Answered step by step

Verified Expert Solution

Question

1 Approved Answer

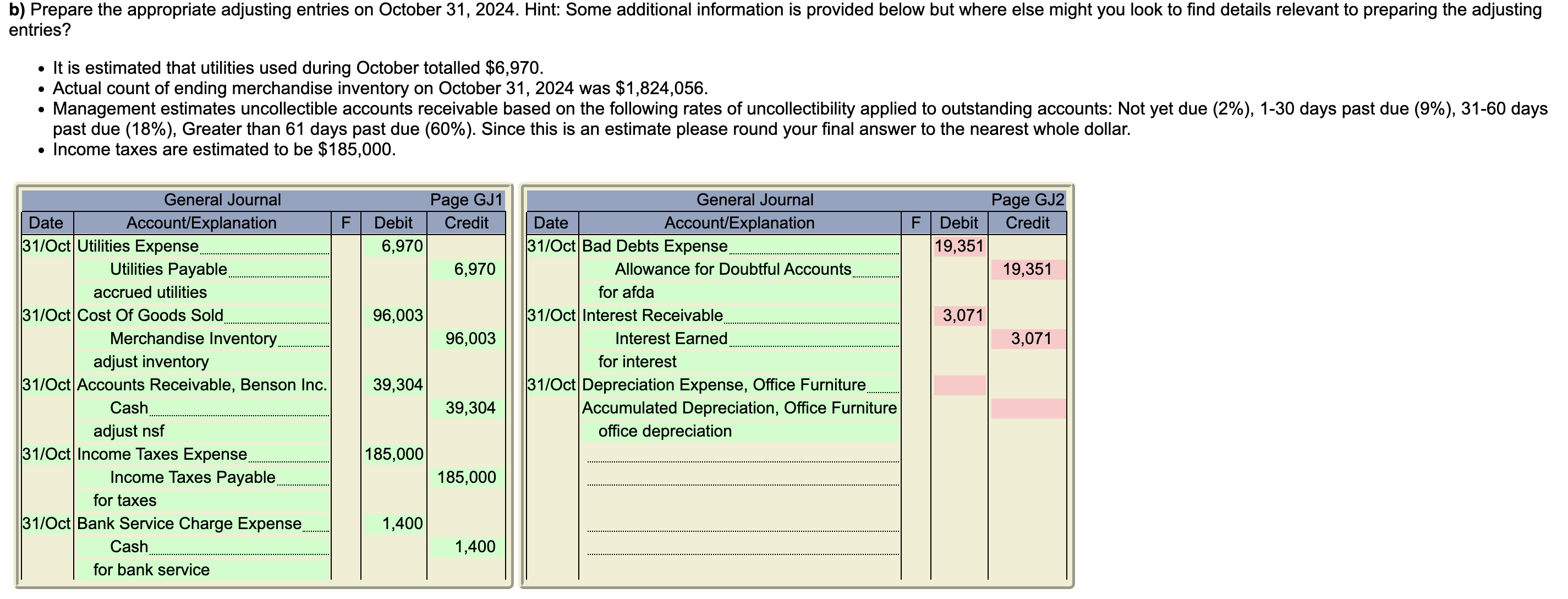

b) Prepare the appropriate adjusting entries on October 31, 2024. Hint: Some additional information is provided below but where else might you look to

