Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The following transactions relate to February 2022 for Build Small Co., a small construction company operating a job costing system. (b) 1)

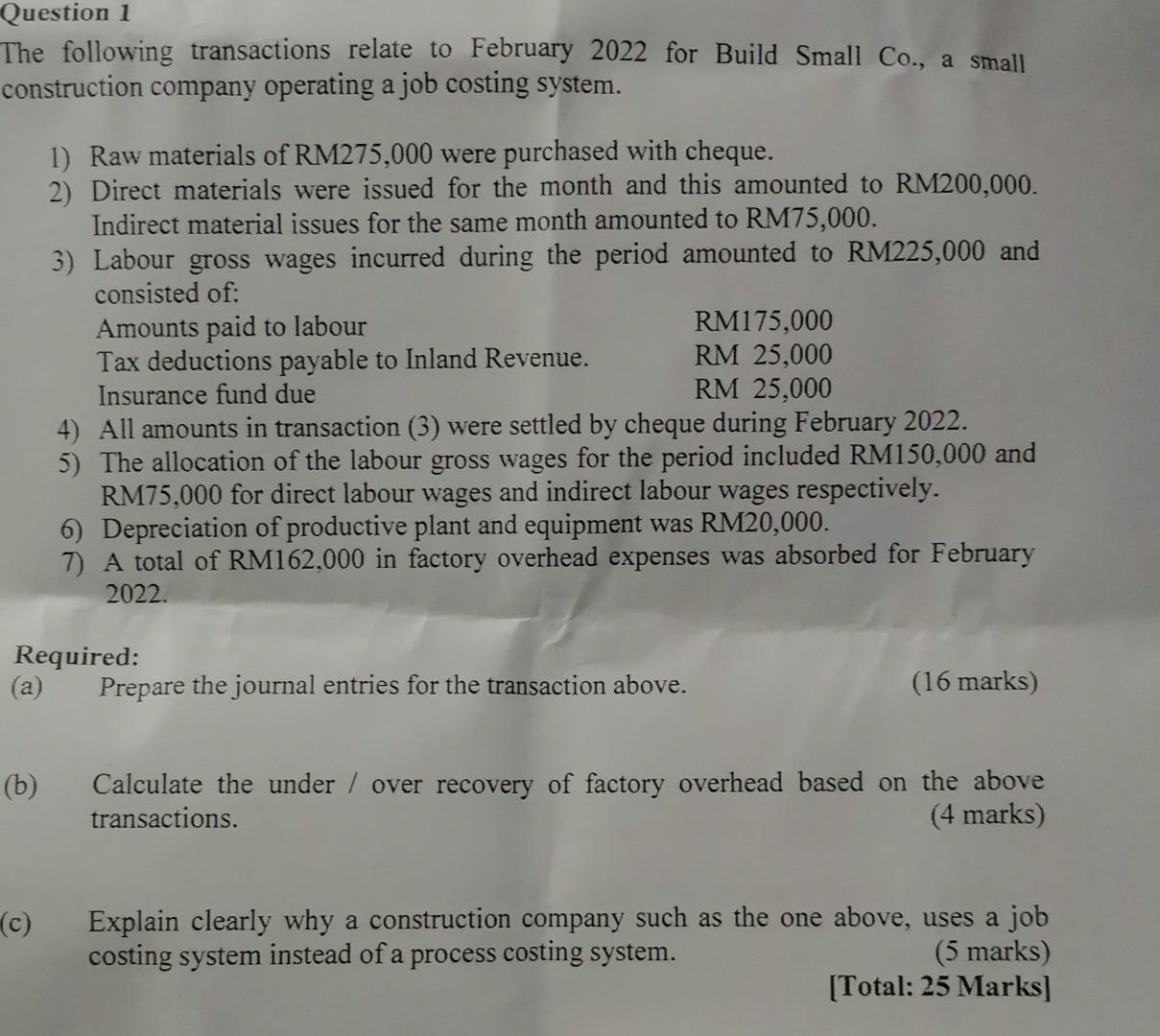

Question 1 The following transactions relate to February 2022 for Build Small Co., a small construction company operating a job costing system. (b) 1) Raw materials of RM275,000 were purchased with cheque. 2) Direct materials were issued for the month and this amounted to RM200,000. Indirect material issues for the same month amounted to RM75,000. (c) 3) Labour gross wages incurred during the period amounted to RM225,000 and consisted of: Amounts paid to labour Tax deductions payable to Inland Revenue. Required: (a) Insurance fund due 4) All amounts in transaction (3) were settled by cheque during February 2022. 5) The allocation of the labour gross wages for the period included RM150,000 and RM75,000 for direct labour wages and indirect labour wages respectively. 6) Depreciation of productive plant and equipment was RM20,000. 7) A total of RM162,000 in factory overhead expenses was absorbed for February 2022. RM175,000 RM 25,000 RM 25,000 Prepare the journal entries for the transaction above. (16 marks) Calculate the under / over recovery of factory overhead based on the above transactions. (4 marks) Explain clearly why a construction company such as the one above, uses a job costing system instead of a process costing system. (5 marks) [Total: 25 Marks]

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER 1 One possible distribution network that I would initiate is a tie red system ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started