Answered step by step

Verified Expert Solution

Question

1 Approved Answer

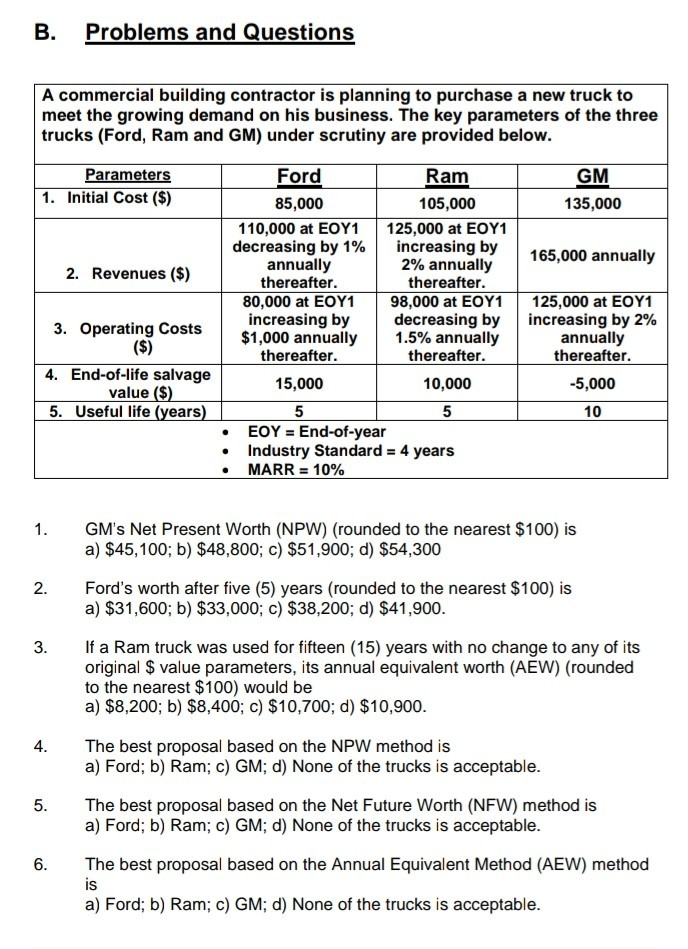

B. Problems and Questions A commercial building contractor is planning to purchase a new truck to meet the growing demand on his business. The key

B. Problems and Questions A commercial building contractor is planning to purchase a new truck to meet the growing demand on his business. The key parameters of the three trucks (Ford, Ram and GM) under scrutiny are provided below. Parameters 1. Initial Cost ($) GM 135,000 165,000 annually 2. Revenues ($) 3. Operating costs ($) 4. End-of-life salvage value ($) 5. Useful life (years) Ford Ram 85,000 105,000 110,000 at EOY1 125,000 at EOY1 decreasing by 1% increasing by annually 2% annually thereafter. thereafter. 80,000 at EOY1 98,000 at EOY1 increasing by decreasing by $1,000 annually 1.5% annually thereafter. thereafter. 15,000 10,000 5 5 EOY = End-of-year Industry Standard = 4 years MARR = 10% 125,000 at EOY1 increasing by 2% annually thereafter. -5,000 10 GM's Net Present Worth (NPW) (rounded to the nearest $100) is a) $45,100; b) $48,800; c) $51,900; d) $54,300 Ford's worth after five (5) years (rounded to the nearest $100) is a) $31,600; b) $33,000; c) $38,200; d) $41,900. If a Ram truck was used for fifteen (15) years with no change to any of its original $ value parameters, its annual equivalent worth (AEW) (rounded to the nearest $100) would be a) $8,200; b) $8,400; c) $10,700; d) $10,900. The best proposal based on the NPW method is a) Ford; b) Ram; c) GM; d) None of the trucks is acceptable. The best proposal based on the Net Future Worth (NFW) method is a) Ford; b) Ram; c) GM; d) None of the trucks is acceptable. The best proposal based on the Annual Equivalent Method (AEW) method is a) Ford; b) Ram; c) GM; d) None of the trucks is acceptable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started