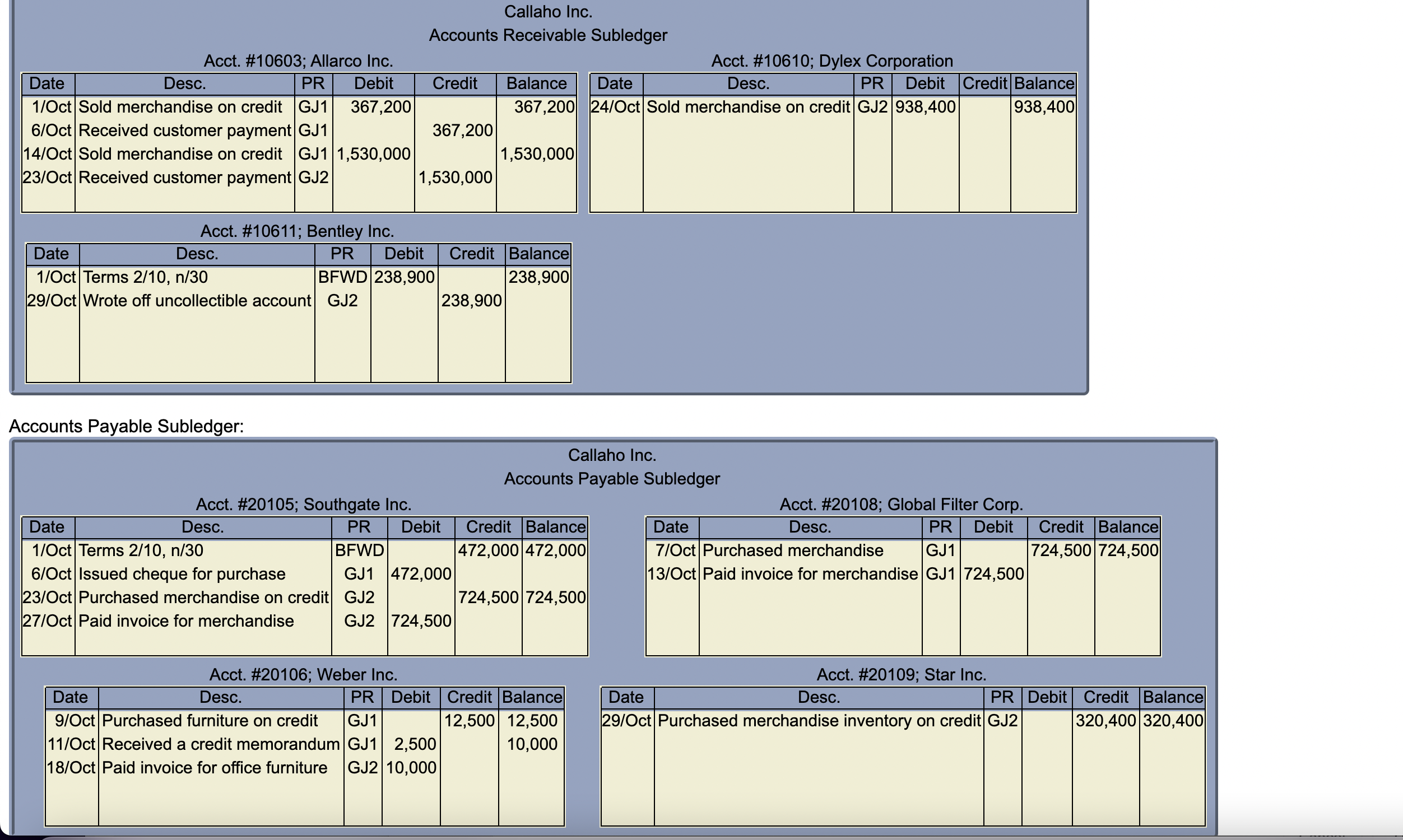

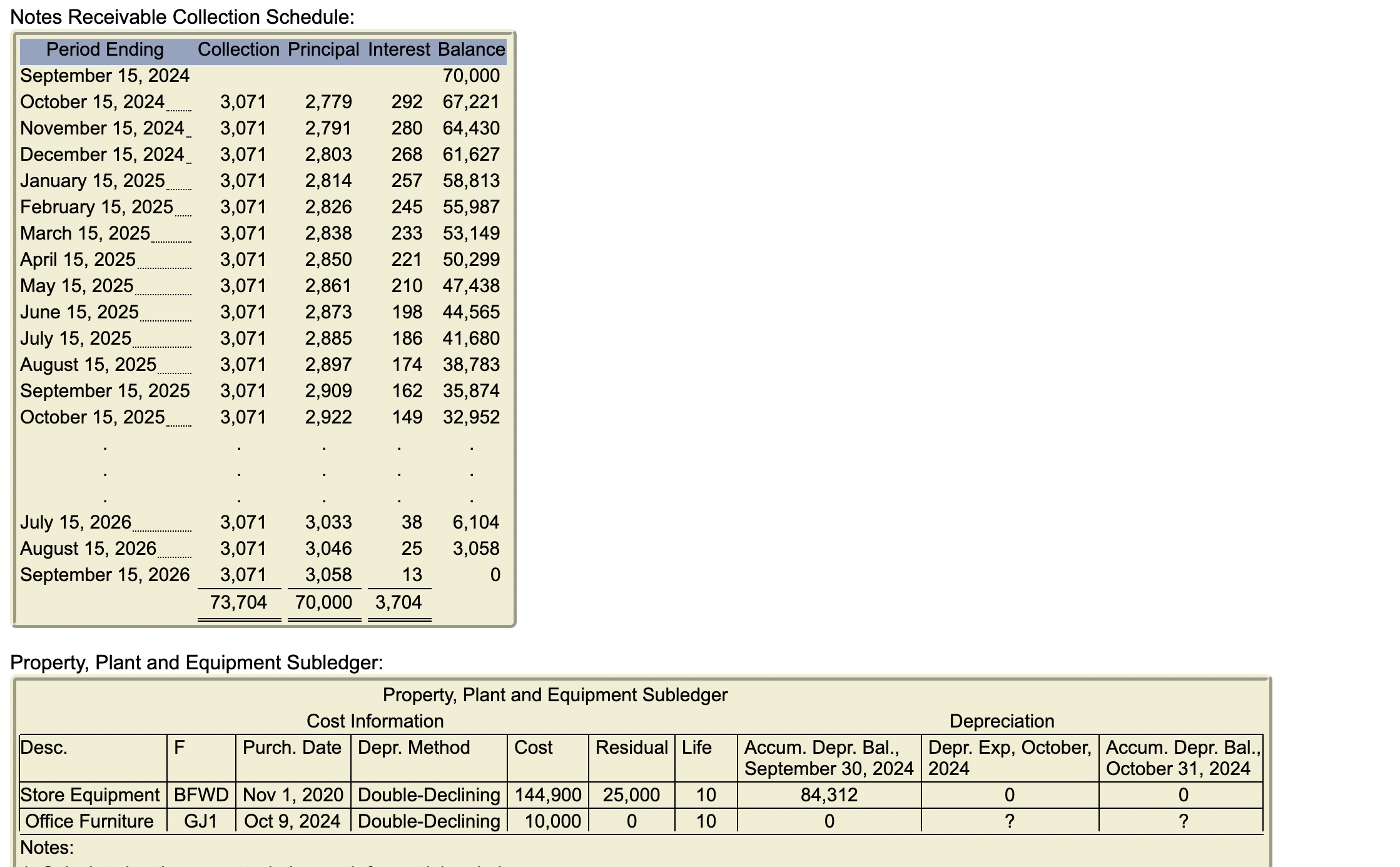

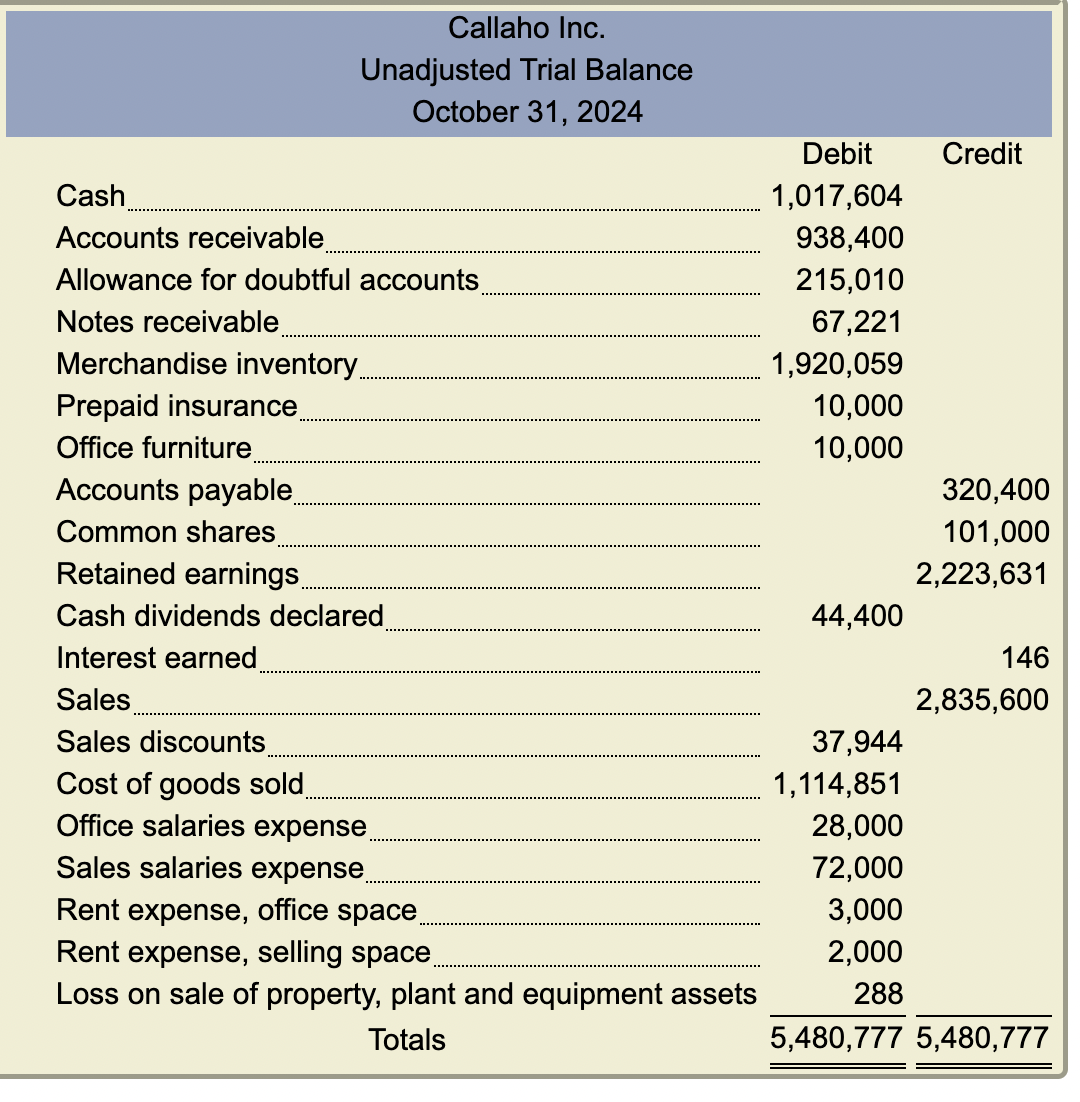

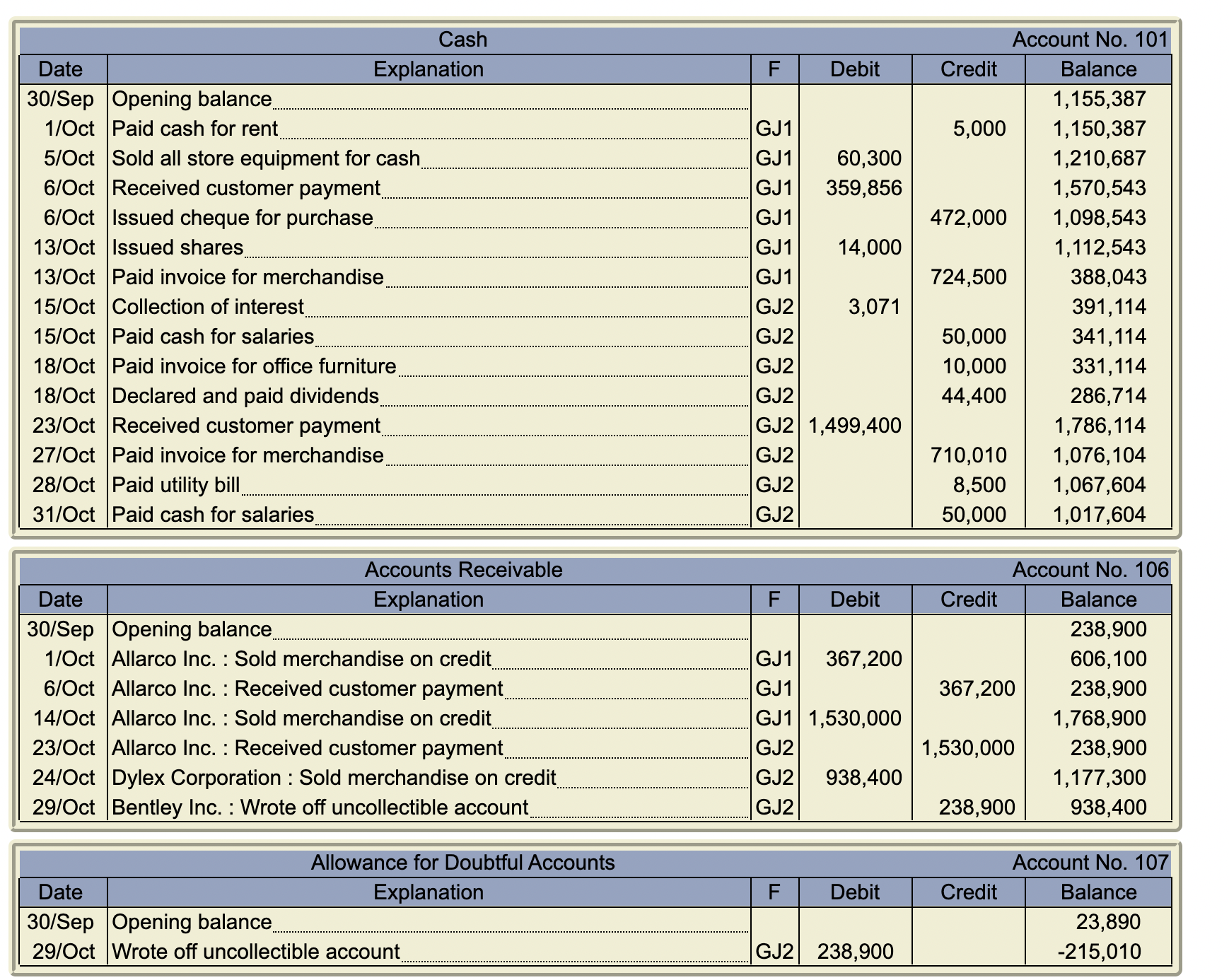

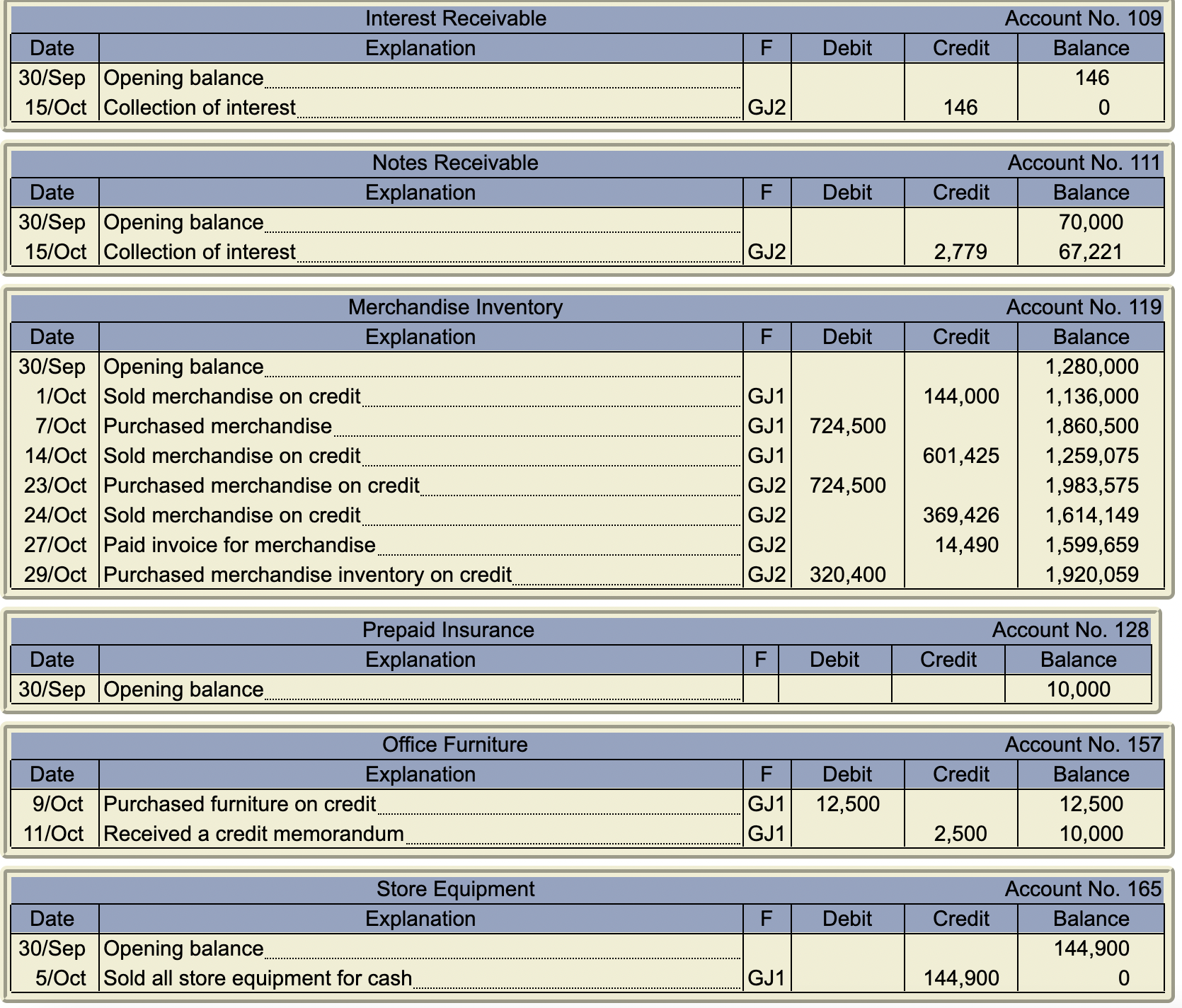

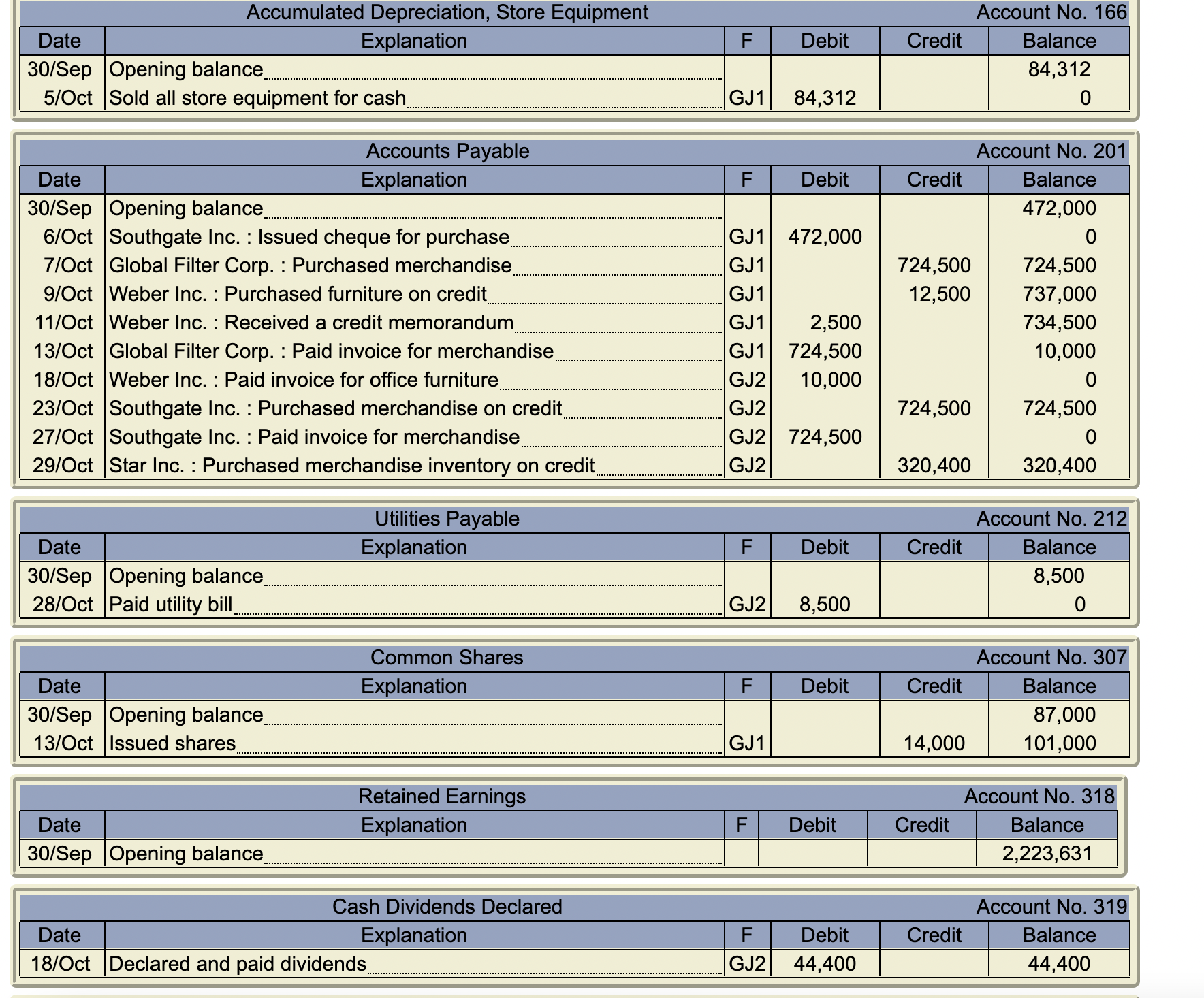

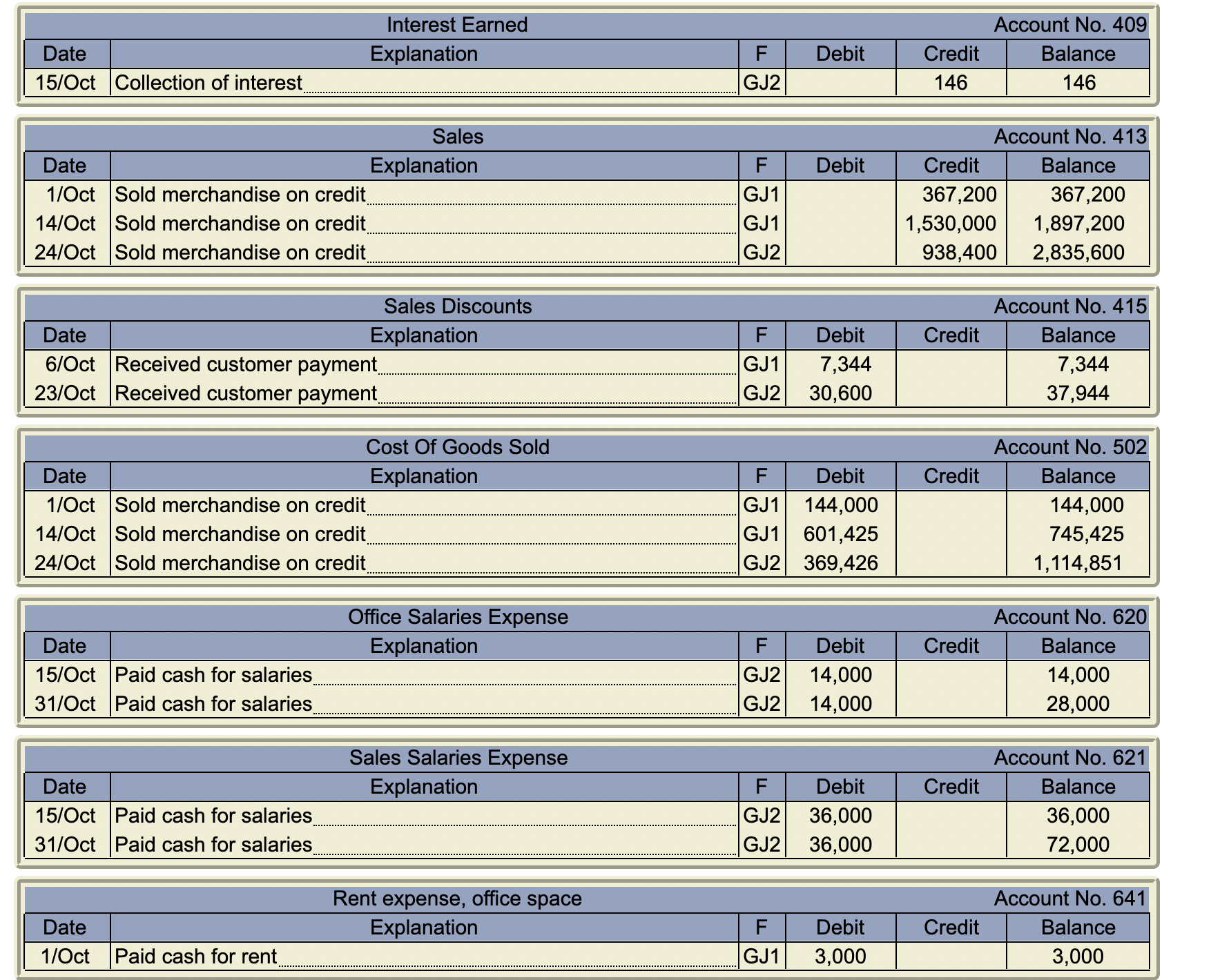

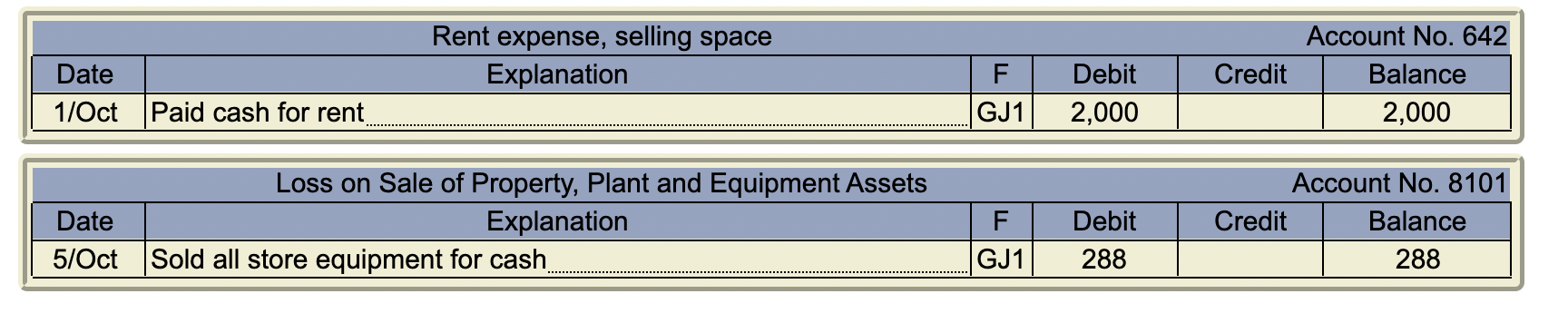

b) Prepare the appropriate adjusting entries on October 31, 2024. Hint: Some additional information is provided below but where else might you look to find details relevant to preparing the adjusting entries? It is estimated that utilities used during October totalled $6,970. Actual count of ending merchandise inventory on October 31, 2024 was $1,824,056. Management estimates uncollectible accounts receivable based on the following rates of uncollectibility applied to outstanding accounts: Not yet due (2%), 1-30 days past due (9%), 31-60 days past due (18%), Greater than 61 days past due (60%). Since this is an estimate please round your final answer to the nearest whole dollar. Income taxes are estimated to be $185,000. General Journal Date Account/Explanation F Debit Page GJ1 Credit Date General Journal Account/Explanation F Debit Page GJ2 Credit 31/Oct Utilities Expense. accrued utilities 6,970 31/Oct Bad Debts Expense. 19,351 Utilities Payable.. 6,970 Allowance for Doubtful Accounts for afda 19,351 31/Oct Cost Of Goods Sold 96,003 31/Oct Interest Receivable 3,071 Merchandise Inventory. 