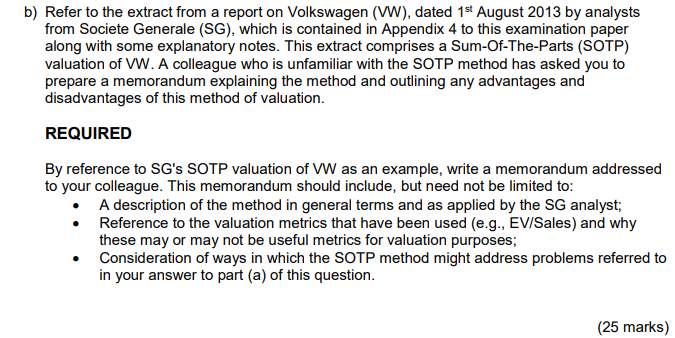

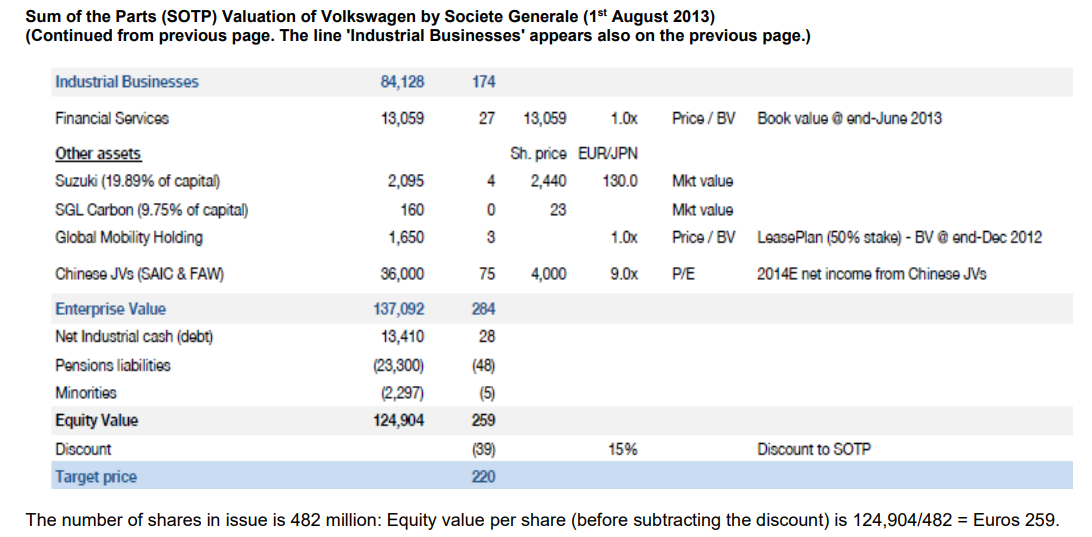

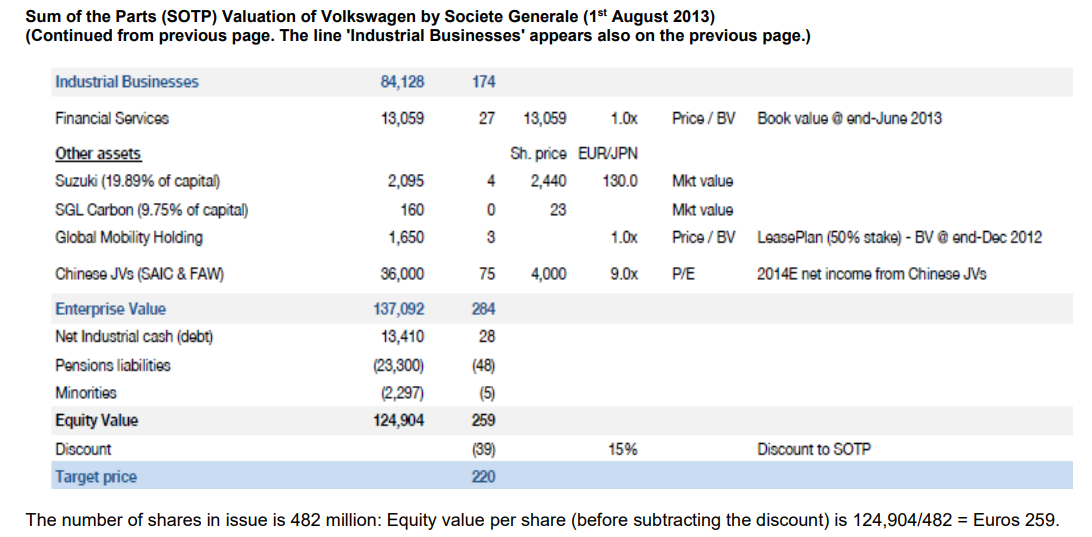

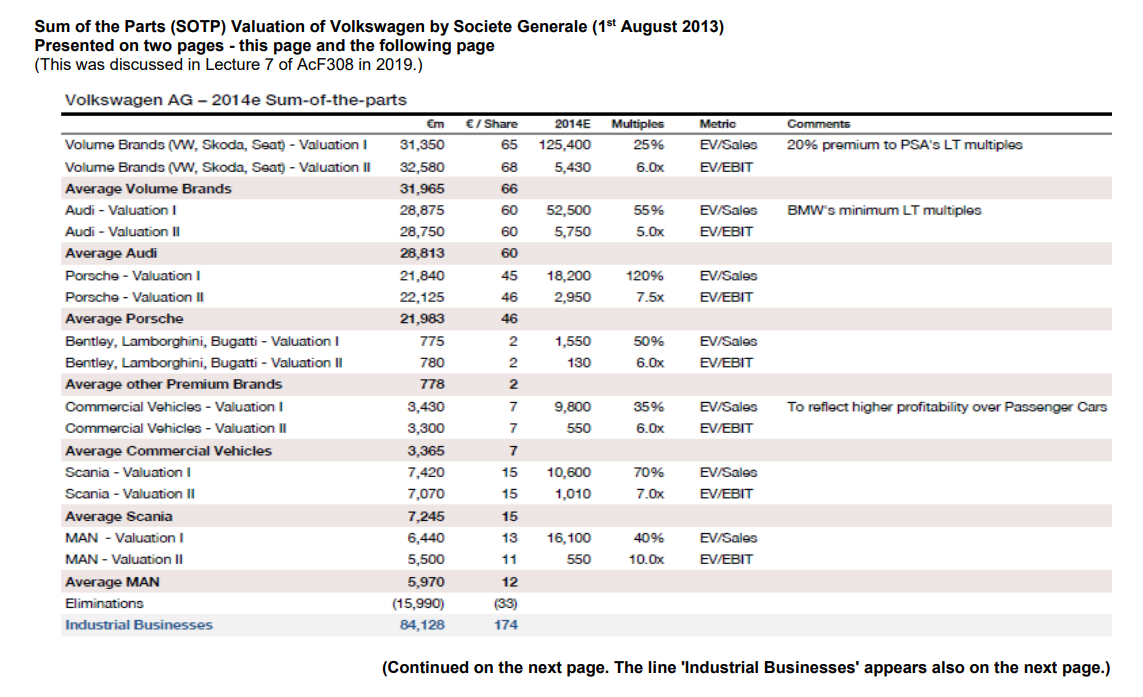

b) Refer to the extract from a report on Volkswagen (VW), dated 1st August 2013 by analysts from Societe Generale (SG), which is contained in Appendix 4 to this examination paper along with some explanatory notes. This extract comprises a Sum-Of-The-Parts (SOTP) valuation of VW. A colleague who is unfamiliar with the SOTP method has asked you to prepare a memorandum explaining the method and outlining any advantages and disadvantages of this method of valuation. REQUIRED By reference to SG's SOTP valuation of VW as an example, write a memorandum addressed to your colleague. This memorandum should include, but need not be limited to: A description of the method in general terms and as applied by the SG analyst; Reference to the valuation metrics that have been used (e.g., EV/Sales) and why these may or may not be useful metrics for valuation purposes; Consideration of ways in which the SOTP method might address problems referred to in your answer to part (a) of this question. (25 marks) Sum of the Parts (SOTP) Valuation of Volkswagen by Societe Generale (1st August 2013) (Continued from previous page. The line 'Industrial Businesses' appears also on the previous page.) Industrial Businesses 84,128 174 Financial Services 13,059 27 13,059 1.0x Price / BV Book value @end-June 2013 Other assets Sh.price EUR/JPN Suzuki (19.89% of capital) 2,095 4 2,440 130.0 Mkt value SGL Carbon (9.75% of capital) 160 0 23 Mkt value Global Mobility Holding 1,650 3 1.0x Price / BV LeasePlan (50% stake) - BV @ end-Dec 2012 Chinese JVs (SAIC & FAW) 36,000 75 4,000 P/E 2014E net income from Chinese JVs Enterprise Value 137,092 284 Net Industrial cash (debt) 13,410 28 Pensions liabilities (23,300) (48) Minorities (2,297) (5) Equity Value 124,904 259 Discount (39) 15% Discount to SOTP Target price 220 The number of shares in issue is 482 million: Equity value per share (before subtracting the discount) is 124,904/482 = Euros 259. 