Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. The table below shows various information for securities C and Z and for the market index. The alphas reflect security analysis that the manager

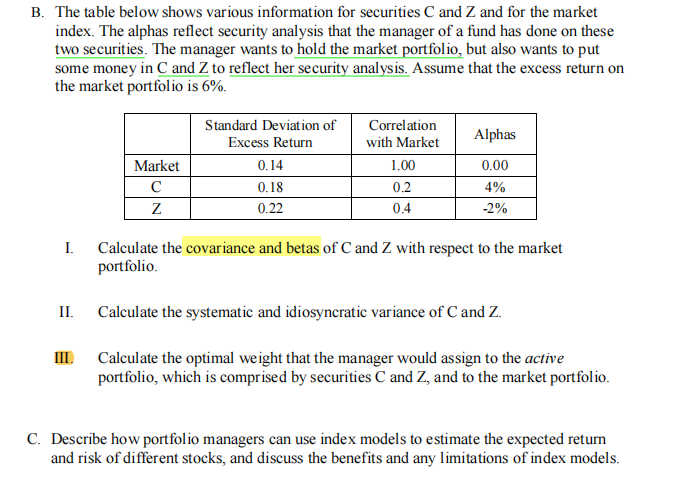

B. The table below shows various information for securities C and Z and for the market index. The alphas reflect security analysis that the manager of a fund has done on these two securities. The manager wants to hold the market portfolio, but also wants to put some money in C and Z to reflect her security analysis. Assume that the excess return on the market portfolio is 6%. I. Calculate the covariance and betas of C and Z with respect to the market portfolio. II. Calculate the systematic and idiosyncratic variance of C and Z. III. Calculate the optimal weight that the manager would assign to the active portfolio, which is comprised by securities C and Z, and to the market portfolio. C. Describe how portfolio managers can use index models to estimate the expected return and risk of different stocks, and discuss the benefits and any limitations of index models

B. The table below shows various information for securities C and Z and for the market index. The alphas reflect security analysis that the manager of a fund has done on these two securities. The manager wants to hold the market portfolio, but also wants to put some money in C and Z to reflect her security analysis. Assume that the excess return on the market portfolio is 6%. I. Calculate the covariance and betas of C and Z with respect to the market portfolio. II. Calculate the systematic and idiosyncratic variance of C and Z. III. Calculate the optimal weight that the manager would assign to the active portfolio, which is comprised by securities C and Z, and to the market portfolio. C. Describe how portfolio managers can use index models to estimate the expected return and risk of different stocks, and discuss the benefits and any limitations of index models Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started