96,003 Interest Earned 3,071 adjust inventory for interest 31/Oct Accounts Receivable, Benson Inc. 39,304 Cash 39,304 adjust nsf 31/Oct Depreciation Expense, Office Furniture Accumulated Depreciation, Office Furniture office depreciation 31/Oct Income Taxes Expense... 185,000 Income Taxes Payable 185,000 for taxes 31/Oct Bank Service Charge Expense_ 1,400 Cash for bank service 1,400 Callaho Inc. Accounts Receivable Subledger Date Desc. Acct. #10603; Allarco Inc. PR Debit 1/Oct Sold merchandise on credit GJ1 367,200 6/Oct Received customer payment|GJ1 14/Oct Sold merchandise on credit GJ1 1,530,000 23/Oct Received customer payment|GJ2| Acct. #10610; Dylex Corporation Credit Balance Date Desc. PR Debit Credit Balance 367,200 24/Oct Sold merchandise on credit GJ2 938,400 |938,400 367,200 1,530,000 1,530,000 Date Acct. #10611; Bentley Inc. Desc. 1/Oct Terms 2/10, n/30 PR Debit Credit Balance BFWD 238,900 238,900 29/Oct Wrote off uncollectible account GJ2 238,900 Accounts Payable Subledger: Acct. #20108; Global Filter Corp. Desc. PR Debit Credit Balance GJ1 724,500 724,500|| 7/Oct Purchased merchandise 13/Oct Paid invoice for merchandise GJ1 724,500| Callaho Inc. Accounts Payable Subledger Date Acct. #20105; Southgate Inc. Desc. 1/Oct Terms 2/10, n/30 6/Oct Issued cheque for purchase PR Debit Credit Balance BFWD 472,000 472,000| GJ1 472,000 Date 23/Oct Purchased merchandise on credit GJ2 27/Oct Paid invoice for merchandise 724,500 724,500 GJ2 724,500 Date Acct. #20106; Weber Inc. Desc. PR Debit 9/Oct Purchased furniture on credit GJ1 11/Oct Received a credit memorandum GJ1| 2,500 18/Oct Paid invoice for office furniture GJ2 10,000 Credit Balance 12,500 12,500 10,000 