd and subtract it from the potential economic ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started