Answered step by step

Verified Expert Solution

Question

1 Approved Answer

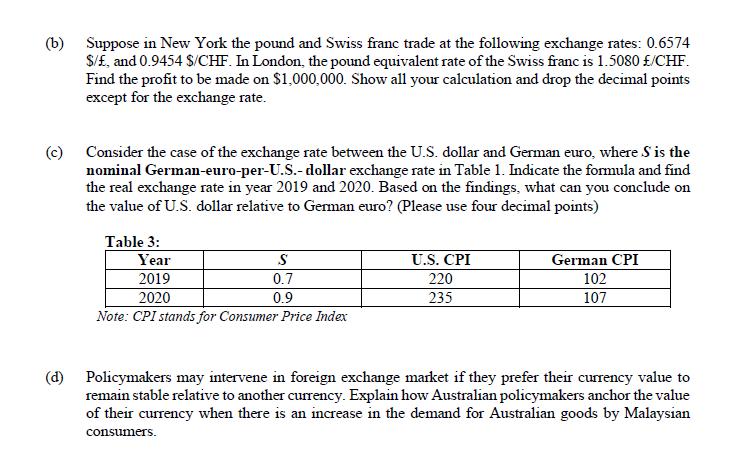

(b) Suppose in New York the pound and Swiss franc trade at the following exchange rates: 0.6574 $/, and 0.9454 $/CHF. In London, the

(b) Suppose in New York the pound and Swiss franc trade at the following exchange rates: 0.6574 $/, and 0.9454 $/CHF. In London, the pound equivalent rate of the Swiss franc is 1.5080 /CHF. Find the profit to be made on $1,000,000. Show all your calculation and drop the decimal points except for the exchange rate. Consider the case of the exchange rate between the U.S. dollar and German euro, where S is the nominal German-euro-per-U.S.- dollar exchange rate in Table 1. Indicate the formula and find the real exchange rate in year 2019 and 2020. Based on the findings, what can you conclude on the value of U.S. dollar relative to German euro? (Please use four decimal points) Table 3: Year S U.S. CPI German CPI 102 2019 0.7 220 2020 0.9 235 107 Note: CPI stands for Consumer Price Index (d) Policymakers may intervene in foreign exchange market if they prefer their currency value to remain stable relative to another currency. Explain how Australian policymakers anchor the value of their currency when there is an increase in the demand for Australian goods by Malaysian consumers.

Step by Step Solution

★★★★★

3.62 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

b06574 x 1000000 657400 pounds 15080 fCHF x 657400 pounds 988032 Swiss francs 09454 SCHF x 988032 Swiss francs 94086528 pounds 94086528 pounds 657400 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started