Date Acct. #20109; Star Inc. Desc. PR Debit Credit Balance 29/Oct Purchased merchandise inventory on credit GJ2 320,400 320,400|| Notes Receivable Collection Schedule: Period Ending September 15, 2024 October 15, 2024. Collection Principal Interest Balance 70,000 3,071 2,779 292 67,221 November 15, 2024 3,071 2,791 280 64,430 December 15, 2024.. 3,071 2,803 268 61,627 January 15, 2025 3,071 2,814 257 58,813 February 15, 2025 3,071 2,826 245 55,987 March 15, 2025. 3,071 2,838 233 53,149 April 15, 2025 3,071 2,850 221 50,299 May 15, 2025 3,071 2,861 210 47,438 June 15, 2025. 3,071 2,873 198 44,565 July 15, 2025 3,071 2,885 186 41,680 August 15, 2025. 3,071 2,897 174 38,783 September 15, 2025 3,071 2,909 162 35,874 October 15, 2025 3,071 2,922 149 32,952 July 15, 2026 3,071 3,033 38 6,104 August 15, 2026 3,071 3,046 25 3,058 September 15, 2026 3,071 3,058 13 0 73,704 70,000 3,704 Property, Plant and Equipment Subledger: Property, Plant and Equipment Subledger Cost Information Depreciation Desc. F Purch. Date Depr. Method Cost Residual Life Store Equipment BFWD Office Furniture GJ1 Notes: Nov 1, 2020 Double-Declining 144,900 25,000 10 Oct 9, 2024 Double-Declining 10,000 0 10 Accum. Depr. Bal., September 30, 2024 84,312 0 Depr. Exp, October, Accum. Depr. Bal., 2024 October 31, 2024 0 0 ? ? Cash Accounts receivable Callaho Inc. Unadjusted Trial Balance October 31, 2024 Debit Credit 1,017,604 938,400 Allowance for doubtful accounts Notes receivable Merchandise inventory.. Prepaid insurance Office furniture Accounts payable... 