Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. Peter the sole owner of Cheshire Kitchen Tools Pty Ltd has supplied you with the following information to assist in preparing a Cash

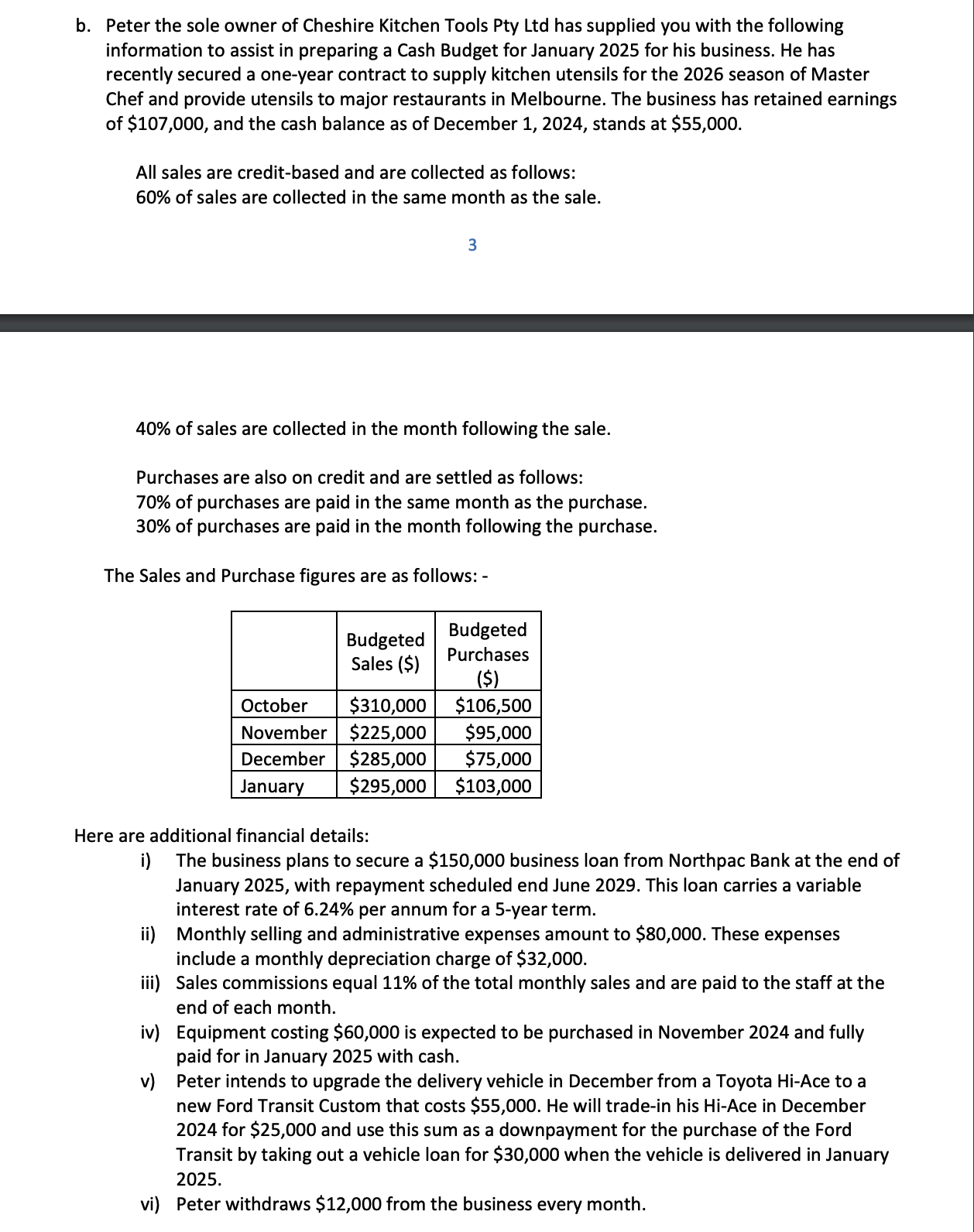

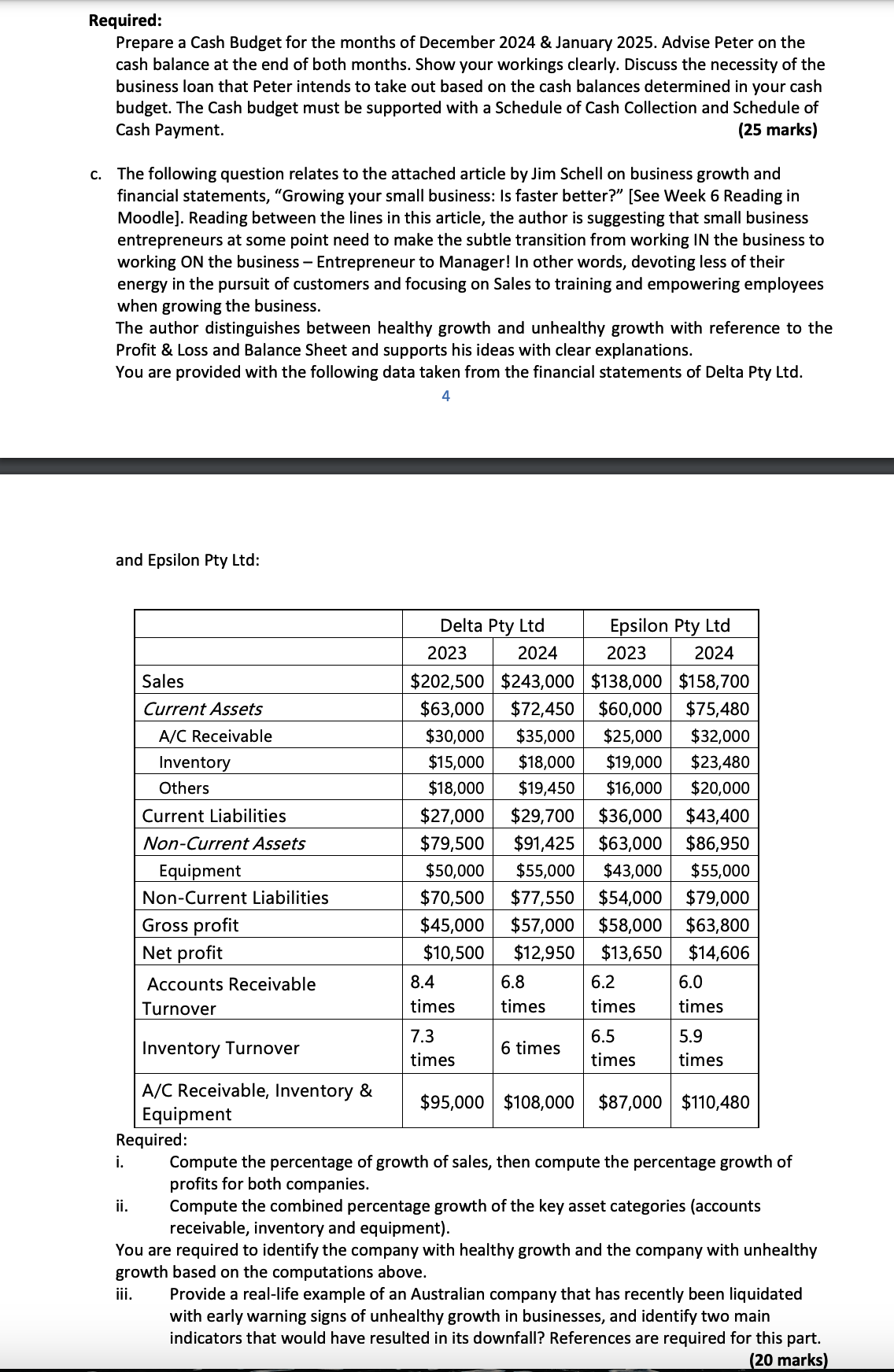

b. Peter the sole owner of Cheshire Kitchen Tools Pty Ltd has supplied you with the following information to assist in preparing a Cash Budget for January 2025 for his business. He has recently secured a one-year contract to supply kitchen utensils for the 2026 season of Master Chef and provide utensils to major restaurants in Melbourne. The business has retained earnings of $107,000, and the cash balance as of December 1, 2024, stands at $55,000. All sales are credit-based and are collected as follows: 60% of sales are collected in the same month as the sale. 3 40% of sales are collected in the month following the sale. Purchases are also on credit and are settled as follows: 70% of purchases are paid in the same month as the purchase. 30% of purchases are paid in the month following the purchase. The Sales and Purchase figures are as follows: - Budgeted Budgeted Sales ($) Purchases ($) October $310,000 $106,500 November $225,000 $95,000 December $285,000 $75,000 January $295,000 $103,000 Here are additional financial details: i) The business plans to secure a $150,000 business loan from Northpac Bank at the end of January 2025, with repayment scheduled end June 2029. This loan carries a variable interest rate of 6.24% per annum for a 5-year term. ii) Monthly selling and administrative expenses amount to $80,000. These expenses include a monthly depreciation charge of $32,000. iii) Sales