9.0x Sum of the Parts (SOTP) Valuation of Volkswagen by Societe Generale (1st August 2013) Presented on two pages - this page and the following page (This was discussed in Lecture 7 of AcF308 in 2019.) Volkswagen AG-2014e Sum-of-the-parts m / Share Comments Metric EV/Sales 65 2014E Multiples 125,400 25% 5,430 6.0x Volume Brands (VW, Skoda, Seat) - Valuation I Volume Brands (VW, Skoda, Seat) - Valuation II Average Volume Brands 20% premium to PSA's LT multiples EV/EBIT Audi - Valuation I EV/Sales BMW's minimum LT multiples 31,350 32,580 31,965 28,875 28,750 28,813 21,840 22,125 21,983 52,500 5,750 55% 5.0x Audi - Valuation II EV/EBIT Average Audi Porsche - Valuation I EV/Sales 18,200 2,950 120% 7.5x Porsche - Valuation II EV/EBIT Average Porsche 50% EV/Sales 775 780 1,550 130 6.0x EV/EBIT 778 2 Bentley, Lamborghini, Bugatti - Valuation I Bentley, Lamborghini, Bugatti - Valuation II Average other Premium Brands Commercial Vehicles - Valuation I Commercial Vehicles - Valuation II Average Commercial Vehicles Scania - Valuation I 7 35% EV/Sales To reflect higher profitability over Passenger Cars 3,430 3,300 9,800 550 7 6.0x EV/EBIT 3,365 7 7,420 15 10,600 70% EV/Sales Scania - Valuation II 7,070 1,010 7.0x EV/EBIT 15 15 Average Scania 7,245 MAN - Valuation I 6,440 13 16,100 40% EV/Sales MAN - Valuation II 5,500 11 550 10.0x EV/EBIT Average MAN 5,970 12 Eliminations (15,990) (33) Industrial Businesses 84,128 174 (Continued on the next page. The line 'Industrial Businesses' appears also on the next page.) UN N 8 8 8 8 8 68 66 60 60 60 45 46 46 2 b) Refer to the extract from a report on Volkswagen (VW), dated 1st August 2013 by analysts from Societe Generale (SG), which is contained in Appendix 4 to this examination paper along with some explanatory notes. This extract comprises a Sum-Of-The-Parts (SOTP) valuation of VW. A colleague who is unfamiliar with the SOTP method has asked you to prepare a memorandum explaining the method and outlining any advantages and disadvantages of this method of valuation. REQUIRED By reference to SG's SOTP valuation of VW as an example, write a memorandum addressed to your colleague. This memorandum should include, but need not be limited to: A description of the method in general terms and as applied by the SG analyst; Reference to the valuation metrics that have been used (e.g., EV/Sales) and why these may or may not be useful metrics for valuation purposes; Consideration of ways in which the SOTP method might address problems referred to in your answer to part (a) of this question. (25 marks) Sum of the Parts (SOTP) Valuation of Volkswagen by Societe Generale (1st August 2013) (Continued from previous