215,010 67,221 1,920,059 10,000 10,000 320,400 Common shares Retained earnings... 101,000 2,223,631 Cash dividends declared 44,400 Interest earned Sales 146 2,835,600 Sales discounts Cost of goods sold. Office salaries expense. 37,944 1,114,851 28,000 Sales salaries expense... 72,000 Rent expense, office space. 3,000 Rent expense, selling space. 2,000 Loss on sale of property, plant and equipment assets 288 Totals 5,480,777 5,480,777 Cash Account No. 101 Date 30/Sep Opening balance_ 1/Oct Paid cash for rent 5/Oct Sold all store equipment for cash. 6/Oct Received customer payment_ 6/Oct Issued cheque for purchase... 13/Oct Issued shares Explanation F Debit Credit Balance 1,155,387 GJ1 5,000 1,150,387 GJ1 60,300 1,210,687 GJ1 359,856 1,570,543 GJ1 472,000 1,098,543 GJ1 14,000 1,112,543 13/Oct Paid invoice for merchandise GJ1 724,500 388,043 15/Oct Collection of interest GJ2 3,071 391,114 15/Oct Paid cash for salaries GJ2 50,000 341,114 18/Oct Paid invoice for office furniture GJ2 10,000 331,114 18/Oct Declared and paid dividends. 23/Oct Received customer payment_ 27/Oct Paid invoice for merchandise 28/Oct Paid utility bill.. GJ2 44,400 286,714 GJ2 1,499,400 1,786,114 GJ2 710,010 1,076,104 GJ2 8,500 1,067,604 31/Oct Paid cash for salaries GJ2 50,000 1,017,604 Date 30/Sep Opening balance_ Accounts Receivable Explanation Account No. 106 F Debit Credit Balance 238,900 Date 30/Sep Opening balance 1/Oct Allarco Inc. : Sold merchandise on credit 6/Oct Allarco Inc.: Received customer payment_ 14/Oct Allarco Inc.: Sold merchandise on credit. 23/Oct Allarco Inc.: Received customer payment... 