Answered step by step

Verified Expert Solution

Question

1 Approved Answer

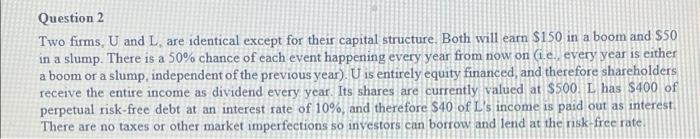

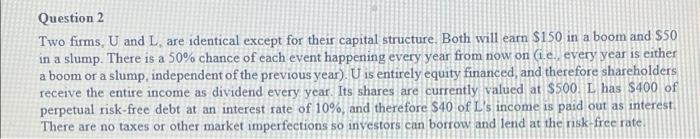

b Question 2 Two firms, U and L. are identical except for their capital structure. Both will earn $150 in a boom and $50 in

b

Question 2 Two firms, U and L. are identical except for their capital structure. Both will earn $150 in a boom and $50 in a slump. There is a 50% chance of each event happening every year from now on (.e., every year is either a boom or a slump, independent of the previous year). U is entirely equity financed, and therefore shareholders receive the entire income as dividend every year. Its shares are currently valued at $500. L has $400 of perpetual risk-free debt at an interest rate of 10%, and therefore $40 of L's income is paid out as interest There are no taxes or other market imperfections so investors can borrow and lend at the risk-free rate (b) Suppose that you invest $20 in U's stock. Is there an alternative investment in L that would give identical payoffs in boom and slump? What is the expected annual payoff from such a strategy? estemth identical navoff

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started