Answered step by step

Verified Expert Solution

Question

1 Approved Answer

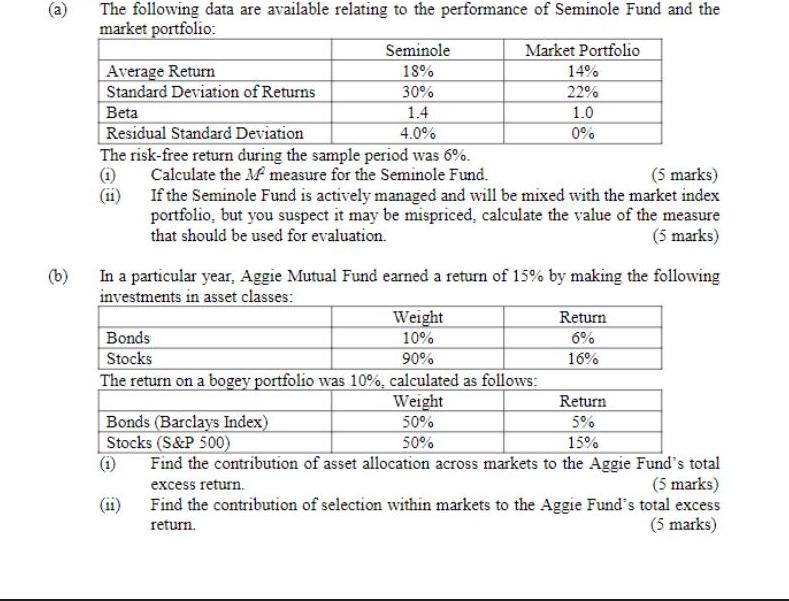

(b) The following data are available relating to the performance of Seminole Fund and the market portfolio: Average Return Standard Deviation of Returns Seminole

(b) The following data are available relating to the performance of Seminole Fund and the market portfolio: Average Return Standard Deviation of Returns Seminole 18% 30% 1.4 4.0% Beta Residual Standard Deviation The risk-free return during the sample period was 6%. (1) Calculate the M measure for the Seminole Fund. (5 marks) (11) If the Seminole Fund is actively managed and will be mixed with the market index portfolio, but you suspect it may be mispriced, calculate the value of the measure that should be used for evaluation. (5 marks) Bonds Stocks Market Portfolio 14% 22% 1.0 0% In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in asset classes: Weight 10% 90% The return on a bogey portfolio was 10%, calculated as follows: Weight 50% 50% Return 6% 16% Return 5% 15% Bonds (Barclays Index) Stocks (S&P 500) (1) Find the contribution of asset allocation across markets to the Aggie Fund's total excess return. (5 marks) (11) Find the contribution of selection within markets to the Aggie Fund's total excess (5 marks) return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a 1 Calculation of M l measure for the Seminole Fund The M l measure is calculated as M l R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started