24/Oct Dylex Corporation: Sold merchandise on credit.. 29/Oct Bentley Inc.: Wrote off uncollectible account_ Allowance for Doubtful Accounts Explanation 29/Oct Wrote off uncollectible account GJ1 367,200 606,100 GJ1 367,200 238,900 GJ1 1,530,000 1,768,900 GJ2 1,530,000 238,900 GJ2 938,400 1,177,300 GJ2 238,900 938,400 Account No. 107 F Debit Credit GJ2 238,900 Balance 23,890 -215,010 Interest Receivable Account No. 109 Date 30/Sep Opening balance_ Explanation F Debit Credit Balance 146 15/Oct Collection of interest GJ2 146 0 Date Notes Receivable Explanation Account No. 111 F Debit Credit Balance 30/Sep Opening balance_ 70,000 15/Oct Collection of interest GJ2 2,779 67,221 Date 30/Sep Opening balance.__ 1/Oct Sold merchandise on credit. 7/Oct Purchased merchandise 14/Oct Sold merchandise on credit Merchandise Inventory Explanation Account No. 119 F Debit Credit Balance 1,280,000 GJ1 144,000 1,136,000 GJ1 724,500 1,860,500 GJ1 601,425 1,259,075 23/Oct Purchased merchandise on credit GJ2 724,500 1,983,575 24/Oct Sold merchandise on credit GJ2 369,426 1,614,149 27/Oct Paid invoice for merchandise GJ2 14,490 1,599,659 29/Oct Purchased merchandise inventory on credit. GJ2 320,400 1,920,059 Prepaid Insurance Account No. 128 Date Explanation FL Debit Credit Balance 30/Sep Opening balance._. 10,000 Date 9/Oct Purchased furniture on credit. 