Answered step by step

Verified Expert Solution

Question

1 Approved Answer

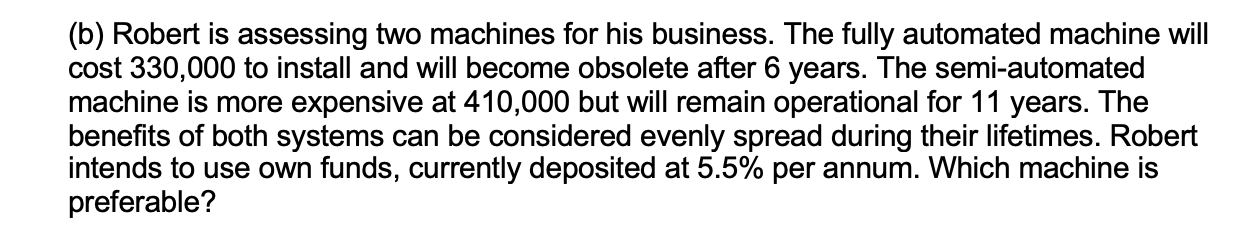

( b ) Robert is assessing two machines for his business. The fully automated machine will cost 3 3 0 , 0 0 0 to

b Robert is assessing two machines for his business. The fully automated machine will

cost to install and will become obsolete after years. The semiautomated

machine is more expensive at but will remain operational for years. The

benefits of both systems can be considered evenly spread during their lifetimes. Robert

intends to use own funds, currently deposited at per annum. Which machine is

preferable?After solving for NPV you have to make a conclusion based PMT and PVAF

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started