Answered step by step

Verified Expert Solution

Question

1 Approved Answer

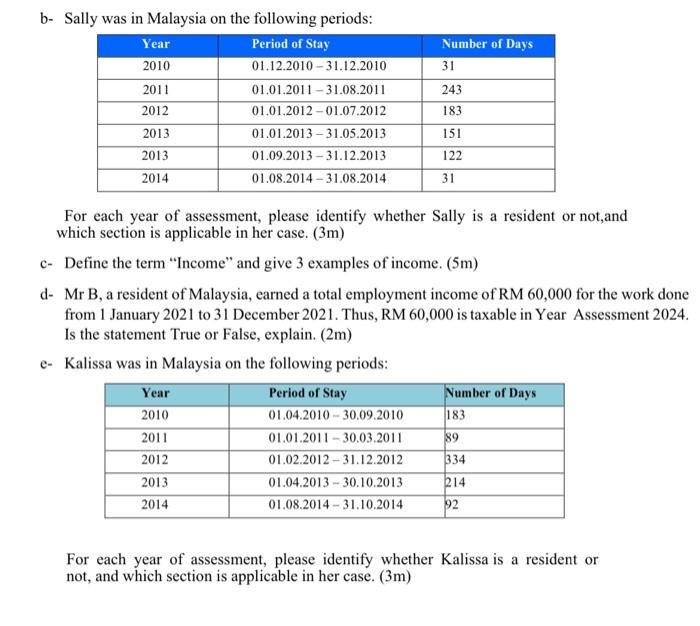

b- Sally was in Malaysia on the following periods: Year Period of Stay Number of Days 2010 01.12.2010 31.12.2010 31 2011 01.01.2011-31.08.2011 243 2012

b- Sally was in Malaysia on the following periods: Year Period of Stay Number of Days 2010 01.12.2010 31.12.2010 31 2011 01.01.2011-31.08.2011 243 2012 01.01.2012 01.07.2012 183 2013 01.01.2013 31.05.2013 151 2013 01.09.2013-31.12.2013 122 01.08.2014 31.08.2014 31 2014 For each year of assessment, please identify whether Sally is a resident or not,and which section is applicable in her case. (3m) c- Define the term "Income" and give 3 examples of income. (5m) d- Mr B, a resident of Malaysia, earned a total employment income of RM 60,000 for the work done from 1 January 2021 to 31 December 2021. Thus, RM 60,000 is taxable in Year Assessment 2024. Is the statement True or False, explain. (2m) e- Kalissa was in Malaysia on the following periods: Period of Stay Year Number of Days 2010 01.04.2010 30.09.2010 183 2011 01.01.2011-30.03.2011 89 2012 01.02.2012 31.12.2012 334 2013 01.04.2013 30.10.2013. 214 2014 01.08.2014 31.10.2014 92 For each year of assessment, please identify whether Kalissa is a resident or not, and which section is applicable in her case. (3m)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer b To determine whether Sally is a resident or not for each year of assessment we need to consider the number of days she stayed in Malaysia during that period 1 For the year 2010 Sally stayed i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started