11/Oct Received a credit memorandum Office Furniture Explanation Account No. 157 F Debit Credit Balance GJ1 12,500 12,500 GJ1 2,500 10,000 Store Equipment Account No. 165 Date Explanation F Debit Credit Balance 30/Sep Opening balance_ 5/Oct Sold all store equipment for cash 144,900 GJ1 144,900 0 Accumulated Depreciation, Store Equipment Explanation Date 30/Sep Opening balance__ 5/Oct Sold all store equipment for cash. Account No. 166 F Debit Credit Balance GJ1 84,312 84,312 0 Date Accounts Payable Explanation Account No. 201 Debit Credit Balance 30/Sep Opening balance__ 472,000 6/Oct Southgate Inc. : Issued cheque for purchase... 7/Oct Global Filter Corp. Purchased merchandise. 9/Oct Weber Inc.: Purchased furniture on credit 11/Oct Weber Inc.: Received a credit memorandum 13/Oct Global Filter Corp.: Paid invoice for merchandise... 18/Oct Weber Inc.: Paid invoice for office furniture 23/Oct Southgate Inc.: Purchased merchandise on credit._. 27/Oct Southgate Inc.: Paid invoice for merchandise... 29/Oct Star Inc.: Purchased merchandise inventory on credit. GJ1 472,000 0 GJ1 724,500 724,500 GJ1 12,500 737,000 GJ1 2,500 734,500 GJ1 724,500 10,000 GJ2 10,000 0 GJ2 724,500 724,500 GJ2 724,500 0 GJ2 320,400 320,400 Date Utilities Payable Explanation Account No. 212 F Debit Credit 30/Sep Opening balance_ 28/Oct Paid utility bill. GJ2 8,500 Balance 8,500 0 Common Shares Account No. 307 Date Explanation F Debit Credit Balance 30/Sep Opening balance_ 87,000 13/Oct Issued shares GJ1 14,000 101,000 Date Retained Earnings Explanation Account No. 318 F Debit Credit 30/Sep Opening balance__ Balance 2,223,631 Cash Dividends Declared Account No. 319 Date Explanation F 18/Oct Declared and paid dividends. GJ2 Debit 44,400 Credit Balance 44,400 Interest