Answered step by step

Verified Expert Solution

Question

1 Approved Answer

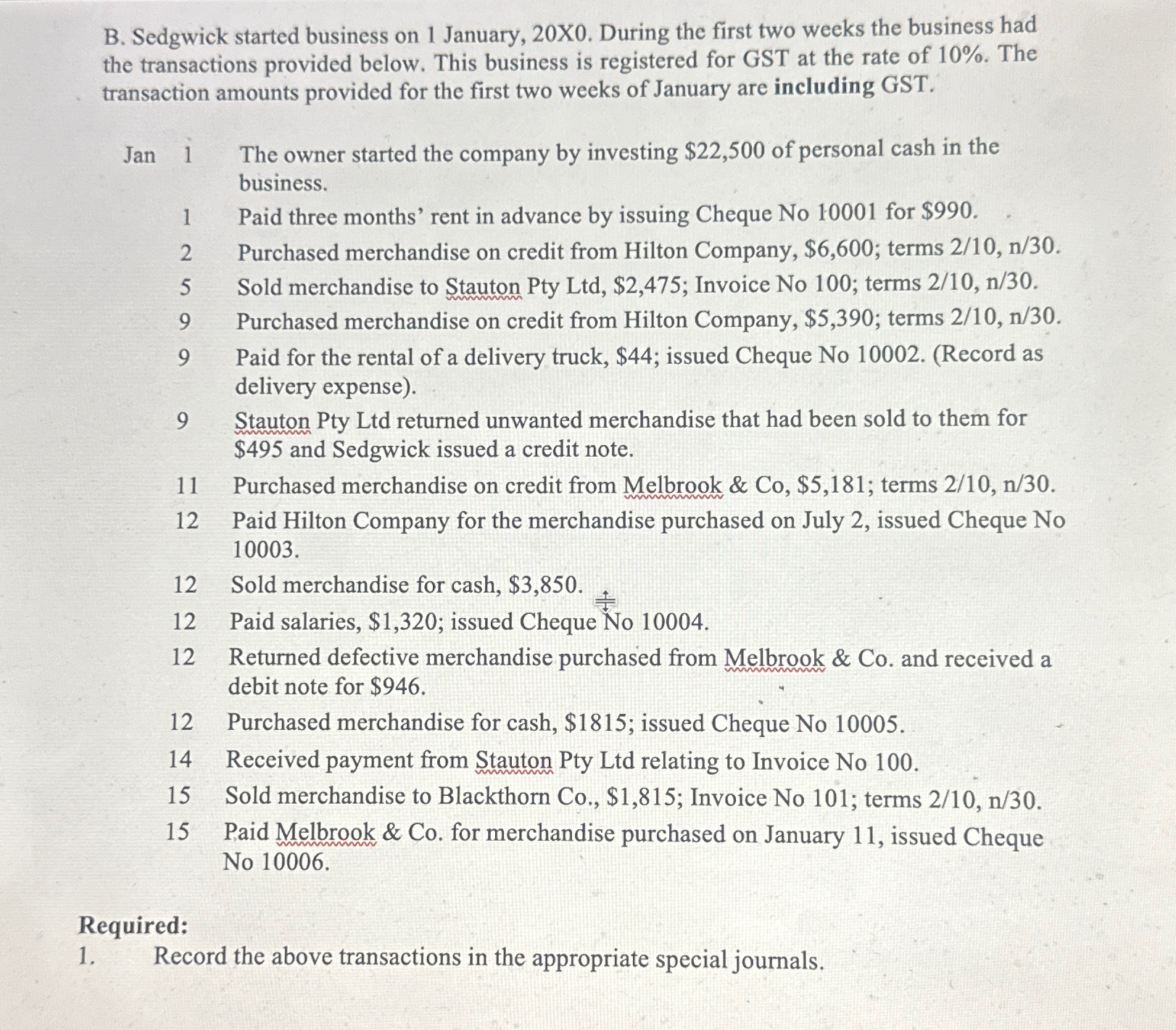

B. Sedgwick started business on 1 January, 20X0. During the first two weeks the business had the transactions provided below. This business is registered

B. Sedgwick started business on 1 January, 20X0. During the first two weeks the business had the transactions provided below. This business is registered for GST at the rate of 10%. The transaction amounts provided for the first two weeks of January are including GST. Jan 1 1 2 5 9 9 9 11 12 12 12 12 12 14 15 15 The owner started the company by investing $22,500 of personal cash in the business. Paid three months' rent in advance by issuing Cheque No 10001 for $990. Purchased merchandise on credit from Hilton Company, $6,600; terms 2/10, n/30. Sold merchandise to Stauton Pty Ltd, $2,475; Invoice No 100; terms 2/10, n/30. Purchased merchandise on credit from Hilton Company, $5,390; terms 2/10, n/30. Paid for the rental of a delivery truck, $44; issued Cheque No 10002. (Record as delivery expense). Stauton Pty Ltd returned unwanted merchandise that had been sold to them for $495 and Sedgwick issued a credit note. Purchased merchandise on credit from Melbrook & Co, $5,181; terms 2/10, n/30. Paid Hilton Company for the merchandise purchased on July 2, issued Cheque No 10003. Sold merchandise for cash, $3,850. # Paid salaries, $1,320; issued Cheque No 10004. Returned defective merchandise purchased from Melbrook & Co. and received a debit note for $946. Purchased merchandise for cash, $1815; issued Cheque No 10005. Received payment from Stauton Pty Ltd relating to Invoice No 100. Sold merchandise to Blackthorn Co., $1,815; Invoice No 101; terms 2/10, n/30. Paid Melbrook & Co. for merchandise purchased on January 11, issued Cheque No 10006. Required: 1. Record the above transactions in the appropriate special journals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sedgwick General Journal For the Period Ended January 31 20X0 Date Account Titles Debit Credit Jan 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started