Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) The question is a given, length of period is not indicated, you can assume length is 1-year . Eddie, a 17 year old aspiring

b)

The question is a given, length of period is not indicated, you can assume length is 1-year

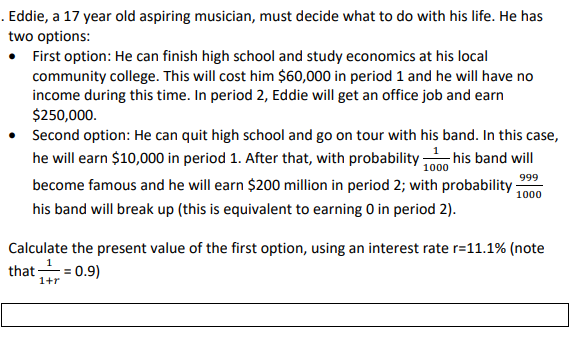

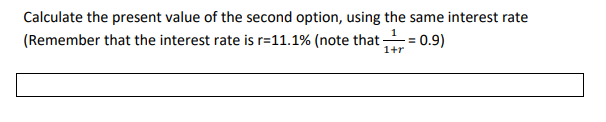

. Eddie, a 17 year old aspiring musician, must decide what to do with his life. He has two options First option: He can finish high school and study economics at his local community college. This will cost him $60,000 in period 1 and he will have no income during this time. In period 2, Eddie will get an office job and earn $250,000. Second option: He can quit high school and go on tour with his band. In this case, he will earn $10,000 in period 1. After that, with probabilityn his band will become famous and he will earn $200 million in period 2; with probability- 1000 his band will break up (this is equivalent to earning 0 in period 2). Calculate the present value of the first option, using an interest rate r=11.1% (note that = 0.9) Calculate the present value of the second option, using the same interest rate (Remember that the interest rate is r=11.1% (note that 0.9)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started