Earned Account No. 409 Date 15/Oct Collection of interest Explanation F Debit Credit GJ2 146 Balance 146 Sales Account No. 413 Date Explanation F Debit Credit Balance 1/Oct Sold merchandise on credit 14/Oct Sold merchandise on credit 24/Oct Sold merchandise on credit GJ1 367,200 367,200 GJ1 1,530,000 1,897,200 GJ2 938,400 2,835,600 Date Sales Discounts Explanation Account No. 415 F Debit Credit Balance 6/Oct Received customer payment_ 23/Oct Received customer payment. GJ1 7,344 7,344 GJ2 30,600 37,944 Date 1/Oct Sold merchandise on credit 14/Oct Sold merchandise on credit 24/Oct Sold merchandise on credit. Cost Of Goods Sold Explanation Account No. 502 F Debit Credit Balance GJ1 144,000 144,000 GJ1 601,425 745,425 GJ2 369,426 1,114,851 Date Office Salaries Expense Explanation Account No. 620 F Debit Credit Balance 15/Oct Paid cash for salaries 31/Oct Paid cash for salaries GJ2 14,000 14,000 GJ2 14,000 28,000 Date Sales Salaries Expense Explanation Account No. 621 F 15/Oct Paid cash for salaries 31/Oct Paid cash for salaries Debit GJ2 36,000 GJ2 36,000 Credit Balance 36,000 72,000 Date Rent expense, office space Explanation Account No. 641 F 1/Oct Paid cash for rent GJ1 Debit 3,000 Credit Balance 3,000 Date 1/Oct Paid cash for rent Rent expense, selling space Explanation Date Loss on Sale of Property, Plant and Equipment Assets Explanation 5/Oct |Sold all store equipment for cash. Account No. 642 Debit Credit Balance GJ1 2,000 2,000 Account No. 8101 F Debit Credit Balance GJ1 288 288

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started