Answered step by step

Verified Expert Solution

Question

1 Approved Answer

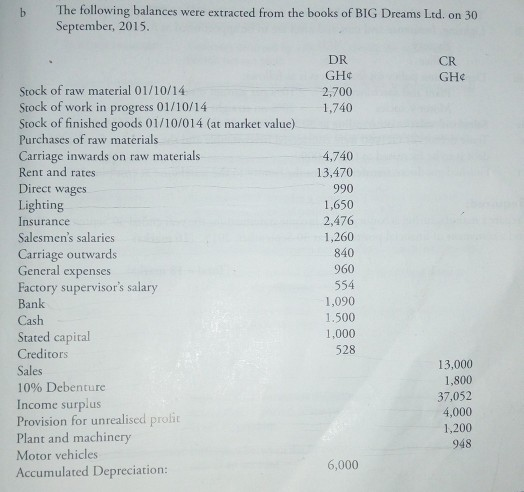

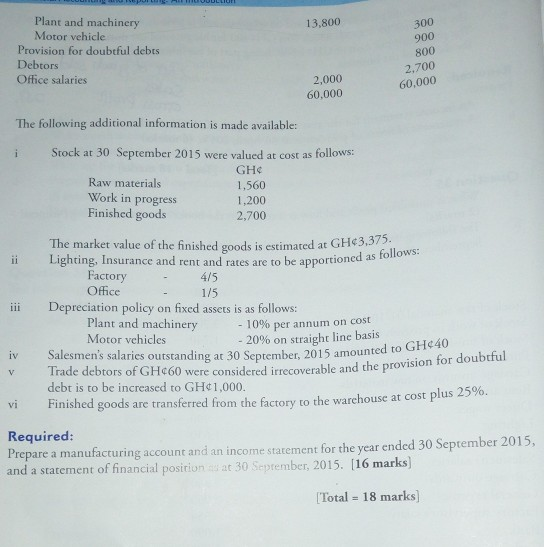

b The following balances were extracted from the books of BIG Dreams Ltd. on 30 September, 2015. CR GHC DR GH 2,700 1,740 Stock of

b The following balances were extracted from the books of BIG Dreams Ltd. on 30 September, 2015. CR GHC DR GH 2,700 1,740 Stock of raw material 01/10/14 Stock of work in progress 01/10/14 Stock of finished goods 01/10/014 (at market value) Purchases of raw materials Carriage inwards on raw materials Rent and rates Direct wages Lighting Insurance Salesmen's salaries Carriage outwards General expenses Factory supervisor's salary Bank Cash Stated capital Creditors Sales 10% Debenture Income surplus Provision for unrealised profit Plant and machinery Motor vehicles Accumulated Depreciation: 4,740 13,470 990 1,650 2,476 1,260 840 960 554 1,090 1.500 1,000 528 13,000 1,800 37,052 4,000 1,200 948 6,000 13,800 Plant and machinery Motor vehicle Provision for doubtful debts Debtors Office salaries 300 900 800 2,700 60.000 2,000 60,000 ii The following additional information is made available: i Stock at 30 September 2015 were valued at cost as follows: GH Raw materials 1,560 Work in progress 1,200 Finished goods 2,700 The market value of the finished goods is estimated at GH43,375. Lighting, Insurance and rent and rates are to be apportioned as follows: Factory 4/5 Office 1/5 Depreciation policy on fixed assets is as follows: Plant and machinery - 10% per annum on cost Motor vehicles - 20% on straight linc basis Salesmen's salaries outstanding at 30 September, 2015 amounted to GH40 Trade debtors of GHc60 were considered irrecoverable and the provision for doubtful debt is to be increased to GH1,000. Finished goods are transferred from the factory to the warchouse at cost plus 25%. Required: Prepare a manufacturing account and an income statement for the year ended 30 September 2015, and a statement of financial position as at 30 Seprember, 2015. [16 marks) [Total = 18 marks) iv V vi b The following balances were extracted from the books of BIG Dreams Ltd. on 30 September, 2015. CR GHC DR GH 2,700 1,740 Stock of raw material 01/10/14 Stock of work in progress 01/10/14 Stock of finished goods 01/10/014 (at market value) Purchases of raw materials Carriage inwards on raw materials Rent and rates Direct wages Lighting Insurance Salesmen's salaries Carriage outwards General expenses Factory supervisor's salary Bank Cash Stated capital Creditors Sales 10% Debenture Income surplus Provision for unrealised profit Plant and machinery Motor vehicles Accumulated Depreciation: 4,740 13,470 990 1,650 2,476 1,260 840 960 554 1,090 1.500 1,000 528 13,000 1,800 37,052 4,000 1,200 948 6,000 13,800 Plant and machinery Motor vehicle Provision for doubtful debts Debtors Office salaries 300 900 800 2,700 60.000 2,000 60,000 ii The following additional information is made available: i Stock at 30 September 2015 were valued at cost as follows: GH Raw materials 1,560 Work in progress 1,200 Finished goods 2,700 The market value of the finished goods is estimated at GH43,375. Lighting, Insurance and rent and rates are to be apportioned as follows: Factory 4/5 Office 1/5 Depreciation policy on fixed assets is as follows: Plant and machinery - 10% per annum on cost Motor vehicles - 20% on straight linc basis Salesmen's salaries outstanding at 30 September, 2015 amounted to GH40 Trade debtors of GHc60 were considered irrecoverable and the provision for doubtful debt is to be increased to GH1,000. Finished goods are transferred from the factory to the warchouse at cost plus 25%. Required: Prepare a manufacturing account and an income statement for the year ended 30 September 2015, and a statement of financial position as at 30 Seprember, 2015. [16 marks) [Total = 18 marks) iv V vi

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started