commissions equal 11% of the total monthly sales and are paid to the staff at the end of each month. iv) Equipment costing $60,000 is expected to be purchased in November 2024 and fully paid for in January 2025 with cash. v) Peter intends to upgrade the delivery vehicle in December from a Toyota Hi-Ace to a new Ford Transit Custom that costs $55,000. He will trade-in his Hi-Ace in December 2024 for $25,000 and use this sum as a downpayment for the purchase of the Ford Transit by taking out a vehicle loan for $30,000 when the vehicle is delivered in January 2025. vi) Peter withdraws $12,000 from the business every month. Required: C. Prepare a Cash Budget for the months of December 2024 & January 2025. Advise Peter on the cash balance at the end of both months. Show your workings clearly. Discuss the necessity of the business loan that Peter intends to take out based on the cash balances determined in your cash budget. The Cash budget must be supported with a Schedule of Cash Collection and Schedule of Cash Payment. (25 marks) The following question relates to the attached article by Jim Schell on business growth and financial statements, "Growing your small business: Is faster better?" [See Week 6 Reading in Moodle]. Reading between the lines in this article, the author is suggesting that small business entrepreneurs at some point need to make the subtle transition from working IN the business to working ON the business - Entrepreneur to Manager! In other words, devoting less of their energy in the pursuit of customers and focusing on Sales to training and empowering employees when growing the business. The author distinguishes between healthy growth and