page. The line 'Industrial Businesses' appears also on the previous page.) Industrial Businesses 84,128 174 Financial Services 13,059 27 13,059 1.0x Price / BV Book value @end-June 2013 Other assets Sh.price EUR/JPN Suzuki (19.89% of capital) 2,095 4 2,440 130.0 Mkt value SGL Carbon (9.75% of capital) 160 0 23 Mkt value Global Mobility Holding 1,650 3 1.0x Price / BV LeasePlan (50% stake) - BV @ end-Dec 2012 Chinese JVs (SAIC & FAW) 36,000 75 4,000 P/E 2014E net income from Chinese JVs Enterprise Value 137,092 284 Net Industrial cash (debt) 13,410 28 Pensions liabilities (23,300) (48) Minorities (2,297) (5) Equity Value 124,904 259 Discount (39) 15% Discount to SOTP Target price 220 The number of shares in issue is 482 million: Equity value per share (before subtracting the discount) is 124,904/482 = Euros 259. 9.0x Sum of the Parts (SOTP) Valuation of Volkswagen by Societe Generale (1st August 2013) Presented on two pages - this page and the following page (This was discussed in Lecture 7 of AcF308 in 2019.) Volkswagen AG-2014e Sum-of-the-parts m / Share Comments Metric EV/Sales 65 2014E Multiples 125,400 25% 5,430 6.0x Volume Brands (VW, Skoda, Seat) - Valuation I Volume Brands (VW, Skoda, Seat) - Valuation II Average Volume Brands 20% premium to PSA's LT multiples EV/EBIT Audi - Valuation I EV/Sales BMW's minimum LT multiples 31,350 32,580 31,965 28,875 28,750 28,813 21,840 22,125 21,983 52,500 5,750 55% 5.0x Audi - Valuation II EV/EBIT Average Audi Porsche - Valuation I EV/Sales 18,200 2,950 120% 7.5x Porsche - Valuation II EV/EBIT Average Porsche 50% EV/Sales 775 780 1,550 130 6.0x EV/EBIT 778 2 Bentley, Lamborghini, Bugatti - Valuation I Bentley, Lamborghini, Bugatti - Valuation II Average other Premium Brands Commercial Vehicles - Valuation I Commercial Vehicles - Valuation II Average Commercial Vehicles Scania - Valuation I 7 35% EV/Sales To reflect higher profitability over Passenger Cars 3,430 3,300 9,800 550 7 6.0x EV/EBIT 3,365 7 7,420 15 10,600 70% EV/Sales Scania - Valuation II 7,070 1,010 7.0x EV/EBIT 15 15 Average Scania 7,245 MAN - Valuation I 6,440 13 16,100 40% EV/Sales MAN - Valuation II 5,500 11 550 10.0x EV/EBIT Average MAN 5,970 12 Eliminations (15,990) (33) Industrial Businesses 84,128 174 (Continued on the next page. The line 'Industrial Businesses' appears also on the next page.) UN N 8 8 8 8 8 68 66 60 60 60 45 46 46 2