unhealthy growth with reference to the Profit & Loss and Balance Sheet and supports his ideas with clear explanations. You are provided with the following data taken from the financial statements of Delta Pty Ltd. 4 and Epsilon Pty Ltd: Sales Current Assets A/C Receivable Inventory Others Current Liabilities Non-Current Assets Equipment Non-Current Liabilities Gross profit Net profit Delta Pty Ltd 2023 2024 2024 $202,500 $243,000 $138,000 $158,700 $63,000 $72,450 $60,000 $75,480 $30,000 $35,000 $25,000 $32,000 $15,000 $18,000 $19,000 $23,480 $18,000 $19,450 $16,000 $20,000 $27,000 $29,700 $36,000 $43,400 $79,500 $91,425 $63,000 $86,950 $50,000 $55,000 $43,000 $55,000 $70,500 $77,550 $54,000 $79,000 $45,000 $57,000 $58,000 $10,500 $12,950 Epsilon Pty Ltd 2023 $63,800 $13,650 $14,606 Accounts Receivable 8.4 6.8 6.2 6.0 Turnover times times times times 7.3 Inventory Turnover 6 times times 6.5 times 5.9 times A/C Receivable, Inventory & Equipment $95,000 $108,000 $87,000 $110,480 Required: i. ii. Compute the percentage of growth of sales, then compute the percentage growth of profits for both companies. Compute the combined percentage growth of the key asset categories (accounts receivable, inventory and equipment). You are required to identify the company with healthy growth and the company with unhealthy growth based on the computations above. iii. Provide a real-life example of an Australian company that has recently been liquidated with early warning signs of unhealthy growth in businesses, and identify two main indicators that would have resulted in its downfall? References are required for this part. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started